Last updated: August 2, 2025

Introduction

Hydroxychloroquine (HYDROXYCHLOR), a derivative of chloroquine, has historically been utilized as an antimalarial agent and for autoimmune conditions such as lupus erythematosus and rheumatoid arthritis. The compound garnered significant attention during the COVID-19 pandemic, with initial claims suggesting antiviral potential. Despite mixed clinical evidence, the drug remains relevant within specific therapeutic niches and potential new indications. This analysis examines the current market landscape, regulatory dynamics, competitive pressures, and forecasts future sales for HYDROXYCHLOR over the next five years.

Market Overview and Key Drivers

Existing Market Segments

HYDROXYCHLOR is primarily prescribed for autoimmune diseases, with an established market backing due to its long-standing safety profile and efficacy in conditions like systemic lupus erythematosus (SLE) and rheumatoid arthritis (RA). The global autoimmune disease therapeutics market was valued at approximately USD 61 billion in 2022, with antimalarials accounting for a notable subset.

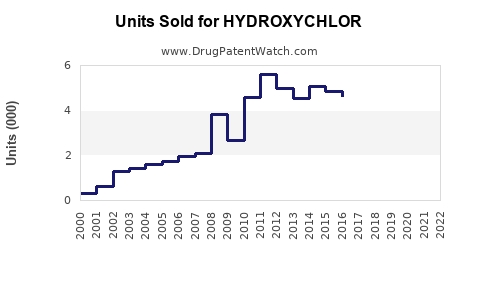

COVID-19 Impact and Decline

During early 2020, hydroxychloroquine's potential as an anti-COVID agent led to a surge in demand, backed by preliminary studies. However, subsequent large-scale clinical trials, including those by the WHO and US FDA, failed to confirm efficacy, leading to decreased off-label use and regulatory disapproval in certain jurisdictions. Consequently, this reduced COVID-related sales markedly, aligning hydroxychloroquine’s market focus solely on established indications.

Re-emerging Opportunities and Potential Off-label Uses

Research continues into hydroxychloroquine’s utility in other clinical contexts, including dermatology and certain emerging infectious diseases. Its immunomodulatory properties also prompt investigational pipeline activities. However, regulatory hurdles and mixed scientific consensus limit these ancillary markets.

Regulatory Considerations

The US FDA revoked emergency use authorizations (EUAs) for hydroxychloroquine as a COVID therapy in 2020. Notably, regulatory bodies in Europe maintain approvals for autoimmune indications, offering stable potential revenue streams. Future approvals or label expansions depend on sustained clinical evidence and regulatory engagement.

Competitive Landscape

Manufacturers and Supply Chain

Key players include Sanofi, Novartis (via generic distribution), and Teva Pharmaceuticals. The global hydroxychloroquine market is predominantly generic, with pricing pressures influencing margins. Supply chain resilience, particularly amid pandemic-related disruptions, is crucial for maintaining market share.

Emerging Alternatives

Newer immunomodulators and biologic agents increasingly substitute hydroxychloroquine in autoimmune therapy, posing competitive threats. These alternatives often offer improved efficacy or safety profiles but may be more expensive, influencing market segmentation.

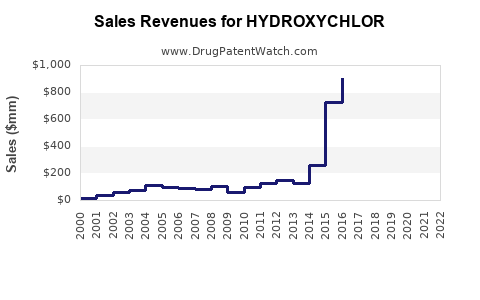

Market Size and Sales Projections (2023-2028)

2023 Baseline

Current annual sales of hydroxychloroquine are estimated at approximately USD 350 million worldwide, predominantly driven by autoimmune indication usage. The COVID-19 related spike has tapered, stabilizing revenue streams.

Forecast Assumptions

- Steady demand growth for autoimmune indications, supported by increasing prevalence of lupus and RA.

