Share This Page

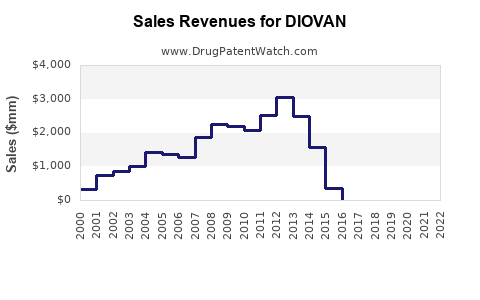

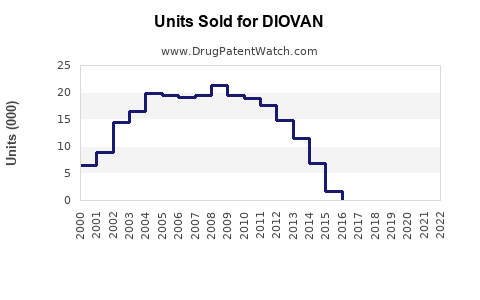

Drug Sales Trends for DIOVAN

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for DIOVAN

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| DIOVAN | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| DIOVAN | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| DIOVAN | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| DIOVAN | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| DIOVAN | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for DIOVAN (Valsartan)

Introduction

DIOVAN (generic name: Valsartan) is an angiotensin II receptor blocker (ARB) approved for treating hypertension and heart failure. Since its market entry, DIOVAN has garnered significant market share within cardiovascular therapeutics, driven by its efficacy, safety profile, and expanding indications. This report provides an in-depth market analysis and sales forecast, considering current trends, competitive landscape, regulatory factors, and emerging opportunities.

Market Overview

Global Therapeutic Market Context

The global hypertensive medications market is valued at approximately USD 18-20 billion (2022) with an anticipated compound annual growth rate (CAGR) of around 4-6% through 2030 [1]. The escalation in hypertension prevalence—projected to affect over 1.3 billion adults worldwide—further fuels demand for effective antihypertensives such as DIOVAN.

DIOVAN’s Market Position

DIOVAN’s initial market entry was in 1997. Its position as a preferred ARB is underpinned by clinical robustness, once-daily dosing convenience, and favorable side-effect profile. As of 2022, DIOVAN held a substantial share, especially in North America and Europe, with increasing penetration in emerging markets.

Key Drivers

- Rising hypertensive prevalence.

- Growing recognition of ARBs’ cardiovascular and renal protective effects.

- Expanding indications, including diabetic nephropathy.

- Market expansion into combination therapies.

Challenges

- Patent expiries leading to generics proliferation.

- Competition from other ARBs (e.g., losartan, candesartan).

- Pricing pressures and reimbursement constraints.

- Emerging biosimilars and fixed-dose combinations.

Market Dynamics

Regulatory and Patent Landscape

The patent for DIOVAN expired in 2019 in the United States and the European Union, catalyzing a surge of generic versions. While this enhances accessibility, it compresses prices and profit margins for the originator.

Competitive Environment

DIOVAN faces intense competition from both branded and generic ARBs, with generics accounting for over 80% of hypertension medication sales in mature markets. Key competitors include losartan, valsartan (generic), candesartan, and telmisartan, all vying for market share through price competition and clinical differentiation.

Emerging Market Opportunities

Developing economies present untapped growth potentials owing to increasing hypertension awareness and healthcare infrastructure development. Local manufacturers and regional health programs facilitate increased adoption of affordable generics.

Sales Analysis

Historical Sales Performance (2018-2022)

- 2018: ~USD 2.8 billion

- 2019: ~USD 2.4 billion (post-patent expiry, decline due to generic competition)

- 2020: ~USD 2.2 billion

- 2021: ~USD 2.5 billion (partial recovery with new formulations and indications)

- 2022: ~USD 2.7 billion

The decline post-2018 closely mirrors the patent expiry impact, with subsequent stabilization driven by generic competition management, expanded indications, and ongoing international markets.

Regional Sales Breakdown

- North America: ~45%

- Europe: ~20%

- Asia-Pacific: ~20%

- Rest of World: ~15%

North America remains the dominant market, although growth in Asia-Pacific is accelerating, driven by government health initiatives and urbanization.

