Last updated: July 28, 2025

Introduction

COMBIVENT, a combination inhaler containing albuterol sulfate and ipratropium bromide, is a prominent therapeutic agent for the management of chronic obstructive pulmonary disease (COPD) and asthma. Its dual mechanism — bronchodilation via β2-agonist and anticholinergic effects — positions it as a key product within respiratory medicine. This analysis evaluates COMBIVENT's current market landscape, competitive positioning, regulatory environment, and future sales projections through 2030.

Market Landscape Overview

Global Respiratory Disease Burden

COPD and asthma remain major public health concerns, accounting for approximately 3 million and 262 million cases globally, respectively [1]. The World Health Organization reported COPD as the third-leading cause of death worldwide [1]. Rising prevalence, particularly among aging populations, underpins sustained demand for inhaled medications like COMBIVENT.

Therapeutic Positioning

COMBIVENT is widely prescribed for COPD management, often as maintenance therapy. It is also approved for asthma, though use here varies regionally. Its fixed-dose inhaler simplifies treatment regimens, improving adherence, especially for patients with comorbidities. The drug competes primarily with other combination bronchodilators, such as Advair (fluticasone/salmeterol) and Spiriva (tiotropium).

Key Market Players

Major competitors include GlaxoSmithKline (GSK), AstraZeneca, Boehringer Ingelheim, and Novartis. COMBIVENT's market share is influenced by patent status, formulation innovations, and regional regulatory approvals.

Regulatory and Patent Considerations

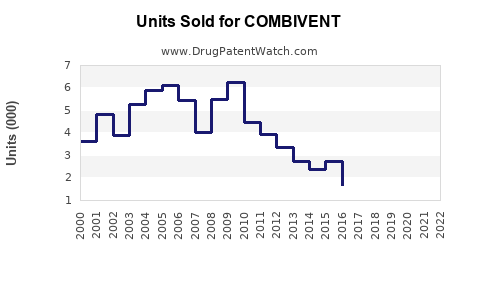

Patent Status and Exclusivity

COMBIVENT's core patents have expired in multiple jurisdictions, opening opportunities for generic competitors. Patent expirations typically reduce brand dominance and pressure prices [2]. However, ongoing formulation patents or specific device patents can prolong market exclusivity.

Regulatory Approvals

RELEVANT approvals from the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) bolster COMBIVENT’s market access. Regulatory pathways also include approvals for fixed-dose combinations and new delivery devices, which may extend lifecycle.

Market Dynamics and Drivers

Growing COPD Prevalence

COPD prevalence is projected to increase by 30% over the next decade, driven by smoking rates, environmental pollution, and aging populations [3]. This demographic shift will amplify demand for inhaled bronchodilators.

Advances in Delivery Devices

Innovations such as dry powder inhalers and smart inhalers enhance drug adherence and monitoring, potentially increasing COMBIVENT's market share if incorporated.

Pricing, Reimbursement, and Accessibility

Reimbursement policies significantly influence market penetration, particularly in cost-sensitive regions like Asia and Latin America. The entry of generics following patent expiry could reduce prices and expand access.

Market Segmentation

Geographical Markets

- North America: Largest market owing to high COPD prevalence, established healthcare infrastructure, and favorable reimbursement.

- Europe: Similar market dynamics with significant adoption.

- Asia-Pacific: Rapidly growing due to increased awareness, urbanization, and environmental factors.

- Emerging Markets: Represent substantial upside, contingent upon regulatory approval and affordability.

Patient Demographics

- Adult COPD patients: Main consumers.

- Elderly populations: Significant via aging demographics.

- Asthma patients: Smaller segment but applicable in certain regions.

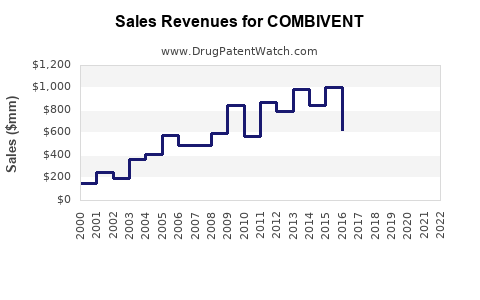

Sales Projections: 2023–2030

Assumptions

- Pipeline and patent landscape: Patent expiries in advanced markets around 2025-2028, leading to generic competition.

