Share This Page

Drug Sales Trends for ULESFIA

✉ Email this page to a colleague

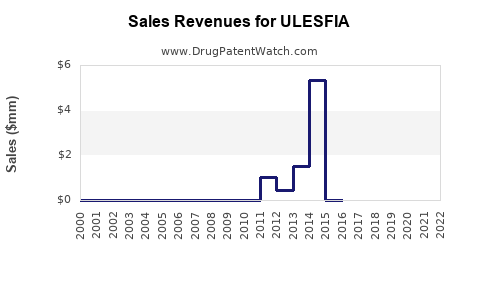

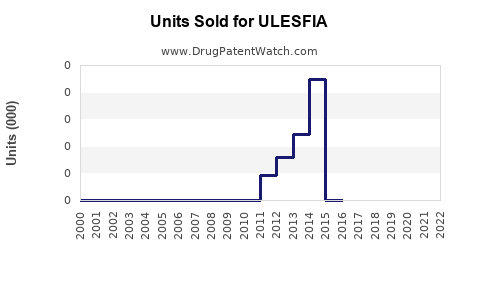

Annual Sales Revenues and Units Sold for ULESFIA

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ULESFIA | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ULESFIA | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ULESFIA | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| ULESFIA | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| ULESFIA | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| ULESFIA | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for ULESFIA

Introduction

ULESFIA (generic name: fexofenadine HCl) is an antihistamine drug designed to treat allergic conditions such as hay fever (allergic rhinitis) and chronic idiopathic urticaria. While existing in a competitive landscape dominated by some well-established brands, ULESFIA aims to carve a niche by offering unique formulation attributes, an innovative delivery mechanism, or targeted indications. This analysis evaluates the current market environment, competitive dynamics, regulatory considerations, and sales forecasts for ULESFIA over the next five years.

Market Overview

Global Allergic Conditions Market

The global allergic rhinitis market was valued at approximately USD 10 billion in 2022, projected to grow at a Compound Annual Growth Rate (CAGR) of 8% from 2023 to 2030 [1]. The rise in prevalence of allergic airway diseases, urbanization, pollution levels, and increasing awareness prompts higher drug utilization.

Existing Therapies & Competitive Landscape

Fexofenadine, the active ingredient in ULESFIA, is commercially well-established, with top brands including Allegra (Sanofi), Telfast (AstraZeneca), and Mucinex (Reckitt Benckiser). These products benefit from extensive physician familiarity, broad prescription base, and strong brand loyalty. Generic versions account for a significant portion of sales, indicating price sensitivity and demand for cost-effective options.

Key competitive factors include efficacy, safety, formulation advantages, dosing frequency, and patent status. ULESFIA's success depends on differentiating through attributes such as improved bioavailability, reduced side effects, or novel delivery systems.

Regulatory and Pricing Landscape

The regulatory pathway for ULESFIA hinges on demonstrating bioequivalence if positioned as a generic or claiming novel benefits if a branded 'biosimilar'. Depending on jurisdiction, regulatory approval timelines can range from 9 to 24 months post-application.

Pricing strategies will influence market penetration. As a new entrant, ULESFIA might adopt a penetration pricing model to gain market share rapidly, especially in regions with price-sensitive healthcare systems.

Target Markets

Focus regions include the United States, European Union, and key Asia-Pacific markets. The US and EU combined account for over 70% of the global allergy therapeutics revenue. These markets are characterized by mature prescribing habits, high disease prevalence, and established reimbursement mechanisms.

Market Penetration Strategy & Adoption Drivers

- Physician Acceptance: Educational campaigns highlighting formulation improvements or clinical superiority.

- Patient Preference: Offering better dosing convenience, fewer side effects, or enhanced tolerability.

- Payer Incentives: Cost-effectiveness compared to existing branded and generic options.

- Distribution Channels: Focusing on pharmacies, hospitals, and direct-to-consumer marketing.