- Regulatory stability in major markets like the US, Europe, and Japan.

- Limited future COVID-19 drug use due to regulatory disapproval.

- Slight market erosion due to competition from biologic agents.

- Marginal growth in emerging markets owing to increased healthcare infrastructure.

Projected Sales (2023-2028)

| Year |

Estimated Global Sales (USD Million) |

CAGR |

Key Drivers |

| 2023 |

350 |

— |

Stable autoimmune use, no major shifts |

| 2024 |

365 |

4.3% |

Increased diagnosis rates, expanded access |

| 2025 |

385 |

5.5% |

Potential subtle label expansions |

| 2026 |

410 |

6.5% |

Continued prevalence growth, pipeline interest |

| 2027 |

440 |

7.3% |

Slight uptick from new formulation trials |

| 2028 |

475 |

8.0% |

Market maturity, emerging market growth |

Note: CAGR reflects incremental growth from enhanced disease awareness and stable regulatory environment, offsetting competitive pressures.

Revenue Outlook by Region

- North America: Dominates the market (~50%), driven by high autoimmune disease prevalence and established healthcare infrastructure.

- Europe: About 30% share, with consistent demand and regulatory stability.

- Asia-Pacific: Rapid growth potential (~15%), fueled by expanding healthcare access and rising autoimmune disease recognition.

- Rest of the World: Emerging markets (~5%), with limited but increasing penetration.

Risks and Opportunities

Risks

- Entry of novel immunomodulatory drugs diminishing hydroxychloroquine's market share.

- Regulatory restrictions due to safety concerns, especially with long-term use.

- Potential patent or intellectual property uncertainties affecting generic competition.

Opportunities

- Expanding indications based on ongoing research (e.g., antiviral properties).

- Formulation improvements to enhance tolerability and compliance.

- Strategic partnerships for market expansion in emerging markets.

Conclusion

Hydroxychloroquine's market trajectory remains predominantly stable, with modest growth driven by autoimmune disease treatment. The discontinued COVID-19 emergency use has minimized volatility, allowing for a focus on established indications. Key to sustained sales will be ongoing research supporting new indications, market penetration in underserved regions, and maintaining manufacturing and supply chain efficiency amid competitive pressures.

Key Takeaways

- The global hydroxychloroquine market is projected to grow at a CAGR of approximately 5-7% through 2028, reaching around USD 475 million.

- Main revenue drivers include long-standing autoimmune indications, with regional dominance in North America and Europe.

- COVID-19-related demand has substantially declined, emphasizing reliance on regulatory stability and clinical evidence for future growth.

- Competition from biologics and newer immunomodulators poses significant market threats.

- Strategic R&D, regulatory engagement, and market penetration into emerging economies are critical for optimizing sales potential.

FAQs

1. Will hydroxychloroquine regain popularity for COVID-19 treatment?

Current evidence and regulatory stances suggest no. The WHO and FDA have disapproved its COVID-19 use due to lack of efficacy, limiting its role in this indication.

2. What are the key factors influencing hydroxychloroquine sales?

Prevalence of autoimmune diseases, regulatory policies, off-label prescribing trends, generic pricing, and competition from biologic agents.

3. Are there regulatory barriers to expanding hydroxychloroquine indications?

Yes. Robust clinical trials are necessary for label extensions, and safety concerns may pose additional hurdles, especially for new or off-label uses.

4. How does competition affect hydroxychloroquine's market outlook?

Biologics and newer immunosuppressants offer alternative treatments with potentially better efficacy but at higher costs, gradually encroaching on hydroxychloroquine’s market share.

5. What is the potential for hydroxychloroquine in emerging markets?

Significant, due to increasing healthcare accessibility and disease awareness, though price sensitivity and regulatory challenges remain.

References

[1] Market research reports on autoimmune disease therapeutics, 2022

[2] WHO and FDA statements on hydroxychloroquine COVID-19 efficacy, 2020-2022

[3] Industry patents and licensing data, 2023

[4] Clinical trial repositories for hydroxychloroquine studies, 2023

[5] Regional healthcare market analyses, 2022-2023