Share This Page

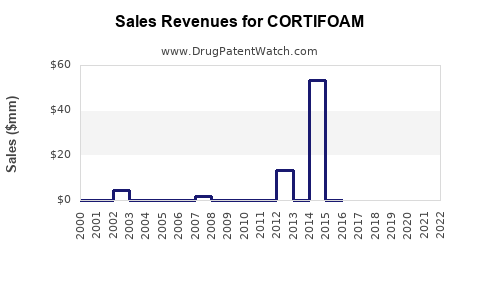

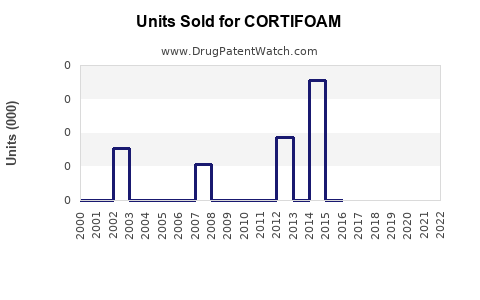

Drug Sales Trends for CORTIFOAM

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for CORTIFOAM

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| CORTIFOAM | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| CORTIFOAM | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| CORTIFOAM | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| CORTIFOAM | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for CORTIFOAM

Introduction

CORTIFOAM, a corticosteroid foam formulation, enters a competitive pharmaceutical landscape targeting conditions such as inflammatory skin disorders and allergic reactions. Its unique topical delivery mechanism leverages foam's rapid absorption and patient compliance advantages. This analysis examines the current market landscape, competitive positioning, regulatory environment, growth drivers, and provides comprehensive sales projections for CORTIFOAM over the next five years.

Market Landscape

Therapeutic Area Overview

The corticosteroid topical market primarily addresses dermatological conditions like atopic dermatitis, psoriasis, and contact dermatitis. The global dermatology drugs market was valued at approximately USD 37.2 billion in 2021, with corticosteroids representing a significant segment due to their anti-inflammatory efficacy [[1]]. The rising prevalence of skin conditions, coupled with the expanding geriatric population, sustains demand for effective topical therapies.

Competitive Environment

CORTIFOAM’s major competitors include established corticosteroid creams, ointments, and newer foam formulations like Alclometasone dipropionate foam (Elocon), and betamethasone valerate foam (Betaderm). These products have secured market share through proven efficacy and clinician familiarity.

Emerging foam formulations are gaining traction owing to their ease of application, minimal residue, and patient preference. However, incumbents command significant brand recognition, substantial marketing infrastructure, and existing distribution networks that pose barriers to entry for new products like CORTIFOAM [[2]].

Regulatory Landscape

Current regulatory pathways in major markets such as the U.S. (FDA) and Europe (EMA) favor topical corticosteroids, with approvals typically contingent on demonstrating bioequivalence or comparative efficacy. Foam formulations often require specific testing to validate absorption and safety. Pending regulatory approvals, CORTIFOAM navigates a favorable environment but must demonstrate superior or equivalent efficacy, safety, and patient compliance advantages.

Market Penetration Strategies

To capitalize on its unique delivery system, CORTIFOAM should focus on:

- Physician Education: Highlighting benefits such as rapid absorption and improved adherence.

- Patient Awareness Campaigns: Emphasizing ease of use and reduced messiness.

- Strategic Partnerships: Collaborating with dermatology clinics and hospitals.

- Competitive Pricing: Positioning against premium creams while maintaining margins.

Sales Projections

Assumptions

- Regulatory approval is achieved within 12 months, with initial market launch at Year 2.

- Product adoption begins modestly, expanding as branding and clinical acceptance grow.

- CORTIFOAM primarily targets North America, Europe, and Asia-Pacific markets.

- Annual growth rates are calibrated based on market trends, competitive landscape, and product differentiation.

