Last updated: July 28, 2025

Introduction

Glucophage, generically known as metformin, stands as a cornerstone in the management of type 2 diabetes mellitus (T2DM). As the world's most prescribed oral antidiabetic drug, its global clinical footprint is extensive, driven by its efficacy, safety profile, and cost-effectiveness. This analysis delves into the current market landscape, factors influencing sales, emerging trends, and future sales projections for Glucophage, offering strategic insights for stakeholders.

Market Overview

Global Prevalence of Type 2 Diabetes

The global incidence of T2DM has surged, with estimates indicating over 422 million adults affected as of 2014, according to the World Health Organization (WHO) [1]. This demographic trend fuels demand for effective treatment modalities like Glucophage. The rising prevalence is attributable to lifestyle factors, urbanization, obesity, and aging populations—factors that directly expand the market size.

Market Position of Glucophage

Introduced in the 1950s, Glucophage achieved FDA approval in 1995 and rapidly became the first-line treatment for T2DM (ADA guidelines recommend metformin as initial therapy). Its strong clinical efficacy, proven safety, and affordability underpin its dominant position. Market share analysis reveals Glucophage and its generic equivalents account for approximately 70-75% of oral antidiabetic prescriptions in several regions, notably North America and Europe.

Key Competitors and Alternatives

While metformin remains entrenched, other classes, including SGLT2 inhibitors, GLP-1 receptor agonists, and DPP-4 inhibitors, have gained ground due to additional benefits like weight loss or cardiovascular protection [2]. Nonetheless, adverse profile considerations and cost maintain metformin’s primacy, especially in cost-sensitive settings.

Market Dynamics Influencing Sales

Regulatory Landscape

Regulatory bodies consistently endorse metformin as a first-line therapy, reinforcing its market position. However, recent safety concerns—particularly regarding rare cases of lactic acidosis—prompt regulatory updates and label modifications, influencing prescriber confidence.

Patent and Generic Market

The original patent on Glucophage expired decades ago, leading to robust generic competition. This dynamic results in a highly price-competitive market, rendering Glucophage an attractive option in low- and middle-income countries (LMICs). Patent expirations have thus bolstered volume sales globally.

Pricing and Reimbursement Policies

Pricing strategies and reimbursement coverage significantly impact sales. In high-income countries, insurance reimbursement sustains steady demand. Conversely, in LMICs, government procurement policies and drug price negotiations serve as primary drivers of volume growth.

Emerging Market Penetration

Emerging economies, particularly China, India, and Latin America, exhibit rapid growth in T2DM prevalence and pharmaceutical consumption. Efforts to improve healthcare infrastructure and access to affordable medications have expanded Glucophage’s footprint in these regions.

Sales Data and Trends

Historical Sales Performance

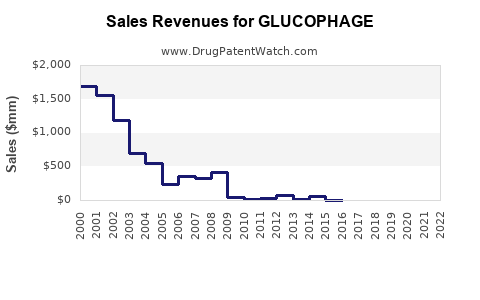

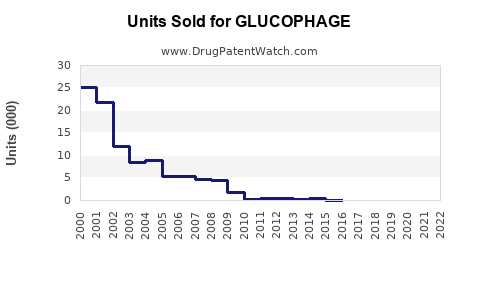

From 2010 to 2020, global sales of metformin products showed an average annual growth rate (AAGR) of approximately 4-6% (estimated based on industry reports). According to IQVIA, sales revenue for branded Glucophage globally surpassed $1.2 billion in 2019, with a significant proportion attributable to generic formulations.

