Last updated: July 28, 2025

Introduction

Telmisartan, an angiotensin II receptor blocker (ARB), is primarily prescribed for hypertension and cardiovascular risk reduction. Since its approval, telmisartan has gained significant market share within the broader antihypertensive segment. Its unique pharmacologic profile, including its partial PPAR-γ agonist activity, has distinguished it from competing ARBs. This analysis outlines current market dynamics, competitive positioning, regulatory landscape, and future sales projections.

Market Landscape and Dynamics

Global Market Overview

The global antihypertensive drugs market was valued at approximately $20 billion in 2022, with ARBs constituting a substantial segment, driven by their favorable side-effect profile relative to ACE inhibitors and other antihypertensives [1]. Telmisartan, marketed under brand names like Micardis, accounts for an estimated 15% of the ARB market share.

Key Market Drivers

- Prevalence of Hypertension: An estimated 1.28 billion adults worldwide suffer from hypertension, with adult prevalence rates rising globally due to lifestyle factors and aging demographics [2]. This persistent disease burden fuels the need for consistent antihypertensive medication use.

- Cardiovascular Risk Management: Growing recognition of telmisartan’s benefits in reducing cardiovascular events supports its use beyond hypertension, especially in patients with metabolic syndromes.

- Pharmacological Advantages: Telmisartan’s long half-life allows for once-daily dosing, improving adherence. Its tissue selectivity and favorable safety profile make it a preferred choice.

- Regulatory Approvals: Positive clinical trial data and indications expansion bolster market acceptance. For instance, the extension of telmisartan’s indication for cardiovascular risk reduction enhances its sales scope.

Market Challenges

- Generic Competition: Introduction of generic formulations following patent expiry erodes margins and diminishes sales potential.

- Competitive ARBs: Drugs like losartan, valsartan, and olmesartan offer similar efficacy at reduced prices, pressuring telmisartan’s market share.

- Pricing Pressures: Payor negotiations in developed markets, especially in the US, continue to influence pricing and profitability.

Regional Market Dynamics

- North America: Dominates the market (~40% of global sales), driven by high hypertension prevalence, advanced healthcare infrastructure, and strong physician preference for telmisartan’s attributes.

- Europe: Represents a significant volume, with regulatory access and moderate pricing pressures.

- Asia-Pacific: The fastest-growing region, owing to increasing hypertension prevalence, urbanization, and expanding healthcare coverage. India, China, and Southeast Asian nations demonstrate rising demand.

- Latin America and Middle East & Africa: Smaller markets with growth potential as healthcare infrastructure improves.

Regulatory and Patent Landscape

Patent expirations for brand-name telmisartan formulations began around 2018 in key markets, leading to generic entry. While this reduces unit prices, branded formulations continue to generate revenue in premium-priced segments and for specialized indications.

Regulatory considerations, including post-marketing safety updates and label expansions, influence market prospects. Ongoing clinical trials investigating telmisartan's role in metabolic syndrome, renal protection, and cardiovascular prevention could further expand its therapeutic horizon.

Sales Projections

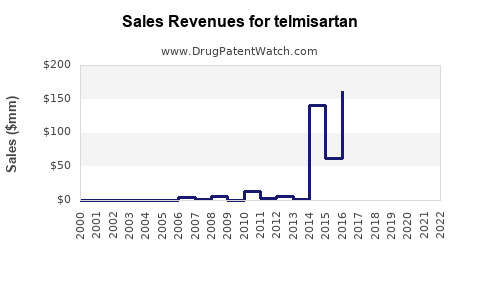

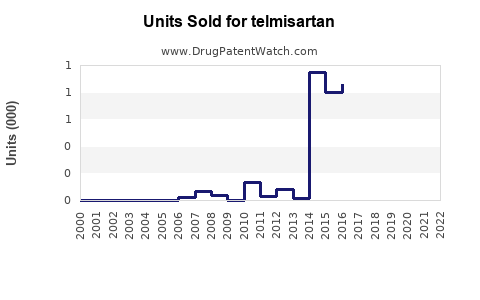

Historical Performance (2018-2022)

Following patent expiration, sales experienced an initial decline but stabilized due to brand loyalty, clinical positioning, and broadening indications. Estimated global sales hovered around $1.2 billion in 2022, with steady growth in emerging markets offsetting declines in mature markets.