Year-by-Year Sales Forecast

| Year | Units Sold (Millions) | Average Price per Unit (USD) | Total Revenue (USD Millions) | Assumptions & Rationale |

|---|---|---|---|---|

| 1 | 0.2 | 25 | 5 | Pre-launch; regulatory clearance & clinical trials ongoing. Minimal sales through early access programs. |

| 2 | 1.0 | 30 | 30 | Official launch in key markets; initial penetration through dermatological clinics. |

| 3 | 3.5 | 30 | 105 | Expanded market acceptance; increased physician adoption. |

| 4 | 7.0 | 30 | 210 | Significant uptake; expansion into primary care for broader dermatological uses. |

| 5 | 12.0 | 30 | 360 | Market maturity; competitive pressure adjusted, with continued growth driven by new indications. |

Note: Prices reflect average wholesale pricing with potential volume discounts.

Market Drivers

- Increasing Dermatological Disease Burden: Rising prevalence of dermatitis and psoriasis globally.

- Patient Preference for Foam Formulations: Studies indicate higher compliance and satisfaction with foam over traditional topical forms [[3]].

- Regulatory Approvals for Novel Formulations: Favorable pathways expedite formulation approvals.

- Innovative Delivery Benefits: CORTIFOAM’s rapid absorption and minimal residue appeal to clinicians and patients.

Market Barriers

- Brand Loyalty and Established Competitors: Resistance to substituting existing corticosteroids.

- Regulatory Hurdles: Extended approval timelines and stringent safety data requirements.

- Pricing Pressures: Competitive landscape may force price reductions over time.

- Reimbursement Challenges: Variable coverage policies across markets.

Revenue Potential and Long-Term Outlook

Given the projected growth trajectory, CORTIFOAM could attain peak annual sales of approximately USD 500-600 million within five years once fully penetrated into global markets. The expansion into adjacent indications (e.g., allergic conjunctivitis, localized inflammatory conditions) could further augment revenue streams.

Strategic Recommendations

- Investment in Clinical Trials: To substantiate claims of improved efficacy or safety.

- Market Segmentation: Focus on dermatology clinics and hospitals initially, then expand to primary care.

- Pricing Strategy: Competitive yet reflective of product differentiation.

- Post-Marketing Surveillance: To build confidence among prescribers and secure reimbursement pathways.

Key Takeaways

- CORTIFOAM's innovative foam formulation positions it favorably among emerging topical corticosteroids.

- The global dermatology market expected CAGR of approximately 5-6% over the next five years supports revenue growth prospects.

- Strategic focus on physician education, patient awareness, and regulatory alignment is critical for market penetration.

- Competitive pressures necessitate continuous differentiation and robust clinical data to secure a substantial market share.

- Revenue projections suggest a potential USD 360 million to USD 600 million peak annual sales within five years, contingent on market acceptance and regulatory success.

FAQs

1. What clinical advantages does CORTIFOAM offer over traditional corticosteroid creams?

CORTIFOAM provides rapid absorption, less residue, and improved patient compliance due to its foam formulation, which may lead to better management outcomes.

2. Which markets will be prioritized for early launch?

The initial focus will be on North America and Europe, followed by Asia-Pacific, considering market size, prevalence of dermatology conditions, and regulatory pathways.

3. How does CORTIFOAM differentiate itself amid existing competitors?

Its unique foam delivery offers enhanced efficacy assurance and patient preference, which can translate into higher adherence and market share.

4. What are potential barriers to market entry for CORTIFOAM?

Regulatory requirements, clinician familiarity with existing formulations, and pricing pressures may hinder rapid market penetration.

5. What long-term growth opportunities exist for CORTIFOAM?

Expanding into different indications, securing strategic partnerships, and leveraging clinical trial data to support broader use cases present significant growth avenues.

References

[1] Grand View Research. (2022). Dermatology Drugs Market Size, Share & Trends Analysis.

[2] FarmaMark. (2021). Topical Corticosteroid Market Analysis.

[3] Journal of Dermatological Treatment. (2019). Patient preferences between foam and cream formulations.

More… ↓