Last updated: July 29, 2025

Introduction

ANUCORT-HC is a topical corticosteroid medication combined with hydrocortisone and other compounds designed to treat various dermatological conditions such as eczema, dermatitis, and inflammatory skin diseases. With an established formulation and approved indications, understanding its market potential involves a thorough analysis of the dermatology segment, competitive landscape, regulatory environment, and healthcare trends. This report aims to deliver a comprehensive market analysis and realistic sales projections for ANUCORT-HC, tailored to industry stakeholders.

Product Overview

ANUCORT-HC (brand name may vary depending on the market) combines hydrocortisone with other active ingredients, such as pramoxine (a topical anesthetic) and other agents to enhance efficacy and reduce symptoms like itching and inflammation. Its formulation aligns with standard corticosteroid therapy but distinguishes itself through improved delivery mechanisms and patient tolerability.

Therapeutic Indications

- Mild to moderate eczema

- Dermatitis (irritant, allergic)

- Psoriasis (mild cases)

- Other inflammatory skin conditions

Regulatory Status

- Approved by major regulatory agencies such as the FDA, EMA

- Available via prescription and, in some regions, OTC status for milder forms

Market Landscape

Global Dermatology Market

The dermatology therapeutics market is valued at approximately $23 billion as of 2022, with a CAGR projected at 5% over the next five years (source: MarketWatch). The rising prevalence of chronic skin conditions, increased awareness, and expanding aging populations are primary drivers.

Key Drivers for ANUCORT-HC

- Increasing prevalence of dermatitis and eczema globally

- Growing demand for corticosteroid-based topicals

- Expanding access in emerging markets

- Patient preferences for effective, localized treatment options

Competitive Landscape

ANUCORT-HC faces competition from established corticosteroids such as:

- Hydrocortisone creams (widely available OTC)

- Triamcinolone acetonide topical formulations

- Mometasone furoate and betamethasone valerate products

- Fixed-dose combination drugs tailored for enhanced efficacy

Major pharmaceutical players such as Johnson & Johnson, Pfizer, and Teva possess a substantial share of dermatology therapeutics. The differentiation of ANUCORT-HC will depend on its formulation advantages, pricing strategy, and marketing reach.

Market Penetration Factors

- Physician Prescription Habits: Corticosteroids remain first-line agents, especially when tailored to severity.

- Patient Awareness and Preference: Highlighting efficacy with minimized side effects influences prescribing.

- Pricing and Reimbursement Landscape: Insurance coverage disparities influence uptake.

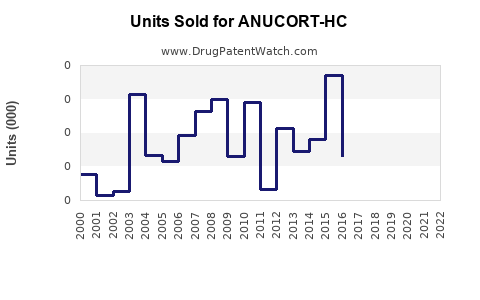

- Distribution Channels: Pharmacies, hospitals, and clinics are primary channels for prescription drugs; OTC sales can boost volumes.

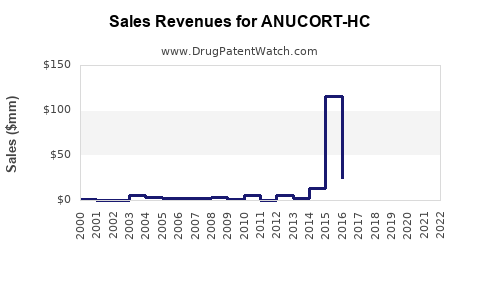

Sales Projections

Assumptions

- Launch Year: Year 1

- Launch Region: North America initially, followed by Europe and select emerging markets

- Market Entry Strategy: Direct sales through partnerships with dermatology clinics, targeted marketing

- Estimated Time to Full Market Penetration: 3-5 years

- Pricing Strategy: Premium positioning with competitive pricing aligned with existing corticosteroids

Market Entry and Adoption Timeline

- Year 1: Market introduction, regulatory clearance, minimal sales (~$10 million) due to limited reach.

