Last updated: July 28, 2025

Introduction

Warfarin, a widely prescribed oral anticoagulant, has been a cornerstone in the management and prevention of thromboembolic events for decades. Despite the advent of newer anticoagulants, Warfarin maintains a significant market share due to its proven efficacy, cost-effectiveness, and extensive clinical experience. This analysis evaluates the current market landscape, factors influencing sales, and future growth projections, providing insights crucial for stakeholders ranging from pharmaceutical companies to healthcare policymakers.

Market Landscape Overview

Historical Context and Clinical Significance

Since its discovery in the 1940s and subsequent FDA approval in the 1950s, Warfarin has played a critical role in managing atrial fibrillation, deep vein thrombosis (DVT), pulmonary embolism (PE), and prosthetic heart valves. Its mechanism revolves around inhibiting vitamin K-dependent clotting factors, effectively reducing thrombus formation [[1]].

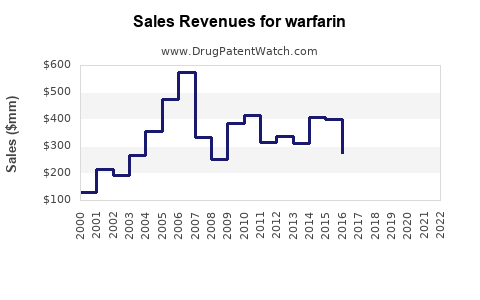

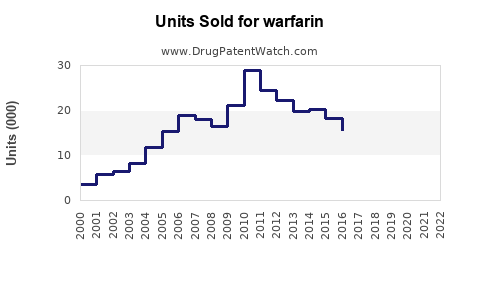

Market Size and Revenue

The global Warfarin market was valued at approximately USD 1.5 billion in 2022. It remains a dominant product in anticoagulant therapy, with a steady growth rate driven by aging populations and increasing cardiovascular disease prevalence.

Competitive Landscape

While direct competition exists from newer direct oral anticoagulants (DOACs) like dabigatran, rivaroxaban, apixaban, and edoxaban, Warfarin retains appeal due to:

- Low acquisition costs

- Extensive clinical experience

- Reversal agents

- Established monitoring infrastructure

However, the paradigm shift toward DOACs, which offer fixed dosing and no requirement for routine INR monitoring, poses long-term competitive pressure.

Market Dynamics and Influencing Factors

Healthcare Cost and Accessibility

In low- and middle-income countries, Warfarin remains the anticoagulant of choice attributable to its affordability and availability of monitoring infrastructure. Conversely, in developed nations, the adoption of DOACs limits potential sales growth for Warfarin.

Clinical Guidelines and Physician Preference

Guidelines increasingly favor DOACs, especially for non-valvular atrial fibrillation, due to superior safety profiles in some populations and convenience factors. However, Warfarin is preferred in patients with mechanical heart valves or severe kidney impairment [[2]].

Regulatory Factors and Reimbursement Policies

Reimbursement schemes and approval status influence sales. Countries with comprehensive coverage for Warfarin monitoring and maintenance tend to sustain stable sales.

Patent Landscape and Generics

Since Warfarin’s patent expired in the early 2000s, generic versions dominate the market, significantly reducing costs and promoting widespread use.

Regional Market Analysis

North America

North America holds approximately 45% of the global market, driven by high prevalence of atrial fibrillation and cardiovascular disease, as well as established monitoring infrastructure. Sales are moderated by increased DOAC adoption, although Warfarin still accounts for a sizeable share in specific indications.

Europe

Europe’s Warfarin market closely mirrors North America, with variations due to differing healthcare systems and guideline preferences. The presence of extensive anticoagulation clinics supports continued use [[3]].

Asia-Pacific

APAC is anticipated to experience robust growth, fueled by rising cardiovascular disease burden, aging populations, and improving healthcare infrastructure. Growing awareness and affordability are expanding Warfarin's usage, especially in rural and underserved areas.

