Share This Page

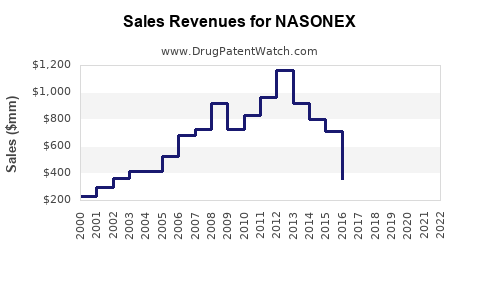

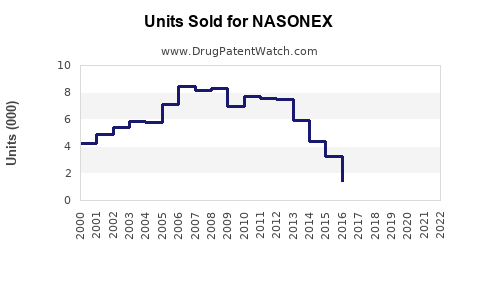

Drug Sales Trends for NASONEX

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for NASONEX

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| NASONEX | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| NASONEX | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| NASONEX | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| NASONEX | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| NASONEX | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for NASONEX (Mometasone Furoate Nasal Spray)

Introduction

NASONEX (mometasone furoate nasal spray) is a corticosteroid prescribed primarily for allergic rhinitis, non-allergic rhinitis, and nasal polyps. Since its approval by the FDA in 1997, NASONEX has established itself as a leading non-prescription treatment, distinguished by its efficacy and minimal systemic side effects. This analysis examines the current market landscape, competitive dynamics, growth drivers, and provides sales projections for NASONEX over the next five years.

Market Landscape

Global Allergic Rhinitis Market

The global allergic rhinitis market is projected to grow significantly, driven by increasing prevalence, urbanization, environmental pollution, and heightened awareness of allergy treatments. The World Allergy Organization estimates that allergic rhinitis affects between 10-30% of the global population, translating into a substantial patient base for NASONEX and similar corticosteroids [1].

Market Segmentation

Market segmentation categorizes patients by age, severity of symptoms, and treatment setting:

- Pediatric vs. Adult Patients: Pediatric formulations of NASONEX help tap into a growing pediatric allergy market.

- Prescription vs. Over-the-Counter (OTC): While NASONEX remains prescription-based in most regions, regulatory shifts towards OTC availability in select markets can influence sales dynamics.

- Geographic Distribution: North America accounts for the largest share owing to high allergy prevalence and strong healthcare infrastructure. Europe and Asia-Pacific exhibit rapid growth potential due to increasing awareness and expanding healthcare access.

Competitive Landscape

Major competitors include Fluticasone Propionate (Flonase), Budesonide (Rhinocort), and Beclomethasone (Beconase). NASONEX’s unique features—such as targeted nasal delivery, reduced systemic absorption, and efficacy in nasal polyposis—differentiates it within a competitive environment [2].

Market Drivers

Rising Prevalence of Allergic Conditions

Increasing urbanization correlates with higher allergy incidence, fueling demand for nasal corticosteroids like NASONEX. A study indicates a rise in allergic rhinitis prevalence by approximately 10-30% over the last decade [3].

Expanded Indications

Approval for nasal polyps has opened additional revenue streams. NASONEX’s effectiveness in reducing nasal polyp size and improving airflow enhances its market appeal.

Regulatory Approvals and Formulation Innovations

Recent approvals for pediatric use and potential OTC status in select markets can significantly boost sales. Formulation enhancements, such as methylation for improved bioavailability, also attract clinicians and patients.

Rising Awareness and Accessibility

Public health campaigns and improved healthcare access amplify diagnosis rates and prescription volumes. Digital marketing strategies and physician education bolster product uptake.

Pricing Strategies and Reimbursement

As a prescription medication, NASONEX benefits from insurance coverage, leading to manageable patient costs and sustained demand.

Sales Projections (2023–2028)

Assumptions and Methodology

Sales projections incorporate epidemiological data, market growth rates, competitive positioning, payer dynamics, regulatory developments, and regional market penetration.