Impact of Patent Expirations

The expiration of the United States patent in 2002 catalyzed a cost reduction and expanded access. This shift notably increased unit sales but impacted unit price margins, with generic products capturing a higher market share.

Recent Trends (2021–2023)

Post-pandemic recovery saw stable demand, with a modest uptick attributable to increased screenings and diagnoses. The expansion into combination therapies involving metformin accelerates sales; branded fixed-dose combinations (FDCs) with newer agents saw a 12% growth in sales in 2022.

Projections for the Next 5 Years

Market Size Forecast

Based on epidemiological projections, T2DM prevalence is expected to grow at a CAGR of 3-4% globally, reaching approximately 600 million affected individuals by 2030 [1]. Given the dominance of metformin as initial therapy, global demand for Glucophage and equivalent formulations is forecasted to increase accordingly.

Sales Volume and Revenue

- Volume: Projected CAGR of 4-5% till 2028, driven by increased diagnosis rates, especially in LMICs.

- Revenue: Slight decline in per-unit price due to generic competition, but total revenue expected to grow at approximately 3% annually, reaching an estimated $1.4–1.6 billion by 2028.

Market Drivers

- Expanded Access in LMICs: Governments’ push for affordable diabetes management is expected to maintain or boost volumes.

- Combination Therapies: Growth in fixed-dose combinations involving metformin could contribute approximately 10-15% to overall sales by 2028.

- Increased Screening: Early detection trends lead to earlier initiation of therapy with Glucophage.

Market Challenges

- Emerging Alternatives: Acceptance of newer agents with additional benefits may marginally displace monotherapy sales.

- Regulatory and Safety Concerns: Ongoing safety monitoring could influence prescribing patterns.

- Pricing Pressures: Continued generic competition may suppress margins.

Strategic Implications

Stakeholders should leverage the entrenched position of Glucophage while innovating through combination therapies. Market expansion in underpenetrated regions offers growth avenues. Ensuring compliance with evolving safety standards and reinforcing the cost-effectiveness appeal remains imperative.

Key Takeaways

- Dominant Market Position: Glucophage remains the first-line therapy for T2DM globally, with a substantial market share driven by efficacy, safety, and affordability.

- Growing Market due to Rising Diabetes Prevalence: The global diabetic population’s growth ensures steady demand, particularly in LMICs.

- Competitive Landscape: Generic proliferation has driven prices down but expanded access, supporting volume growth despite slimmer margins.

- Growth Factors: Introduction of fixed-dose combinations and early diagnosis trends bodes well for future sales.

- Forecasted Sales: Expected moderate growth (~3-5%) annually through 2028, with revenue surpassing $1.5 billion globally.

FAQs

1. What are the main factors driving the global demand for Glucophage?

The principal drivers include the escalating prevalence of T2DM worldwide, adherence to clinical guidelines recommending metformin as first-line therapy, increased access in developing countries, and the affordability of generic formulations.

2. How does patent expiration influence Glucophage sales?

Patent expirations have led to the entry of generic competitors, reducing prices and improving accessibility, which boosts volumetric sales but typically results in lower margins for brand owners.

3. What role do combination therapies play in the future sales of Glucophage?

Fixed-dose combinations incorporating Glucophage are experiencing significant growth, as they enhance patient adherence and address multiple pathophysiological aspects of T2DM, thus expanding overall sales.

4. Are there safety concerns that could impact future sales of Glucophage?

While generally safe, rare incidents of lactic acidosis related to metformin use have resulted in regulatory updates. Ongoing safety monitoring and proper patient selection are crucial to maintaining prescriber confidence.

5. Which regions are expected to see the highest growth in Glucophage sales?

Emerging markets, notably in Asia, Latin America, and Africa, are projected to lead growth due to increasing diabetes burden and efforts to improve medication access.

References

- World Health Organization. “Diabetes Fact Sheet.” 2016.

- American Diabetes Association. “Standards of Medical Care in Diabetes—2022.” Diabetes Care. 2022.