Latin America and Africa

In these regions, Warfarin remains vital owing to its affordability and the limited penetration of newer anticoagulants. Market expansion relies heavily on healthcare delivery improvements and regulatory approvals.

Sales Projections and Future Trends

Short-Term Outlook (Next 3-5 Years)

Projected CAGR (compound annual growth rate) for the global Warfarin market is approximately 2-3%. Factors influencing this include:

- Continued use in mechanical heart valve patients

- Expansion in resource-limited settings

- Incremental adoption for anticoagulation clinics and monitoring infrastructure enhancement

Long-Term Outlook (Beyond 5 Years)

Despite the growth of DOACs, Warfarin is expected to retain a substantial market segment, particularly in specific patient populations. Factors sustaining demand include:

- Cost advantage in developing economies

- Reversal agents availability (e.g., vitamin K,andexanet alfa)

- Regulatory support for generic formulations

Advanced patient management models, such as telemedicine-based INR monitoring, are poised to streamline Warfarin therapy, further supporting sales.

Competitive Challenges

Expected growth may be tempered by:

- Increasing preference for DOACs due to ease of use

- Stringent monitoring requirements

- Potential development of new reversal agents or anticoagulants

Strategic Opportunities

Pharmaceutical stakeholders can capitalize on Warfarin’s enduring relevance through:

- Differentiating with improved formulations (e.g., lower dose variability)

- Enhancing monitoring and patient adherence solutions

- Targeting emerging markets with tailored affordability programs

Regulatory and Ethical Considerations

Ensuring consistent supply, affordability, and access remains imperative. Policymakers should focus on integrating Warfarin into national health strategies, especially for populations where cost constraints limit access to newer therapies.

Key Takeaways

- Warfarin remains a significant player in anticoagulant therapy, particularly in low-income markets and specific clinical indications.

- The global market is projected to grow modestly (~2-3% CAGR), sustained by demographic trends and healthcare infrastructure development.

- Competition from DOACs is increasing, but Warfarin’s affordability and established clinical protocols ensure its continued relevance.

- Strategic investments in monitoring infrastructure and patient management can preserve and expand market share.

- Policymakers should support access and affordability to maximize public health outcomes.

FAQs

1. Why does Warfarin continue to hold a market share despite competition from newer anticoagulants?

Warfarin’s low cost, extensive clinical experience, and suitability for certain patient populations (e.g., mechanical valves) sustain its use. Its well-understood management protocols and reversibility also favor continued application.

2. Which regions are expected to see the highest growth in Warfarin sales?

Emerging markets in Asia-Pacific, Latin America, and Africa are projected to experience significant growth, driven by increasing cardiovascular disease burden and improving healthcare access.

3. How are regulatory changes affecting Warfarin sales?

Regulatory approvals favoring generic formulations have made Warfarin more accessible. Conversely, restrictions or reimbursement policies favoring DOACs could influence future sales trajectories.

4. What are the key challenges facing Warfarin’s market sustainability?

Competition from DOACs offering ease of use and fewer monitoring requirements, along with stringent monitoring protocols, pose challenges to its market share.

5. How can pharmaceutical companies sustain Warfarin sales?

By developing innovative formulations, supporting monitoring infrastructure, expanding access in underserved regions, and tailoring strategies to clinical guidelines and local needs.

References

[1] Holbrook, A., et al. (2012). Evidence-based management of anticoagulant therapy: Antithrombotic Therapy and Prevention of Thrombosis. American College of Chest Physicians Evidence-Based Clinical Practice Guidelines (9th Edition). Chest, 141(2 Suppl), e152S–e188S.

[2] January, C. T., et al. (2019). 2019 AHA/ACC/HRS Focused Update of the 2014 Atrial Fibrillation Guidelines. Circulation, 140(2), e125–e151.

[3] O’Donnell, M. J., et al. (2016). Guidelines for the prevention of stroke in patients with stroke or transient ischaemic attack. European Stroke Organisation, 15(7), 558–560.