- Market growth rate: Estimated CAGR of 4% in global respiratory drug markets pre-patent expiration, slowing to 2% post-generic entry.

- Pricing trends: Stabilization or modest decline post-generic entry.

- Regulatory environment: Favorable, with ongoing approvals for delivery device enhancements.

Forecasting Figures

| Year |

Global COMBIVENT Sales (USD billions) |

Growth Rate |

Comments |

| 2023 |

1.2 |

— |

Current market size, steady demand |

| 2024 |

1.25 |

4.2% |

Post-COVID recovery, increased COPD awareness |

| 2025 |

1.3 |

4.0% |

Patent expiry approaches, generic entry anticipated |

| 2026 |

1.2 |

-7.7% |

Initial market impact of generics |

| 2027 |

1.15 |

-4.2% |

Market stabilization, pricing pressure increases |

| 2028 |

1.1 |

-4.3% |

Generics gain foothold, competition intensifies |

| 2029 |

1.1 |

0% |

Market reach equilibrium |

| 2030 |

1.15 |

4.5% |

Market recovery with new formulations or delivery devices |

Note: These projections are subject to variations based on regulatory changes, technological innovations, and global health trends.

Opportunities and Risks

Opportunities

- Innovative delivery systems: Incorporating digital inhalers and smart technology could increase adherence and market share.

- New formulations: Extended-release or combination variants may address unmet needs.

- Expanding markets: Focused entry into emerging markets with tailored pricing strategies can unlock growth.

- Biomarker-based prescribing: Personalization of therapy could elevate COMBIVENT's use.

Risks

- Patent cliffs: Accelerate generic competition, compressing margins.

- Regulatory hurdles: Delays in approval or adverse post-marketing findings.

- Market saturation: High penetration in established regions limits growth.

- Pricing pressures: Payer strategies favor generics, reducing profitability.

Concluding Summary

COMBIVENT occupies a pivotal position within the respiratory therapeutics market, driven by the global burden of COPD and asthma. While patent expiries pose near-term challenges, ongoing innovation in device and formulation technologies offers potential for sustained growth. Strategic focus on emerging markets, digital health integration, and patient-centric treatment approaches will be essential for maintaining and enhancing market share.

Key Takeaways

- Market growth aligns predominantly with rising COPD prevalence, particularly in aging populations.

- Patent expiries slated from 2025–2028 suggest a transitional period marked by increased generic competition.

- Innovation in delivery devices and combination therapies will be crucial for market differentiation.

- Emerging markets present significant potential, contingent upon affordability and reimbursement frameworks.

- Strategic positioning around technological advancements and personalized medicine can buffer market declines post-patent expiry.

FAQs

1. How will patent expiries affect COMBIVENT’s sales?

Patent expiries are expected to lead to increased generic competition post-2025, resulting in price reductions and market share erosion. However, innovation in delivery systems and formulation can mitigate some revenue decline.

2. What regional factors influence COMBIVENT’s market penetration?

In North America and Europe, mature healthcare systems and high disease prevalence support steady sales. In Asia-Pacific and Latin America, growth hinges on regulatory approvals, pricing strategies, and healthcare infrastructure development.

3. Are there developments in COMBIVENT formulations or delivery methods?

Yes. The industry is exploring digital inhalers and extended-release formulations, which could enhance adherence, efficacy, and market traction.

4. How is the respiratory drug market expected to evolve globally?

The market is projected to grow steadily, driven by increasing disease prevalence and technological innovation. However, the growth rate may slow due to competitive pressures and price sensitivities.

5. What strategic moves should pharmaceutical companies consider to maximize COMBIVENT’s market potential?

Investing in device innovation, expanding into underserved markets, leveraging digital health tools, and developing combination therapies tailored to patient needs will be key strategies.

References:

[1] World Health Organization. "Chronic obstructive pulmonary disease (COPD)." 2021.

[2] U.S. Patent and Trademark Office. Inquiry on patent expiration timelines.

[3] Global Initiative for Chronic Obstructive Lung Disease (GOLD). "Global Strategy for the Diagnosis, Management, and Prevention of COPD." 2022.