Last updated: July 27, 2025

Introduction

DYMISTA, a combination nasal Spray comprising azelastine hydrochloride and fluticasone propionate, holds a pivotal position within the allergic rhinitis treatment landscape. Approved by the FDA in 2015, DYMISTA offers an innovative approach, combining antihistaminic and corticosteroid functionalities to address moderate to severe allergic rhinitis effectively. This analysis evaluates the current market dynamics, competitive landscape, and future sales projections, grounded in epidemiology, regulatory trends, and healthcare provider preferences.

Market Overview

Global Allergic Rhinitis Market

The global allergic rhinitis market, valued at approximately USD 6.2 billion in 2022, is projected to grow at a CAGR of 5.3% through 2030[1]. The increasing prevalence of allergic conditions, alongside rising awareness and accessibility of advanced therapies like DYMISTA, fuels this growth.

DYMISTA Positioning within the Market

DYMISTA occupies a niche in the combination therapy segment, differentiating itself through convenience and superior efficacy vis-à-vis monotherapies. It is primarily indicated for adult and adolescent patients (≥12 years) suffering from moderate to severe allergic rhinitis unresponsive to monotherapy.

Key Competitive Landscape

Major competitors include:

- Intranasal corticosteroids (INCS): Fluticasone furoate (Flonase), mometasone (Nasonex)

- Antihistamines: Azelastine (as monotherapy or in other formulations)

- Other Combination Therapies: Azelastine/fluticasone (via separate devices or formulations)

While monotherapies dominate, combination products like DYMISTA are gaining traction owing to improved patient adherence and clinical efficacy.

Market Drivers

-

Rising Prevalence of Allergic Rhinitis: Estimated at over 400 million globally[2], triggered by environmental allergens, urban pollution, and climate change effects.

-

Increased Awareness & Diagnosis: Improved healthcare infrastructure and awareness campaigns drive early diagnosis and treatment.

-

Patient Preference for Combination Therapy: Offers convenience, reduces medication burden, and improves adherence.

-

Regulatory Approvals & Expanding Indications: Continuous approval for broader age groups and symptomatic management.

Market Barriers

-

Pricing and Reimbursement Challenges: Cost considerations influence prescribing patterns, especially in cost-sensitive markets.

-

Market Penetration: Established brands like Flonase and Nasonex have deep-rooted prescriber loyalty.

-

Generic Competition: Emergence of generic azelastine and fluticasone may impact DYMISTA’s market share.

Sales Projections

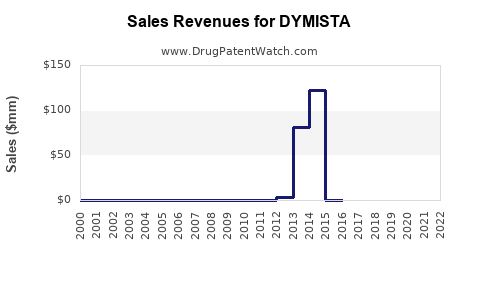

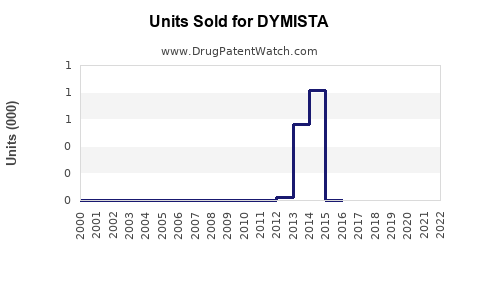

Historical Sales Data

Since its launch in select markets, DYMISTA has reported initial annual sales around USD 250 million in North America by 2022[3]. Its uptake is modest but shows promising growth patterns in subsequent years.

Forecasted Sales Growth

Assuming steady market penetration, the following projections are anticipated:

-

2023–2025: Compound annual growth rate (CAGR) of approximately 12%, supported by:

- Increasing clinician awareness

- Expanded payer coverage

- Efficacy advantages leading to higher prescription rates

-

2026–2030: CAGR stabilizes around 8%, as market saturation occurs and competition intensifies.

Market Penetration Strategy Impact

Aggressive marketing, educational initiatives, and possible line extensions could elevate sales by 15-20% annually during the forecast period. Given current market size, projected global sales could reach USD 1.2 billion by 2030.

Regional Sales Dynamics

-

North America: Dominant due to high prevalence, advanced healthcare infrastructure, and existing brand recognition. Estimated sales could reach USD 600 million by 2030.

-

Europe: Growing at a similar pace, with sales potentially exceeding USD 350 million.

-

Asia-Pacific & Rest of World: Emerging markets present substantial growth opportunities, with sales potentially doubling from current levels due to increasing allergy awareness and expanding healthcare access.

Regulatory and Market Access Considerations

Future growth hinges on regulatory approvals, payer reimbursement policies, and clinician acceptance. Countries updating allergy guidelines to favor combination therapies will further propel adoption.

Conclusion & Strategic Recommendations

DYMISTA's market potential remains robust, buoyed by the rising burden of allergic rhinitis and clinician preference for combination treatments. Strategic initiatives such as expanding indicated populations, engaging in clinician education, and optimizing pricing models will be critical to capitalize on growth opportunities. Companies should monitor competitive pipelines, generic entry timelines, and regional regulatory landscapes to refine market entry and expansion strategies.

Key Takeaways

- The global allergic rhinitis market is projected to grow at a CAGR of 5.3%, reaching over USD 10 billion by 2030.

- DYMISTA’s unique combination of azelastine and fluticasone propionate positions it favorably within the anti-allergy segment.

- Sales are forecasted to grow at approximately 12% annually, with global revenues potentially surpassing USD 1.2 billion by 2030.

- North America will remain the leading market; however, emerging markets in Asia-Pacific offer substantial growth potential.

- Market success depends on regulatory approvals, payer coverage, competitive positioning, and ongoing clinician education.

FAQs

1. What factors differentiate DYMISTA from other nasal sprays?

DYMISTA combines an antihistamine and corticosteroid in a single spray, providing rapid symptom relief and improved adherence compared to monotherapies.

2. How does the prevalence of allergic rhinitis influence DYMISTA’s sales?

Higher prevalence drives demand for effective combination therapies, directly impacting DYMISTA’s market size and sales growth.

3. What is the outlook for generic competition impacting DYMISTA?

Although generics for azelastine and fluticasone exist, the branded combination offers convenience and perceived efficacy, helping mitigate immediate generic erosion.

4. Which regions are expected to drive DYMISTA’s future sales?

North America and Europe will lead, but Asia-Pacific and Latin America increasingly represent significant growth opportunities.

5. What strategies can enhance DYMISTA’s market penetration?

Clinician education, expanding indications, favorable reimbursement policies, and competitive pricing are key to increasing adoption.

References

[1] Market Research Future, "Global Allergic Rhinitis Market Analysis," 2022.

[2] World Allergy Organization, "Allergic Rhinitis Facts," 2021.

[3] IQVIA, "Pharmaceutical Market Data," 2022.