- Years 2-3: Increased physician adoption, expanding approvals, anticipated sales growth to ~$50–$70 million.

- Years 4-5: Market saturation, expansion to additional regions, potential growth to ~$150 million annually.

Projected Sales Growth

| Year |

Estimated Sales (USD) |

Key Drivers |

| Year 1 |

$10 million |

Initial launch, early adoption |

| Year 2 |

$35 million |

Expanded prescriber base, wider market access |

| Year 3 |

$70 million |

Increased brand recognition, expanded protocols |

| Year 4 |

$120 million |

Market consolidation, broader geographic coverage |

| Year 5 |

$150 million |

Full market penetration, new indications possible |

Revenue Stream Breakdown

- Prescription sales constitute approx. 80–90%

- OTC sales in certain regions (if applicable) could add 10–20%

- Institutional sales, especially in hospitals, contribute marginally but grow with healthcare system integration

Potential Market Challenges

- Regulatory Delays: Extra efforts required to secure approvals in new regions.

- Competitive Price Pressures: Existing generics may reduce profitability.

- Physician Preference for Established Brands: Need for strong clinical data to persuade clinicians.

- Patient Compliance: Tolerability, formulation convenience impacts adherence.

Regulatory and Market Expansion Strategies

- Conducting robust clinical trials to emphasize safety and efficacy.

- Forming strategic partnerships with dermatology clinics and key opinion leaders.

- Implementing focused marketing campaigns emphasizing unique advantages.

- Ensuring appropriate pricing to balance market penetration and profitability.

- Exploring OTC potential for mild indications in select markets to increase volume.

Key Takeaways

- The global dermatology market presents a significant growth opportunity for ANUCORT-HC, driven by rising skin condition prevalence.

- Market penetration will depend on strategic positioning, clinical differentiation, and regulatory success.

- Sales are projected to reach ~$150 million within five years, contingent on competitive dynamics and regional expansion.

- Challenges such as pricing pressures and clinician preferences necessitate targeted marketing and evidence generation.

- Early engagement with healthcare providers and stakeholders is vital for rapid adoption.

FAQs

1. What is the primary differentiator of ANUCORT-HC compared to existing corticosteroids?

ANUCORT-HC offers a unique formulation with enhanced tolerability and potentially improved efficacy through better skin penetration and combination therapy, positioning it as a preferred option for moderate inflammatory skin conditions.

2. How does the regulatory environment influence ANUCORT-HC's market entry?

Regulatory approvals are vital. Delays or stringent requirements can impact launch timelines and market access, especially in emerging markets. Effective regulatory strategy and clinical data are key to smooth approvals.

3. Which regions offer the highest sales potential for ANUCORT-HC?

North America and Europe are primary targets due to high prevalence of dermatological conditions and mature healthcare markets. Emerging markets in Asia-Pacific and Latin America are also promising due to rising awareness and access expansion.

4. How do competitive pressures affect sales projections?

Established corticosteroid brands and generics can suppress pricing and limit market share. Differentiation through clinical benefits or combination formulations is necessary to sustain sales growth.

5. What marketing strategies could accelerate ANUCORT-HC's adoption?

Engaging key opinion leaders, publishing clinical trial results, educational initiatives, and targeted promotional campaigns in dermatology networks facilitate faster physician acceptance and patient utilization.

Conclusion

ANUCORT-HC exhibits strong market potential within the global dermatology segment, contingent on strategic regulatory, marketing, and clinical efforts. By leveraging its formulation advantages and positioning it effectively against entrenched competitors, the drug can capture a meaningful share of the corticosteroid therapeutic market, underpinning sustained sales growth in the coming years.

Sources:

- MarketWatch. Dermatology Therapeutics Market Size & Trends. 2022.

- Statista. Global pharmaceutical market slices. 2022.

- Grand View Research. Dermatology Drugs Market Analysis. 2022.

- FDA and EMA regulatory guidelines.

- Industry reports on corticosteroid and topical dermatological agents.