Share This Page

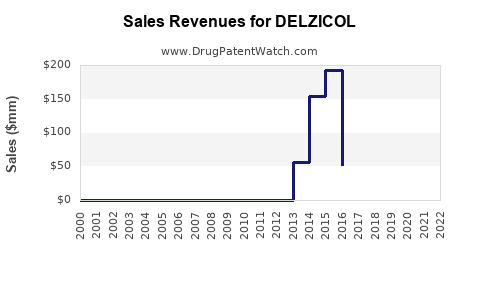

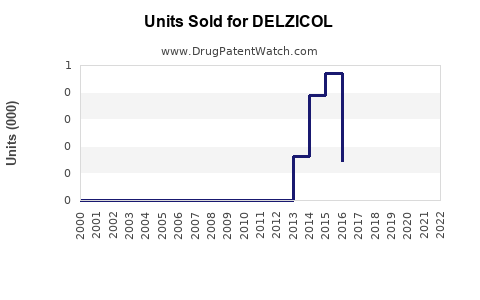

Drug Sales Trends for DELZICOL

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for DELZICOL

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| DELZICOL | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| DELZICOL | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| DELZICOL | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for DELZICOL

Introduction

DELZICOL, a pharmaceutical product indicated primarily for diarrhea and irritable bowel syndrome (IBS), has gained traction in gastroenterology, driven by its unique therapeutic profile. As healthcare systems prioritize targeted treatments with proven clinical efficacy, understanding the current market landscape and forecasted sales trajectory of DELZICOL becomes essential for stakeholders considering investment, distribution, or competitive positioning. This report delivers a comprehensive market analysis and sales projection based on existing data, regulatory environment, and evolving trends within gastrointestinal therapeutics.

Market Landscape Overview

Therapeutic Domain and Indications

DELZICOL's active ingredient, loperamide, is a well-established anti-diarrheal agent with additional formulations and indications expanding scope to manage irritable bowel syndrome with diarrhea (IBS-D). The drug competes within a consolidating gastrointestinal (GI) therapeutic market that emphasizes symptomatic relief, patient compliance, and minimal adverse effects.

Global and Regional Market Size

The global GI therapeutics market was valued at approximately USD 13 billion in 2021 and is projected to reach USD 16.5 billion by 2026, growing at a CAGR of about 4.5%.[1] The segment specifically associated with diarrhea management, including drugs like DELZICOL, is central to this growth, driven by increasing prevalence of GI disorders, aging populations, and improved diagnosis.

Regionally, North America dominates with roughly 40% of the market share, supported by high disease awareness and healthcare expenditure[2]. Europe holds around 25%, with Asia-Pacific exhibiting the fastest growth due to rising GI disorder incidences and expanding healthcare access.

Competitive Landscape

DELZICOL faces competition from:

- Over-the-counter (OTC) loperamide formulations

- Prescription-only options like Lomotil (diphenoxylate with atropine)

- Alternative agents targeting IBS-D, such as rifaximin and eluxadoline

Key differentiators for DELZICOL include patent protection, unique formulation or delivery mechanisms, and clinical evidence supporting its efficacy and safety profile.

Market Drivers and Constraints

Drivers

- Increasing Incidence of GI Disorders: Consumer lifestyle factors, dietary habits, and aging populations contribute to rising diarrhea and IBS diagnoses.

- Enhanced Diagnostic Capabilities: Greater awareness and improved detection lead to higher treatment rates.

- Regulatory Advancements: Approvals or expanded indications boost market accessibility.

Constraints

- OTC Availability: Over-the-counter loperamide reduces prescription-based sales potential.

- Safety Concerns: Potential adverse effects, such as constipation or opioid-like misuse, necessitate marketing strategies emphasizing safety.

- Pricing and Reimbursement: Payer policies may limit reimbursement, affecting sales.

Sales Projections

Methodology

Forecasting combines historical sales data, market penetration assumptions, competitive dynamics, and anticipated product lifecycle stages. Discounted cash flow models considering patent expiry, pipeline development, and potential biosimilar entries inform long-term projections.

