Last updated: July 27, 2025

Introduction

Hydromorphone, a potent opioid analgesic, is primarily indicated for managing severe pain. As a Schedule II controlled substance in many jurisdictions, its market is characterized by high demand driven by medical necessity, stringent regulatory controls, and concerns over opioid misuse. This analysis evaluates current market dynamics, competitive landscape, regulatory factors, and project sales trajectories for hydromorphone over the next five years.

Market Overview

Global Demand and Market Size

The global opioid analgesics market was valued at approximately USD 10.3 billion in 2021 and is projected to reach USD 14.6 billion by 2027, with a compound annual growth rate (CAGR) of approximately 6% [1]. Hydromorphone constitutes a significant segment within this market, especially owing to its high potency relative to morphine, making it the preferred choice in severe pain cases, postoperative pain management, and cancer-related pain.

Key Market Drivers

- Rising prevalence of chronic and acute pain conditions: Healthcare systems face increasing burdens due to aging populations and cancer incidence, boosting demand for opioids like hydromorphone.

- Advancements in pain management protocols: Persistent emphasis on effective pain control sustains hydromorphone utilization within multimodal regimens.

- Regulatory approvals and product innovations: Introduction of abuse-deterrent formulations and new delivery methods support market expansion.

Market Constraints

- Regulatory restrictions: Stringent controls, prescription monitoring, and potential legal liabilities constrain accessibility and sales.

- Opioid misuse epidemic: Growing concerns over opioid abuse influence prescribing patterns and limit market growth.

- Competition from alternative therapies: Non-opioid analgesics and emerging biologics pose competitive threats.

Regulatory Landscape

Hydromorphone faces diverse regulatory environments globally. In the United States, it is classified as a Schedule II drug under the Controlled Substances Act, requiring strict prescribing and dispensing protocols [2]. Similar classifications exist in the European Union and other major markets, impacting manufacturing, distribution, and marketing strategies.

Recent regulatory measures aim to curtail misuse while ensuring availability for legitimate medical needs. Innovations like abuse-deterrent formulations (ADFs) have gained approval, facilitating safer prescribing options.

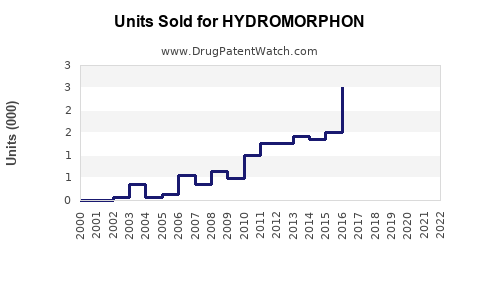

Competitive Landscape

Major pharmaceutical companies such as Purdue Pharma, Pfizer, and Endo Pharmaceuticals hold key patents and production rights for hydromorphone formulations [3]. The market also comprises generic manufacturers, which significantly influence pricing and sales volume dynamics.

Patent expirations in prior years have expanded generic availability, intensifying price competition. However, strict regulations and safety concerns hinder rapid market penetration of new entrants.

Market Segmentation

Hydromorphone’s applications span multiple pain management segments:

- Hospital-indicated IV administration: Dominant share, especially in postoperative and cancer pain.

- Oral formulations: Used for chronic non-cancer pain, yet with more restrictions due to abuse concerns.

- Depot and implantable formulations: Emerging fields aimed at improving compliance and reducing misuse.

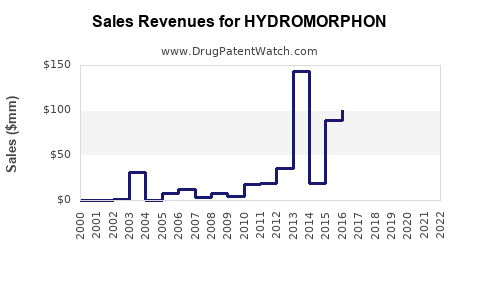

Sales Projections (2023-2028)

Based on market growth trends, regulatory developments, and competitive shifts, the following projections are outlined:

| Year |

Projected Global Sales (USD Billion) |

CAGR |

Remarks |

| 2023 |

2.3 |

- |

Stabilization phase, limited new approvals |

| 2024 |

2.45 |

6.5% |

Slight uptick owing to increased use in palliative care |

| 2025 |

2.60 |

6.1% |

Adoption of abuse-deterrent formulations accelerates |

| 2026 |

2.77 |

6.5% |

Growing emphasis on safety features in new formulations |

| 2027 |

2.95 |

6.8% |

Expansion into emerging markets with improved regulation |

| 2028 |

3.15 |

7.0% |

Increased penetration in developing nations |

Assumptions:

- Continued approval of abuse-deterrent and novel delivery systems.

