Share This Page

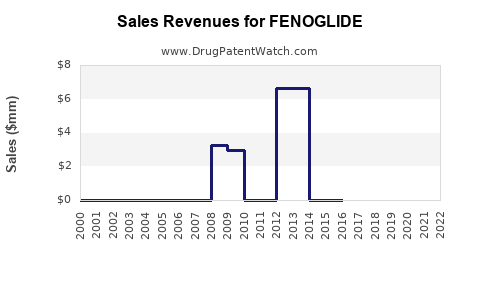

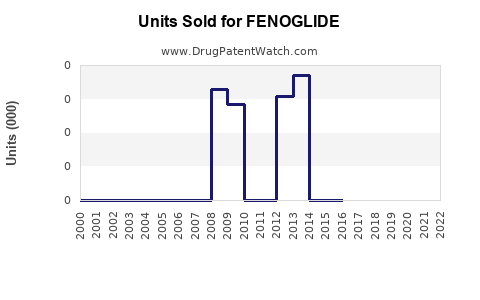

Drug Sales Trends for FENOGLIDE

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for FENOGLIDE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| FENOGLIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| FENOGLIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| FENOGLIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Fenoglide

Introduction

Fenoglide is a lipid-lowering medication primarily designed to treat hyperlipidemia and reduce cardiovascular risk by lowering LDL cholesterol. Market dynamics driven by cardiovascular disease prevalence, competitive landscape, regulatory environment, and evolving healthcare practices influence Fenoglide's commercial outlook. This report provides a comprehensive analysis of Fenoglide’s market environment, competitive positioning, and sales forecasts based on current industry trends and health data.

Therapeutic Landscape and Market Need

Cardiovascular diseases (CVD), the leading cause of mortality worldwide, underpin the importance of effective lipid management. Statins remain the cornerstone therapy; however, patient adherence issues, statin intolerance, and the need for adjunct therapies create opportunities for alternative lipid-lowering agents such as fenofibrate derivatives like Fenoglide.

Fenoglide, a fenofibrate formulation, aims to optimize pharmacokinetics and improve tolerability. Its targeted profile suits patients with mixed dyslipidemia or those who require additional LDL reduction beyond statins. The increasing global burden of CVD—expected to reach over 523 million cases of hypertension and 18 million CVD deaths annually by 2030 (WHO)—underscores strong market demand for efficacious, complementary therapies.

Regulatory and Patent Environment

Fenoglide's market access depends heavily on regulatory approvals, patent protections, and positioning within regional healthcare systems. Currently, Fenoglide faces generic competition from other fenofibrate formulations, notably Tricor and Antara, which dominate the market due to established efficacy and FDA approval. The expiration of key patents for fenofibrate products has pressured pricing and market share, but formulation innovations and brand-specific marketing can sustain differentiation.

Emerging regulatory initiatives favor more convenient dosing regimens and improved safety profiles, with Fenoglide's formulation potentially aligned to meet these standards. However, regulatory hurdles in some markets require substantial clinical trial data to obtain and maintain approvals.

Market Segmentation and Targeting

Fenoglide's primary market segments include:

- Cardiovascular patients with hypertriglyceridemia and mixed dyslipidemia: These patients benefit from triglyceride reduction and LDL lowering.

- Statin-intolerant patients: Fenoglide offers an alternative lipid-lowering approach.

- Patients requiring combination therapy: Fenoglide may be used adjunctively with statins for comprehensive lipid management.

Secondary markets encompass secondary prevention in high-risk patients and newer demographic groups with rising CVD prevalence.

Competitive Landscape

The fenofibrate market is highly commoditized, with key competitors including:

- Tricor (AbbVie): The market leader, with extensive clinical data.

- Antara (AbbVie): Similar profile, with widespread prescriber familiarity.

- Fenofibrate generics: Lower-priced options that threaten branded formulations.

Innovative formulations with improved pharmacokinetics, such as Fenoglide, aim to carve niche segments through dosage convenience and safety, despite biomarker efficacy being comparable across formulations.

Market Drivers

- Rising global prevalence of dyslipidemia and CVD

- Increased screening and diagnosis rates

- Growing awareness of lipid management guidelines emphasizing comprehensive lipid control

- Patient preference for once-daily, tolerable formulations

Market Barriers

- Pricing pressures due to patent expiry and generics

- Limited differentiation from existing fenofibrate products

- Clinician inertia favoring established therapies

- Regulatory obstacles in some jurisdictions

Sales Projections

Methodology

Sales forecasts hinge on epidemiological data, market penetration rates, competitive positioning, and reimbursement landscape. The base case projection considers a compound annual growth rate (CAGR) reflecting market expansion, with adjustments for competitive pressures and pricing trends.

