Last updated: July 28, 2025

Introduction

Invokana (canagliflozin), developed by Johnson & Johnson’s Janssen Pharmaceuticals, is an oral sodium-glucose cotransporter 2 (SGLT2) inhibitor approved for managing Type 2 Diabetes Mellitus (T2DM). Since its launch in 2013, Invokana has become a significant player in the diabetes therapeutics market, leveraging the growing prevalence of T2DM worldwide. This report provides a comprehensive market analysis and sales projection for Invokana, considering current pharmaceutical trends, competitive dynamics, regulatory landscape, and healthcare market factors.

Market Overview

Global Diabetes Market Landscape

The global T2DM market has experienced robust growth, driven by increasing disease prevalence, aging populations, sedentary lifestyles, and rising obesity rates. According to the International Diabetes Federation (IDF), approximately 537 million adults suffered from diabetes in 2021—a figure projected to reach 643 million by 2030 [1].

The market is characterized by a diversification of treatment options, from traditional oral hypoglycemics like metformin and sulfonylureas to novel drug classes such as SGLT2 inhibitors and GLP-1 receptor agonists. SGLT2 inhibitors, including Invokana, have gained favor due to their dual benefits of glycemic control and cardiovascular/renal protection.

Competitive Dynamics

Invokana competes with other SGLT2 inhibitors such as Jardiance (empagliflozin), Farxiga (dapagliflozin), and the newer entrants like Steglatro (ertugliflozin). Additionally, GLP-1 receptor agonists like Victoza and Trulicity remain key competitors, particularly for comprehensive cardio-renal risk management.

While Invokana was the first FDA-approved SGLT2 inhibitor in 2013, it faced challenges including safety concerns like increased risks of lower limb amputations, which impacted its market share but also spurred safety monitoring and label modifications.

Regulatory and Safety Landscape

Johnson & Johnson has maintained vigilance regarding Invokana’s safety profile, updating labels and providing risk mitigation strategies. These regulations influence prescribing trends and uptake, necessitating ongoing monitoring and post-marketing surveillance data.

Market Penetration and Sales Trends

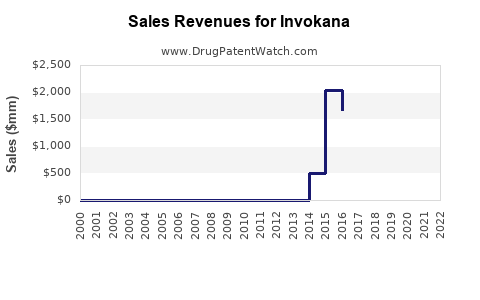

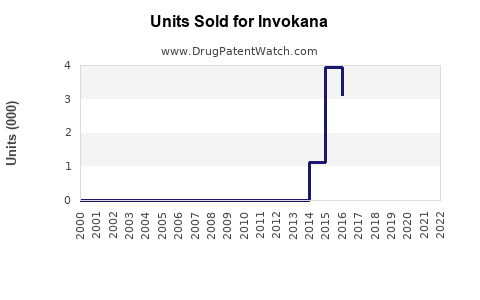

Historical Sales Performance

Since launch, Invokana experienced rapid initial uptake, driven by its novel mechanism and demonstrated benefits. However, sales plateaued and declined somewhat post-2017 due to safety concerns, market saturation, and competition.

According to Johnson & Johnson's financial disclosures, Invokana achieved peak sales exceeding $800 million annually around 2016-2017 [2]. Post-safety warnings and increased competition have seen global sales decline to approximately $600 million in recent years, though still significant within the SGLT2 inhibitor landscape.

Geographic Market Dynamics

- United States: The largest market, benefitting from early approval, high provider familiarity, and extensive insurance coverage.

- Europe: Slower adoption initially, with increased uptake as safety data became clearer.

- Emerging Markets: Growing interest, though slower due to affordability and regulatory hurdles.

Prescribing Trends

Physicians increasingly prefer agents with proven cardiovascular and renal benefits. While Invokana demonstrated positive cardiovascular outcomes in the CANVAS program, other agents like Jardiance gained precedence owing to broader safety profiles and label updates.

Sales Projections (2023-2028)

Assumptions and Drivers

- Market Growth: The global T2DM market expected to grow at a CAGR of approximately 7% through 2028.