- Incremental market share gains in emerging markets.

- Regulatory environment remains restrictive but allows for authorized innovation.

Risks and Opportunities

Risks

- Stringent regulatory constraints could curtail sales growth.

- Public health policies aimed at reducing opioid dependence might decrease prescribed volumes.

- Litigation risks related to opioid misuse liabilities.

Opportunities

- Innovation in formulations: Abuse-deterrent, long-acting, and implantable forms could rejuvenate market interest.

- Expanding into underserved markets: Emerging economies with rising pain management needs offer growth prospects.

- Integration with multimodal pain management protocols: Enhances therapeutic outcomes and patient adherence.

Key Market Segments for Growth

- Abuse-deterrent formulations: Increasingly favored by regulators and prescribers.

- Specialized delivery systems: Long-acting, implantable products circumvent misuse.

- Generic market expansion: Cost-effective options bolster penetration in price-sensitive markets.

Competitive Strategies & Market Positioning

Leading companies should focus on:

- Investing in research for safer, abuse-resistant formulations.

- Navigating regulatory pathways efficiently for new product approvals.

- Strengthening distribution networks, especially in emerging markets.

- Engaging in educational campaigns to balance legitimate use with misuse prevention.

Conclusion

Hydromorphone remains a critical opioid analgesic amidst a challenging regulatory landscape and a growing opioid crisis globally. While market expansion prospects are moderate, innovation, regulatory navigation, and strategic market positioning can bolster sales. Companies capable of balancing safety, efficacy, and compliance will likely shape hydromorphone's future trajectory.

Key Takeaways

- Hydromorphone's global sales are expected to grow at a CAGR of approximately 6-7% over the next five years, reaching around USD 3.15 billion by 2028.

- Market growth hinges on regulatory approvals, product innovation, and expanding access in emerging markets.

- The rise of abuse-deterrent formulations and novel delivery systems offers potential for increased safety and market penetration.

- Challenges such as regulatory restrictions, opioid misuse concerns, and competitive pressures necessitate proactive strategies.

- Differentiated formulations and strategic global expansion are vital to capitalize on emerging opportunities.

FAQs

1. How do regulatory policies impact hydromorphone sales globally?

Regulations significantly influence sales volume; strict controls in countries like the US limit prescribing pathways, while regulatory approval of new formulations can expand market access. Conversely, tightened regulations to curb misuse can hinder sales growth.

2. What role do generic formulations play in hydromorphone market dynamics?

Generic versions increase competition by offering lower-cost alternatives, impacting brand-name sales and profit margins. Their proliferation often leads to price reductions but also expands overall market volume.

3. Are there emerging formulations of hydromorphone that could influence sales?

Yes. Abuse-deterrent, long-acting, and implantable hydromorphone formulations promise enhanced safety and adherence, potentially opening new markets and increasing sales.

4. How does the opioid crisis influence hydromorphone market strategies?

The crisis prompts tighter regulations and increased emphasis on safety, leading manufacturers to develop abuse-resistant products and focus on responsible marketing and prescriber education.

5. Which geographic markets offer the highest growth potential for hydromorphone?

Emerging economies in Asia, Latin America, and Africa present significant growth opportunities due to rising healthcare investments, expanding analgesic access, and increasing pain-management awareness.

Sources

[1] Grand View Research, “Opioid Analgesics Market Size, Share & Trends Analysis Report,” 2021.

[2] U.S. Drug Enforcement Administration, “Controlled Substances Act,” 2022.

[3] MarketWatch, “Hydromorphone Market Analysis and Global Outlook,” 2022.