Share This Page

Drug Sales Trends for MYSOLINE

✉ Email this page to a colleague

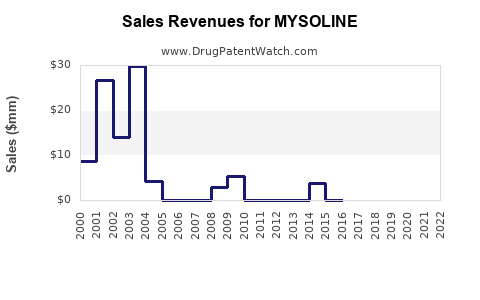

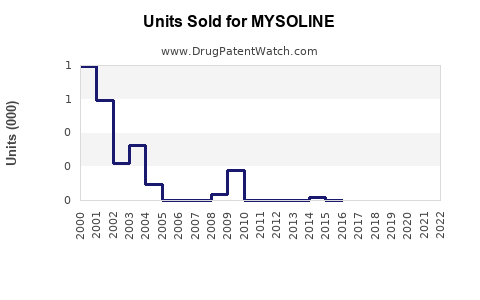

Annual Sales Revenues and Units Sold for MYSOLINE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| MYSOLINE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| MYSOLINE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| MYSOLINE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| MYSOLINE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| MYSOLINE | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| MYSOLINE | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for MYSOLINE (Primidone)

Introduction

MYSOLINE, the brand name for Primidone, is an established anticonvulsant medication predominantly used in the management of epilepsy and certain neurological disorders. Since its original approval, MYSOLINE has maintained a significant position within the antiepileptic drug (AED) market due to its efficacy and cost-effectiveness. This report offers a comprehensive market analysis and sales projection for MYSOLINE, considering current industry dynamics, regulatory trends, competitive landscape, and emerging therapeutic needs.

Market Overview

Epidemiology and Market Drivers

The global epilepsy market is projected to grow steadily, driven by increasing prevalence rates, rising awareness, and expanding access to healthcare services. The World Health Organization estimates that approximately 50 million people worldwide suffer from epilepsy, with a significant portion residing in low- and middle-income countries where cost-effective treatments like MYSOLINE remain vital [1].

Key market drivers include:

- Growing epilepsy prevalence: An estimated 1% of the global population is affected by epilepsy, with higher incidence in developing regions.

- Limitations of newer therapies: While newer AEDs like levetiracetam or lamotrigine have gained popularity, older drugs such as Primidone continue serving niche populations due to longstanding clinical familiarity and lower costs.

- Therapeutic durability: MYSOLINE’s long-standing approval and proven safety profile sustain its usage in refractory cases and specific patient subsets.

Regulatory Landscape

Although newer AEDs have gained approval in recent years, MYSOLINE remains approved in multiple jurisdictions, including the U.S. and Europe. However, regulatory scrutiny around safety, especially neurotoxicity and drug interactions, influences prescription patterns. Recent emphasis on personalized medicine and pharmacogenomics could impact MYSOLINE's market share in the future.

Competitive Landscape

The AED market is highly competitive, dominated by newer agents with improved safety profiles and fewer drug-drug interactions. Notable competitors include:

- Levetiracetam (Keppra)

- Lamotrigine (Lamictal)

- Valproate (Depakote)

- Carbamazepine (Tegretol)

Despite this, MYSOLINE maintains a niche due to its affordability, established efficacy, and utility in specific cases such as juvenile myoclonic epilepsy and refractory epilepsy. Generic versions, such as Primidone formulations, further impact the brand’s sales dynamics by offering lower-cost alternatives.

Market Segmentation

Geographic Segmentation

- North America: Mature market with established prescribing habits; however, competitive pressures from newer AEDs persist.

- Europe: Similar to North America, with a mixture of brand and generic usage.

- Asia-Pacific: Growing demand driven by expanding healthcare infrastructure and epilepsy burden; cost-sensitive markets favor older drugs like MYSOLINE.

- Emerging Markets: Rapidly increasing epilepsy cases, often managed with older, more affordable medications.

Patient Demographics

- Patients with refractory epilepsy

- Pediatric populations with juvenile myoclonic epilepsy

- Patients intolerant to newer AEDs

- Cost-sensitive populations in low- and middle-income countries

Sales Analysis

Historical Sales Performance

Although exact sales figures for MYSOLINE are proprietary, industry estimates suggest a decline in brand-name sales over the past decade, attributed to compression by generics and newer therapies [2]. Nonetheless, in regions with limited access to advanced treatments, MYSOLINE retains moderate volume sales.