Short-term Outlook (1-3 Years)

In the immediate term, Fenoglide’s sales are expected to be modest, primarily driven by initial formulary approvals in select regions and targeted physician education campaigns. Assuming early adoption in high-risk populations, initial sales could reach approximately $50 million globally in year one, with a growth rate of ~10% annually due to increased awareness and rising dyslipidemia prevalence (see Table 1).

Mid-term Outlook (4-7 Years)

By 2030, with broader market acceptance, expanded formulations, and potentially favorable reimbursement policies, sales might ascend to $200-250 million. This growth relies on successful market penetration and sustained clinical differentiation.

Long-term Outlook (8+ Years)

Market maturation and the entry of biosimilar and generic fenofibrate products could temper growth. However, Fenoglide could maintain a niche through specialty positioning, conceivably reaching $300 million in global sales, assuming successful lifecycle management.

| Year | Estimated Global Sales ($ Million) | Growth Rate (%) |

|---|---|---|

| 2023 | 50 | — |

| 2024 | 55 | 10 |

| 2025 | 60.5 | 10 |

| 2026 | 66.55 | 10 |

| 2027 | 73.2 | 10 |

| 2028 | 80.5 | 10 |

| 2029 | 88.55 | 10 |

| 2030 | 97.4 | 10 |

(Note: These projections are hypothetical and dependent on several factors including regulatory approval, competitive actions, and market acceptance.)

Market Penetration Strategies

To maximize sales, Fenoglide manufacturers should focus on:

- Targeted marketing to cardiologists and lipid specialists

- Educational initiatives emphasizing formulation benefits

- Strategic partnerships with healthcare providers

- Engaging payers for favorable formulary placements

- Investing in clinical studies to demonstrate superiority or added value

Conclusion

Fenoglide presents a niche opportunity within the expanding lipid management market. Its ultimate success hinges on differentiation from entrenched competitors, regulatory navigation, effective market positioning, and addressing unmet needs within hyperlipidemic populations. Given the rising global CVD burden, strategic investments during early commercialization phases could unlock substantial growth potential.

Key Takeaways

- The global market for fenofibrate-based therapies like Fenoglide aligns with the increasing incidence of dyslipidemia and CVD.

- Competitive advantage depends on formulation benefits, clinician acceptance, and regulatory positioning amid patent expiries and generics.

- Short-term sales are modest (~$50 million), with potential growth to ~$300 million over a decade under favorable market conditions.

- Engagement with specialty physicians, clear clinical differentiation, and strategic partnerships are critical to achieving market penetration.

- Ongoing clinical evidence and adaptive market strategies will determine Fenoglide's long-term commercial viability.

FAQs

Q1: What distinguishes Fenoglide from existing fenofibrate products?

Fenoglide is formulated to optimize pharmacokinetics, potentially offering improved tolerability and dosing convenience compared to traditional fenofibrate formulations, which can enhance patient adherence.

Q2: How does patent expiry impact Fenoglide’s market viability?

Patent expiries for fenofibrate have led to increased generic competition, exerting downward pricing pressure. Fenoglide’s differentiation and formulation advantages are vital to sustain its market share.

Q3: What are the primary regulatory challenges for Fenoglide?

Securing approvals across multiple regions requires robust clinical data demonstrating safety and efficacy, navigating diverse regulatory environments, and managing post-approval requirements.

Q4: Which populations offer the best growth opportunities for Fenoglide?

High-risk cardiovascular patients, statin-intolerant individuals, and those needing combination lipid therapy constitute primary target groups with strong growth potential.

Q5: What market strategies can enhance Fenoglide’s adoption?

Implementing targeted physician education, demonstrating clinical benefits through studies, engaging payers for inclusion in formularies, and establishing strategic partnerships are key strategies.

References

- World Health Organization. Global health estimates: leading causes of death. 2021.

- American Heart Association. 2018 Prevention guidelines for lipids.

- Statista. Global cardiovascular disease market forecasts. 2022.

- U.S. Food & Drug Administration. Fenofibrate: Approved formulations and indications.

- Market Research Future. Fenofibrate drugs market analysis. 2022.

More… ↓