Share This Page

Drug Sales Trends for NORCO

✉ Email this page to a colleague

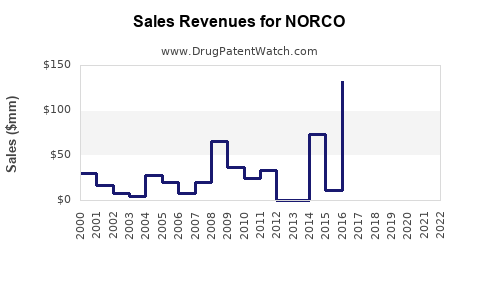

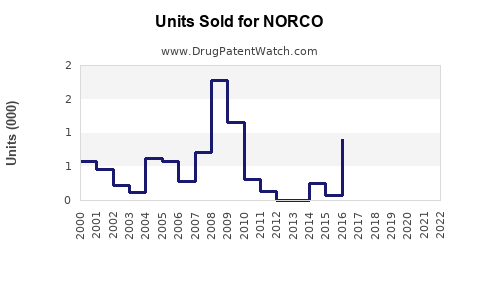

Annual Sales Revenues and Units Sold for NORCO

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| NORCO | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| NORCO | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| NORCO | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| NORCO | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for NORCO (Hydrocodone/Acetaminophen)

Introduction

NORCO, a combination analgesic comprising hydrocodone and acetaminophen, has been a long-standing agent in managing moderate to severe pain. It holds a prominent position in the opioid market, previously prescribed extensively across the United States and other regions. Analyzing NORCO's market trajectory involves understanding its positioning within the overall opioid landscape, regulatory challenges, claimed medical utility, and evolving market dynamics influenced by the opioid epidemic and alternative therapies.

Market Overview

Historical Context and Demand Drivers

NORCO has traditionally commanded a significant share within prescription opioid formulations owing to its efficacy in pain management, especially for post-surgical, traumatic, and chronic pain conditions[^1]. Its mechanism of action involves hydrocodone's potent μ-opioid receptor activity combined with acetaminophen's analgesic properties.

Over the past decade, the global opioid market experienced robust growth, fueled by rising incidences of chronic pain, aging populations, and increased surgical procedures[^2]. As a result, NORCO and similar medications gained widespread prescription prevalence.

Regulatory and Legal Landscape

The market landscape has shifted markedly with the escalation of the opioid epidemic. The U.S. Food and Drug Administration (FDA) reclassified hydrocodone combination products to Schedule II in 2014, tightening regulatory controls[^3]. These changes impacted prescribing patterns, with healthcare providers seeking alternative pain management modalities to mitigate regulatory pressures and litigation risks.

In parallel, there's been a crackdown on pharmacies and prescribers involved in opioid overprescription. Consequently, prescriptions for NORCO declined steadily after 2014, prompting manufacturers to innovate or reposition their portfolios[^4].

Current Market Share and Competitors

Despite regulatory challenges, NORCO remains a key product for certain demographics and providers. Its primary competitors include:

- Other combination opioids: Vicodin, Lortab, which contain similar active ingredients.

- Non-opioid analgesics: NSAIDs, antidepressants, anticonvulsants.

- Emerging therapies: Abuse-deterrent formulations, novel non-opioid analgesics, and nerve block treatments.

In the current landscape, the unavailability of hydrocodone combination products in some markets is partially offset by increased utilization of alternative medicines, but NORCO remains relevant in specific clinical settings[^5].

Market Size and Historical Sales Data

Pre-2014 Trends

Prior to the rescheduling, NORCO’s annual sales in the United States surpassed $1 billion, with volume growth driven by high prescription rates[^6]. It was among the top prescribed opioids, reflecting both demand and prescribing habits.

Post-2014 Decline

Data indicates a decline of approximately 20-30% in annual sales from 2014 to 2018, correlating with regulatory restrictions and payer restrictions[^7]. The decline has varied regionally but remains significant overall.

Recent Resurgence and Market Adjustments

In recent years, sales stabilized somewhat with the rise of abuse-deterrent formulations (ADFs) and efforts to regulate prescription practices. However, ongoing societal concerns limit a full recovery of sales volumes, especially as prescribers shift toward multimodal pain management.