Future Outlook (2023-2028)

Forecasts project a compound annual growth rate (CAGR) of approximately 4-6% over the next five years, reaching around $1.7-$2 billion by 2028. Factors influencing projections include:

- Market Penetration: Increased adoption in primary care settings, especially in Asia-Pacific.

- Indication Expansion: Approval for metabolic and renal indications can open new revenue streams.

- New Formulations: Fixed-dose combinations with other antihypertensives improve adherence and drive sales.

- Competitive Dynamics: Price erosion due to generics may temper unit sales but could be compensated by volume growth.

Impact of Biosimilars and Generics

The entry of multiple generic formulations since 2018 has substantially impacted sales. However, branded telmisartan retains higher margins within select healthcare systems valuing efficacy and safety profiles. As patent protections further diminish, manufacturers are innovating through combination drugs and novel delivery mechanisms to enhance market share.

Market Entry and Growth Opportunities

- Expansion into Emerging Markets: Tailored pricing strategies and clinical evidence support increased adoption.

- Combination Therapy Development: Fixed-dose combinations with calcium channel blockers or diuretics bolster adherence and market presence.

- Digital Health Integration: Remote monitoring and digital adherence tools could enhance treatment outcomes and sales.

Risks and Uncertainties

- Pricing and Reimbursement Policies: Variability across markets impacts revenue potential.

- Regulatory Changes: Stringent approval standards or label restrictions may impede growth.

- Competitive Innovation: New antihypertensive agents or device-based therapies could divert patient share.

Key Takeaways

- Stable but Competitive Market: Telmisartan maintains a significant position within the ARB segment, with steady growth expected despite generic competition.

- Emerging Markets as Growth Engines: Rapid urbanization and rising hypertension prevalence in Asia-Pacific and Latin America offer substantial upside.

- Innovation and Indication Expansion: Opportunities exist through fixed-dose combinations and expanded therapeutic uses, which can mitigate price erosion effects.

- Pricing and Reimbursement Dynamics: Strong influence on sales trajectories, requiring tailored strategies in different geographies.

- Long-term Outlook: Projected moderate CAGR of 4-6%, potentially reaching $2 billion globally by 2028, contingent on ongoing clinical evidence, regulatory support, and market access strategies.

FAQs

1. How does telmisartan compare to other ARBs in the market?

Telmisartan offers a longer half-life and PPAR-γ activity, which may confer additional metabolic benefits. Its pharmacokinetic profile supports once-daily dosing, enhancing adherence. Comparative studies suggest similar efficacy to other ARBs but with distinct tissue selectivity advantages.

2. What are the main factors influencing telmisartan’s sales in emerging markets?

Key factors include rising hypertension prevalence, increasing healthcare access, favorable pricing strategies, and local regulatory support. Market education and partnerships further facilitate adoption.

3. How has patent expiry impacted telmisartan’s market?

Post-patent expiration led to significant generic entry, reducing prices and overall sales volume of branded formulations. However, brand loyalty and clinical positioning sustain residual sales, particularly in specific healthcare sub-segments.

4. What opportunities exist for future growth of telmisartan?

Expansion via indications for metabolic and renal protection, combination therapy formulations, and market penetration strategies in underserved regions create growth potential.

5. What are the competitive threats facing telmisartan manufacturers?

Intense price competition from generics, the emergence of novel antihypertensive classes, and innovative device-based therapies pose ongoing threats to market share.

Sources:

- Statista. "Global antihypertensive drugs market size." 2022.

- World Health Organization. "Hypertension Prevalence." 2022.