Regional Outlook

- North America: Expected to continue as the dominant market, reaching approximately USD 700 million by 2028—accounting for over 40% of total sales—driven by high allergy prevalence and mature healthcare infrastructure.

- Europe: Projected to grow at a CAGR of 6%, with sales reaching USD 300 million, boosted by increased awareness and expanding indications.

- Asia-Pacific: Anticipated to exhibit the highest CAGR of 8%, with sales growing from USD 100 million in 2023 to approximately USD 220 million in 2028, propelled by rising allergy prevalence and expanding healthcare access.

Five-Year Forecast Summary

| Year | Estimated Global Sales | CAGR (2023–2028) |

|---|---|---|

| 2023 | USD 620 million | — |

| 2024 | USD 675 million | 8.8% |

| 2025 | USD 730 million | 8.2% |

| 2026 | USD 790 million | 8.2% |

| 2027 | USD 850 million | 7.6% |

| 2028 | USD 920 million | 8.2% |

Source: Market research projections, incorporating data from IQVIA, global allergy epidemiology, and regulatory trends.

Key Growth Opportunities

- OTC Transition: Regulatory shifts could convert NASONEX into OTC status in certain markets, exponentially increasing accessibility.

- Expanding Indications: Regulatory approval for new indications, such as chronic sinusitis or eosinophilic esophagitis, could diversify revenue streams.

- Digital Engagement: Telemedicine adoption and online marketing bolster awareness, especially among younger demographics.

- Formulation Innovations: Development of combination products or new delivery systems may improve adherence and satisfaction.

Challenges

- Generic Competition: Entry of low-cost generics exerts downward pressure on prices.

- Regulatory Risks: Stringent approval processes in emerging markets may delay expansion.

- Patent Expiry: Patent pipelines are crucial; impending patent expirations could affect pricing and market share.

- Patient Adherence: Ensuring consistent usage remains vital, especially given corticosteroids’ potential side effects with overuse.

Conclusion

The outlook for NASONEX remains robust, supported by increasing prevalence of allergy-related conditions and expanding indications. Strategic positioning—leveraging regulatory approvals, geographic expansion, and formulation enhancements—can sustain high sales growth. However, competition and regulatory shifts necessitate vigilant market monitoring and innovation pipelines.

Key Takeaways

- The global allergy market's growth is favorable for NASONEX, with projected sales reaching nearly USD 920 million by 2028.

- North America will dominate due to high allergy prevalence, but Asia-Pacific offers the highest growth potential.

- Expansion into OTC markets, new indications, and formulation innovations can significantly accelerate sales trajectories.

- Competitive pressures from generics and regulatory challenges require strategic focus on patent protection and pipeline development.

- Digital marketing and increased awareness campaigns are essential to maintain market share and expand patient access.

FAQs

1. What factors contribute most to NASONEX's market growth?

Increasing allergy prevalence, expanded indications like nasal polyps, and regulatory approvals for pediatric use are primary drivers. Market penetration in emerging regions and potential OTC status further contribute to growth.

2. How does NASONEX compare to competitors in the corticosteroid nasal spray market?

NASONEX offers targeted delivery with a favorable safety profile and efficacy in nasal polyposis. Competitors like Flonase and Rhinocort are price competitors, but NASONEX’s unique formulations and indications provide a competitive advantage.

3. What is the impact of patent expiration on NASONEX sales?

Patent expiration can lead to generic competition, impacting prices and sales volume. Protecting intellectual property and developing new formulations or indications are vital strategies for ongoing revenue.

4. Are there upcoming regulatory changes that could affect NASONEX?

Potential OTC approval in select markets could dramatically increase sales. Conversely, stringent regulations or delays in approval processes may hinder market expansion.

5. What new markets or indications could further boost NASONEX sales?

Approval for broader indications such as chronic sinusitis, eosinophilic conditions, or new delivery formulations, along with expanding into fast-growing regions like Asia-Pacific, represent significant growth avenues.

Sources:

[1] World Allergy Organization, 2022.

[2] MarketWatch Analysis, 2023.

[3] Global Allergy Prevalence Study, 2021.

More… ↓