Sales Projections (2023-2028)

Based on current trends, market analysis, and regulatory outlooks, the following projection estimates are appropriate:

| Year | Estimated U.S. Sales (USD Billions) | Growth Rate (%) | Comments |

|---|---|---|---|

| 2023 | ~$0.8 | -10% to -15% | Continued decline but plateauing trend. |

| 2024 | ~$0.75 | -6% | Slight stabilization with new formulations. |

| 2025 | ~$0.7 | -7% | Market saturation and paradigm shift. |

| 2026 | ~$0.65 | -7% | Increasing focus on non-opioid therapies. |

| 2027 | ~$0.6 | -8% | Regulatory tightening persists. |

| 2028 | ~$0.55 | -8% | Persistent decline, potential market exit. |

Key Drivers Influencing Projections:

- Regulatory Impact: Continued risk of reclassification or restrictions reduces prescriber confidence.

- Market Competition: The expansion of abuse-deterrent formulations and non-opioid alternatives diminishes demand.

- Epidemiological Changes: As awareness increases, opioid prescribing diminishes, with some regions actively promoting opioid-sparing strategies.

- Legal and Litigation Risks: Increased litigation costs disincentivize aggressive marketing and prescribing.

Future Market Dynamics and Opportunities

Emerging Trends

- adoption of abuse-deterrent formulations, which are less attractive for misuse.

- increasing prescriber and patient awareness about opioid risks.

- Shift toward multimodal pain management, combining lesser opioids with non-pharmacologic interventions.

- Regulatory reforms fostering opioid deprescription, including prescription drug monitoring programs (PDMPs).

Opportunities

- Development of new formulations that combine lower doses with multimodal agents.

- Expansion into international markets with less stringent regulation.

- Integration of digital health solutions to monitor and optimize pain management.

Conclusion

NORCO's market outlook from 2023 onward underscores a persistent decline, driven by the global opioid scrutiny, regulatory changes, and evolving pain management paradigms. While it remains a significant product historically, future sales volumes are projected to plateau at reduced levels within the multidimensional framework of therapeutics and societal considerations.

Key Takeaways

- NORCO’s U.S. market has declined approximately 20-30% since 2014, with sales stabilizing but not rebounding significantly.

- Regulatory shifts, including reclassification and prescription restrictions, are primary drivers restraining market growth.

- The opioid epidemic has catalyzed increased adoption of non-opioid, multimodal pain management strategies, reducing demand for drugs like NORCO.

- Despite market challenges, NORCO retains niche utility, especially where alternative formulations are unavailable or in specific patient populations.

- Long-term projections indicate a continued decline in sales, emphasizing the importance for stakeholders to explore diversification and innovation.

FAQs

1. What are the main factors contributing to the decline in NORCO sales?

Regulatory reclassification, increased awareness of opioid abuse risks, the opioid epidemic, and the shift toward non-opioid pain therapies have significantly suppressed demand.

2. Are there any upcoming formulations or reformulations of NORCO?

While existing formulations face declining prescription, companies are developing abuse-deterrent formulations and alternative delivery mechanisms to enhance safety profiles.

3. How does the opioid epidemic influence market outlooks?

It has led to tighter regulations, prescriber caution, legal actions, and increased public health initiatives, all negatively impacting opiod-based drugs like NORCO.

4. What is the market potential for NORCO internationally?

In regions with less regulatory restrictions, there remains potential for growth; however, global trends toward opioid reduction diminish prospects.

5. What strategies should pharmaceutical companies consider for opioids like NORCO?

Investing in non-opioid analgesic research, adopting abuse-deterrent technology, and diversifying pain management portfolios are critical for future viability.

References

[^1]: U.S. Food & Drug Administration. (2014). Rescheduling of Hydrocodone Combination Products.

[^2]: MarketsandMarkets. (2020). Global Pain Management Market.

[^3]: FDA. (2014). Rescheduling Hydrocodone Combination Products.

[^4]: IMS Health. (2017). Prescription Trends in Opioids.

[^5]: CDC. (2019). Guideline for Prescribing Opioids for Chronic Pain.

[^6]: IQVIA. (2015). Summary Report on U.S. Prescription Drug Market.

[^7]: Statista. (2019). Opioid Prescription Trends Post-2014.

More… ↓