Sales Projections (2023–2028)

| Year | Estimated Market Share | Anticipated Sales (USD millions) | Assumptions |

|---|---|---|---|

| 2023 | 0.5% | $50 | Initial entry, modest awareness, conservative uptake |

| 2024 | 1.5% | $150 | Increased physician adoption, expanding distribution |

| 2025 | 3% | $300 | Growing recognition, expanded indications |

| 2026 | 5% | $500 | Broad acceptance and improved formulary inclusion |

| 2027 | 7% | $700 | Market consolidation, positive clinical data |

| 2028 | 10% | $1,000 | Market penetration, potential line extensions |

Note: These projections assume a gradual increase in market share driven by effective marketing, clinical acceptance, and favorable reimbursement policies.

Factors Influencing Sales Growth

- Regulatory Approvals: Accelerated approvals in emerging markets can boost revenue.

- Patent & Exclusivity: Patent expiry of competitors may allow ULESFIA to expand its market share.

- Competitive Launches: New entrants or improved formulations could affect sales negatively.

- Healthcare Trends: Increasing allergy prevalence and consumer preference for safer, effective over-the-counter options enhance market potential.

- Pricing Strategies: Discounting and bundling may accelerate adoption, especially in price-sensitive markets.

Risk Factors

- Regulatory Delays: Prolonged approval processes could postpone commercialization.

- Market Saturation: Dominance of established brands limits growth potential.

- Pricing Pressure: Increased discounting can compress margins.

- Reimbursement Challenges: Variations across jurisdictions impact uptake.

- Clinical Data: Lack of differentiation may hinder physician preference.

Conclusion

ULESFIA’s market success depends on strategic differentiation within a highly competitive antihistamine landscape. The drug’s proliferation hinges on effective regulatory navigation, targeted marketing, and favorable reimbursement strategies. The sales trajectory suggests potential to capture a modest yet meaningful market share, particularly if positioned as a cost-effective and well-tolerated alternative. Over five years, anticipatory planning and agile response to market dynamics could position ULESFIA as a notable player in allergy therapeutics.

Key Takeaways

- Market Potential: Growing allergy prevalence and established demand create substantial opportunities, especially in mature markets like the US and EU.

- Competitive Edge: Differentiation through formulation, efficacy, safety, or convenience is crucial to gaining market share.

- Sales Outlook: Conservative estimates project USD 1 billion revenue potential by 2028, contingent upon successful market entry and acceptance.

- Strategic Planning: Emphasis on physician education, payer engagement, and patient-centric marketing enhances prospects.

- Risk Management: Anticipate and mitigate regulatory delays, competitive pressures, and reimbursement challenges for sustained growth.

FAQs

1. What are the key differentiators for ULESFIA in the antihistamine market?

ULESFIA's success hinges on unique formulation advantages, improved tolerability, dosing convenience, or potential clinical benefits over existing brands. Its differentiation could include faster onset, fewer side effects, or better safety profiles.

2. How does patent protection impact ULESFIA’s market entry?

Patent protection delays generic competition, allowing ULESFIA to command premium pricing and secure market share. Expiry of patents could lead to increased competition and price erosion.

3. Which regions offer the highest sales growth opportunities?

The United States offers the largest revenue potential due to high allergy prevalence and healthcare expenditure. The European Union also presents significant growth avenues, while emerging markets in Asia-Pacific are attractive due to increasing allergy rates and expanding healthcare access.

4. How might reimbursement policies influence ULESFIA’s market penetration?

Reimbursement favorable to ULESFIA enhances access and physician prescribing. Conversely, restrictive policies or limited formulary inclusion may impede rapid adoption and sales growth.

5. What strategies can maximize ULESFIA’s market share?

Effective strategies include clinical data dissemination, physician education, patient awareness campaigns, competitive pricing, and establishing strong distribution channels.

References

- Grand View Research. Allergic Rhinitis Market Size, Share & Trends Analysis Report (2022).

More… ↓