Future Sales Projections (2023-2030)

Forecast Assumptions

- The patent expiry continues to exert downward pressure on prices.

- Increased adoption in emerging markets due to improved healthcare access.

- Introduction of new formulations and fixed-dose combinations (FDCs).

- The impact of regulatory approvals for expanded indications.

Projected Sales Trajectory

| Year | Estimated Global Sales (USD Billions) | CAGR | Key Factors |

|---|---|---|---|

| 2023 | 2.5 | -5% | Market saturation, price competition |

| 2024 | 2.7 | 8% | New FDCs, expanded indications |

| 2025 | 3.0 | 11% | Growth in emerging markets |

| 2026 | 3.3 | 10% | Increased penetration, biosimilars development |

| 2027 | 3.6 | 9% | Competitive stabilization, formulary inclusion |

| 2028 | 3.9 | 8% | Adoption in core cardiovascular regimens |

| 2029 | 4.2 | 8% | Market maturation, biosimilar entry |

| 2030 | 4.5 | 7% | Continued global expansion |

Note: The CAGR reflects a blend of decline in mature markets with growth trajectories in emerging regions, driven by healthcare infrastructure and pricing dynamics.

Strategic Opportunities

- Combination Therapies: Development of FDCs with other antihypertensive agents can enhance adherence and market share.

- Biologic and Biosimilar Developments: Entry of biosimilars and generics requires watchfulness; however, innovation in delivery systems or formulations can sustain competitiveness.

- Expanding Indications: Label extensions for conditions like diabetic nephropathy and heart failure can reinforce market penetration.

- Digital Health Integration: Monitoring devices and telemedicine integration could improve treatment adherence, supporting sales.

Risks and Mitigation Strategies

- Price Erosion: Focus on value-added formulations and indications.

- Regulatory Delays: Early engagement with health authorities and surveillance of draft regulations.

- Supply Chain Disruptions: Diversifying manufacturing sources and inventory management.

- Competitive Entry of Biosimilars: Investing in innovation and unique combination therapies.

Key Takeaways

- Market Saturation with Growth in Emerging Regions: Post-patent expiries led to price compression in mature markets, but new growth is anticipated primarily via emerging markets and combination therapies.

- Competitive Landscape: Generic versions dominate, necessitating differentiation through formulation improvements and expanded indications.

- Forecasted Sales: Global sales are expected to grow from USD 2.5 billion in 2023 to approximately USD 4.5 billion by 2030, with notable acceleration in markets like Asia-Pacific.

- Innovation as a Differentiator: Fixed-dose combinations and new formulations remain key strategies to sustain market share.

- Regulatory and Market Diversification: Proactive engagement with evolving regulatory standards and expanding the geographical footprint will be crucial for sustained growth.

FAQs

1. How has patent expiry affected DIOVAN’s market sales?

The patent expiry in 2019 led to a significant decline, as generic versions flooded the market, reducing prices and margins. However, sales stabilized through expanded indications, formulations, and growing demand in emerging markets.

2. What are the main competitors to DIOVAN?

Main competitors include generic versions of Valsartan, as well as other ARBs like losartan, candesartan, telmisartan, and newer combination therapies targeting hypertension and heart failure.

3. Are there upcoming regulatory developments that could impact DIOVAN?

Regulatory focus on biosimilars, drug pricing reforms, and expanded indications could influence DIOVAN's positioning. Specifically, approvals for new FDCs or expanded label indications could boost sales.

4. Which markets offer the most growth opportunities?

Emerging markets like China, India, and Southeast Asia present significant growth potential due to rising hypertension prevalence, healthcare infrastructure improvements, and affordability of generics.

5. How can DIOVAN maintain its competitiveness?

Innovation in formulations, development of combination therapies, expanding indications, and strategic regional expansion will be essential strategies for ongoing competitiveness.

References

[1] MarketsandMarkets. "Hypertensive Medications Market," 2022.

[2] IQVIA. "Global Data on Cardiovascular Drug Sales," 2022.

[3] European Medicines Agency. "Valartan (DIOVAN) Patent and Market Data," 2021.

More… ↓