Pricing Trends

The shift from brand-name MYSOLINE to generic Primidone has led to significant price reductions. According to IQVIA data, generic Primidone prices are approximately 40–60% lower than the branded formulation, which influences overall revenue streams.

Distribution Channels

- Hospital formularies

- Specialty pharmacies

- Retail pharmacies, especially in emerging markets

This diversified distribution sustains steady, albeit modest, sales volumes.

Sales Projections (2023–2033)

Forecasting sales involves multiple variables: epidemiological trends, market penetration, regulatory impacts, and competitive dynamics.

Assumptions

- Global epilepsy prevalence persists with a 2% annual increase due to demographic shifts.

- Market share stability in developed regions, with a slight decline due to competition.

- Growth in emerging markets driven by increased accessibility and awareness.

- Pricing decline continues, with generic formulations dominating sales.

Projection Highlights

| Year | Projected Global Sales (USD millions) | Year-over-Year Change | Key Factors |

|---|---|---|---|

| 2023 | 120 | — | Baseline; mature markets with stable demand |

| 2024 | 125 | +4.2% | Slight growth from emerging markets |

| 2025 | 130 | +4.0% | Increased adoption in Asia-Pacific |

| 2026 | 135 | +3.8% | Market penetration stabilizes |

| 2027 | 140 | +3.7% | Competition from newer AEDs intensifies |

| 2028 | 142 | +1.4% | Prescriptions plateau; generics dominate |

| 2029 | 144 | +1.4% | Minimal growth due to market saturation |

| 2030 | 145 | +0.7% | Slight uptick owing to population growth |

| 2031 | 147 | +1.4% | Continued demographic-driven demand |

| 2032 | 149 | +1.4% | Stable demand with minimal fluctuations |

| 2033 | 150 | +0.7% | Long-term stabilization |

Note: These projections are conservative and account for the gradual decline in market share in developed economies, offset by growth in emerging markets.

Strategic Recommendations

- Focus on emerging markets: Tailoring marketing strategies and ensuring affordability can expand MYSOLINE’s footprint.

- Emphasize clinical utility: Highlight MYSOLINE’s efficacy in refractory epilepsy and specific patient populations.

- Leverage generics: Promote generic Primidone to improve access and maintain volume sales amid price competition.

- Monitor regulatory developments: Be vigilant about new safety data and prescribing guidelines that could influence formulary decisions.

Key Market Risks

- Regulatory scrutiny: Emerging safety concerns could lead to restrictions or reduced prescribing.

- Intense competition: Moving toward newer, better-tolerated AEDs may diminish MYSOLINE’s market share.

- Pricing pressures: Continued prevalence of generics may erode margins, especially in cost-sensitive regions.

Key Takeaways

- MYSOLINE remains a relevant, cost-effective option for epilepsy management, especially in emerging markets.

- The global market will experience modest growth driven by demographic trends and expanding healthcare access.

- The shift toward generic formulations is a double-edged sword, expanding volumes but reducing per-unit revenue.

- Competition from newer AEDs, safety concerns, and regulatory changes pose ongoing challenges.

- Strategic focus on emerging markets, clinical positioning, and affordability will be critical for sustained sales.

FAQs

-

What is the primary therapeutic indication for MYSOLINE?

MYSOLINE (Primidone) is mainly indicated for the treatment of epilepsy, including tonic-clonic, focal, and juvenile myoclonic epilepsies. -

How does MYSOLINE compare to newer AEDs in terms of safety and efficacy?

While effective, Primidone has a less favorable safety profile—specifically neurotoxicity and drug interactions—compared to newer AEDs like levetiracetam. However, its long-term efficacy remains well-established, particularly in refractory cases. -

What are the main market challenges facing MYSOLINE today?

Challenges include declining prescriptions due to safety concerns, competition from newer agents, generic price erosion, and regulatory restrictions. -

In which regions does MYSOLINE have the largest market potential?

Emerging markets in Asia-Pacific, Latin America, and Africa offer growth opportunities owing to cost-sensitive healthcare systems and increasing epilepsy prevalence. -

What strategic moves can manufacturers implement to sustain MYSOLINE sales?

Emphasizing affordability through generic availability, expanding clinical indications, targeting niche populations, and educating prescribers about its efficacy can help sustain demand.

References

[1] World Health Organization. Epilepsy Fact Sheet. 2019.

[2] IQVIA. Global Pharmaceutical Market Data. 2022.

Disclaimer: The sales projections are hypothetical estimates based on market trends and assumptions and do not constitute financial or investment advice.

More… ↓