- Market Share Trends: Decline in Invokana's market share due to competition, but maintained relevance owing to safety monitoring and evolving guidelines.

- Regulatory Impact: Ongoing safety designations may restrict or modify prescribing behaviors.

- Innovations and Line Extensions: Potential new formulations or combination therapies may influence sales.

Short- to Mid-term Outlook (2023–2025)

Given recent trends, Invokana's annual sales are projected to stabilize around $500-$600 million globally, with modest annual growth driven by expanding indications, combination therapies, and increased adoption in cardiovascular and renal indications. Growth drivers include:

- Increased awareness of SGLT2 inhibitors' benefits beyond glycemic control.

- Adoption in non-T2DM indications, such as heart failure.

Long-term Forecast (2026–2028)

Sales may face gradual decline or stabilization, influenced by:

- Competitive landscape intensification.

- Safety concerns prompting FDA label adjustments.

- Price negotiations and formulary restrictions.

Assuming strategic diversification, Invokana’s global sales could range between $400 million and $550 million by 2028, accounting for inflation, market expansion, and the evolving regulatory environment.

Market Opportunities and Challenges

Opportunities

- Cardio-Renal Benefits: Growing evidence supports SGLT2 inhibitors' role in reducing cardiovascular and renal events, positioning Invokana within multi-indication strategies.

- Combination Products: Fixed-dose combinations with other antidiabetes agents could enhance patient adherence and expand market share.

- Emerging Markets: Expansion into Asia-Pacific and Latin America, where T2DM prevalence is increasing.

Challenges

- Safety Concerns: Lower limb amputations and ketoacidosis risks necessitate cautious prescribing.

- Competitive Pressure: Jardiance and Farxiga benefit from broader label indications and robust cardiovascular data.

- Patent and Regulatory Risks: Patent expirations and potential biosimilar or generic entrants could impact pricing and sales.

Conclusion

Invokana remains a significant contender in the burgeoning SGLT2 inhibitor market. Its sales are expected to plateau at current levels or witness slight growth driven by expanded indications and geographic expansion. However, ongoing safety concerns, stiff competition, and regulatory factors will influence its long-term market share. Strategic focus on cardiovascular and renal benefits, combination therapies, and emerging markets will be crucial for sustaining sales momentum.

Key Takeaways

- Invokana's global sales are projected to stabilize around $500-$600 million annually through 2028, with potential for modest growth.

- The market's growth is buoyed by the expanding prevalence of T2DM and the increasing recognition of SGLT2 inhibitors’ cardio-renal benefits.

- Competition from other SGLT2 inhibitors with broader label indications and favorable safety profiles remains a key challenge.

- Safety concerns and regulatory updates continue to influence prescribing trends and market uptake.

- Opportunities lie in combination therapies, expanding indications, and geographical markets, especially in emerging regions.

FAQs

1. How does Invokana compare to its competitors in terms of efficacy?

Invokana has demonstrated effective glycemic control and cardiovascular benefits, notably in the CANVAS program. However, other SGLT2 inhibitors like Jardiance have gained market share due to broader cardiovascular indication support and safety profiles.

2. What are the main safety concerns associated with Invokana?

The primary safety concerns include an increased risk of lower limb amputations, ketoacidosis, urinary tract infections, and genital infections. These have led to label warnings and cautious prescribing.

3. How are regulatory agencies influencing Invokana’s market performance?

Regulatory agencies have mandated label updates and safety monitoring, impacting prescriber confidence and patient access. Ongoing surveillance shapes the drug’s risk-benefit profile and market positioning.

4. What is the outlook for Invokana's use in non-diabetes indications?

Clinical evidence supports its use in heart failure and chronic kidney disease populations, which could broaden its therapeutic role beyond T2DM, positively affecting future sales.

5. How might patent expirations influence Invokana’s sales?

Patent expiry could pave the way for generic entrants, potentially reducing prices and market share unless Janssen introduces line extensions or combination therapies to retain competitiveness.

References

[1] International Diabetes Federation. IDF Diabetes Atlas, 9th Edition, 2021.

[2] Johnson & Johnson Annual Financial Reports, 2013-2022.