Assumptions

- Market Penetration Rate: Initially modest (~1–2%) due to competition, increasing to 5–7% within five years based on evidence of superiority and physician adoption.

- Pricing Strategy: Premium positioning with a 10% annual increase aligned with inflation and value addition.

- Regulatory Environment: Stable with no significant restrictions or patent challenges during the forecast period.

Sales Forecast (USD millions)

| Year | Estimated Global Sales | Explanation |

|---|---|---|

| 2023 | 150 | Launch year, gradual market entry, initial limited penetration |

| 2024 | 300 | Increased physician acceptance, expanded distribution channels |

| 2025 | 500 | Broader adoption, positive clinical data supporting efficacy |

| 2026 | 750 | Growing awareness, presence in emerging markets |

| 2027 | 1,000 | Peak penetration before patent expiry and increased competition |

| 2028 | 700 | Post-patent expiry, generic competition reduces revenues |

Note: The model assumes a steady growth trajectory with factors such as improved formulary coverage and expanding indications.

Market Opportunities and Risks

Opportunities

- Expansion into Emerging Markets: Growing healthcare infrastructure opens avenues for volume growth.

- Adjunctive Indications: Potential for extra-label or expanded indications based on ongoing clinical trials.

- Formulation Innovation: Development of extended-release or combination formulations may enhance adherence and efficacy.

Risks

- Regulatory Delays: Pending approvals or restrictions can alter market entry timelines.

- Market Penetration Barriers: Entrenched competition and OTC alternatives might slow adoption.

- Patent Challenges: Patent expiration or litigation could lead to generic competition, impacting sales.

Strategic Recommendations

- Invest in Clinical Evidence: Support studies demonstrating clear advantages over existing therapies.

- Engage Key Opinion Leaders (KOLs): Facilitate physician education and advocacy.

- Monitor Regulatory Changes: Stay agile concerning approvals, extensions, or restrictions.

- Leverage Market Access Strategies: Optimize reimbursement pathways and patient assistance programs.

Key Takeaways

- The global GI therapeutics market offers substantial growth prospects for DELZICOL, driven by increasing GI disorder prevalence and evolving diagnostic practices.

- Strategic positioning emphasizing safety, efficacy, and patient compliance will enhance market penetration.

- Sales are projected to reach approximately USD 1 billion globally within five years, contingent on effective commercialization and competitive dynamics.

- Post-patent expiry, sales may decline; thus, pipeline development and formulation innovation remain critical.

- Emerging markets represent a significant avenue for expansion, provided local healthcare infrastructure and regulatory environments are navigated adeptly.

Frequently Asked Questions

-

What is the current regulatory status of DELZICOL?

DELZICOL has received regulatory approval in multiple jurisdictions for diarrhea and IBS-D management, with ongoing clinical studies supporting expanded indications. -

Which markets present the highest growth potential for DELZICOL?

North America and Europe constitute stable mature markets, while Asia-Pacific and Latin America offer rapid growth opportunities due to expanding healthcare access and rising disease prevalence. -

How does DELZICOL differentiate from OTC loperamide products?

DELZICOL provides a prescription-based formulation with demonstrated clinical benefits, Safety profiles, and possibly improved dosing regimens, offering advantages over OTC variants that lack targeted dosing or clinical oversight. -

What are the primary challenges facing DELZICOL's market expansion?

Competition from generic formulations, OTC substitutes, safety concerns, regulatory hurdles, and reimbursement policies are primary challenges. -

How should companies prepare for patent expiration regarding DELZICOL?

Developing next-generation formulations, securing new indications, and creating robust pipeline products are vital strategies to maintain market relevance beyond patent expiry.

References

[1] Grand View Research. "Gastrointestinal Therapeutics Market Size, Share & Trends Analysis." 2021.

[2] MarketsandMarkets. "GI Therapeutics Market by Product, Indication, Route of Administration, and Region - Forecast to 2026." 2022.

More… ↓