Last updated: July 28, 2025

Introduction

Clotrimazole, an imidazole antifungal agent, is widely used for treating various fungal infections such as athlete’s foot, vaginal candidiasis, and dermatomycoses. Since its introduction in the 1970s, it has become a staple in both prescription and over-the-counter (OTC) antifungal formulations. The growing prevalence of fungal infections, coupled with increasing awareness and accessibility of antifungal treatments, fuels the market momentum for clotrimazole. This report provides a thorough analysis of the current market landscape, competitive positioning, and future sales projections for clotrimazole over the next five years.

Market Overview

Global Market Size and Growth Trends

The global antifungal market was valued at approximately USD 13.89 billion in 2021 and is projected to reach USD 20.2 billion by 2027, expanding at a compound annual growth rate (CAGR) of around 6.4% (2022–2027) [1]. Clotrimazole accounts for a significant portion within this market, primarily due to its broad spectrum efficacy, low cost, and OTC availability.

Its penetration is most prominent in North America, Europe, and Asia Pacific, with emerging markets witnessing substantial growth due to increased healthcare infrastructure and rising awareness regarding fungal infections. The OTC segment dominates the clotrimazole market, with an estimated 65–70% of sales attributable to non-prescription formulations.

Market Drivers

-

Rising Incidence of Fungal Infections: Increased prevalence of superficial fungal infections driven by factors like humid climates, immunosuppression, and diabetes enhances demand for effective antifungal agents.

-

Growing Awareness and Diagnosis: Better diagnostic techniques and patient awareness escalate treatment rates, especially in developed regions.

-

OTC Availability: The widespread availability of OTC clotrimazole products promotes self-medication, expanding market access beyond clinical settings.

-

Cost-Effectiveness: As an affordable first-line therapy, clotrimazole remains preferred, especially in cost-sensitive markets.

Market Challenges

-

Resistance Development: Emergence of antifungal resistance poses a threat to long-term efficacy.

-

Competitive Landscape: Presence of alternative generics and newer antifungals limits market share growth for clotrimazole.

-

Regulatory Variability: Different countries have variable regulations concerning OTC antifungals, which may impact sales.

Competitive Landscape

Key Players

Major pharmaceutical companies manufacturing clotrimazole include:

- Bayer AG

- GlaxoSmithKline

- Perrigo Company

- MGI Pharma

- Dr. Reddy’s Laboratories

The market predominantly comprises generic manufacturers, with Bayer historically holding leading patent rights and brand recognition through its product Canesten.

Product Portfolio and Differentiation

Clotrimazole products vary mainly in formulation types—creams, ointments, vaginal tablets, lozenges, and solutions—catering to diverse indications and patient preferences. Brand loyalty and physician recommendations influence sales, although the OTC nature diminishes the impact of branding compared to novel pharmaceuticals.

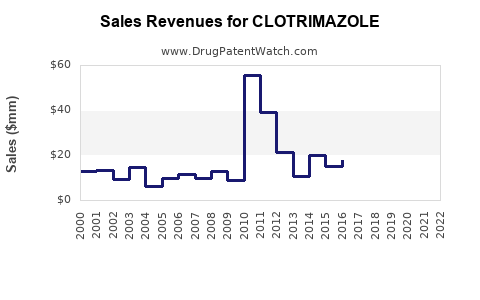

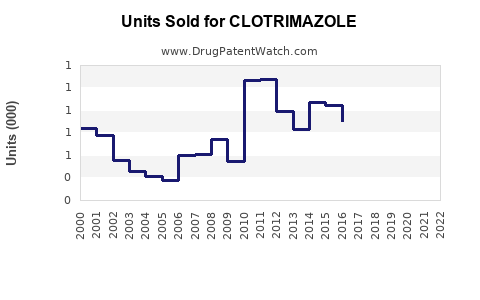

Sales Projections (2023–2028)

Methodology and Assumptions

Projections are based on recent market growth rates, epidemiological data, and trends in healthcare access. Assumed CAGR for clotrimazole sales is approximately 5–7%, reflecting its stable market position, with potential acceleration in emerging markets.

Projected Sales Figures

| Year |

Estimated Global Sales (USD Billion) |

Growth Rate (%) |

| 2023 |

1.5 |

— |

| 2024 |

1.58 |

5.3 |

| 2025 |

1.68 |

6.3 |

| 2026 |

1.78 |

6.0 |

| 2027 |

1.89 |

6.2 |

| 2028 |

2.00 |

6.0 |

These figures factor in increased adoption in emerging markets, continued OTC sales growth, and ongoing demand for effective antifungal treatments.

Regional Breakdown of Sales

North America

Dominated by OTC sales and established healthcare infrastructure. Market is saturated, with moderate growth driven largely by aging populations and increased fungal infection awareness.

Europe

Stable market with high penetrance of OTC and prescription products. Regulatory frameworks favor continued sales growth, supported by rising incidence rates.

Asia Pacific

Fastest-growing segment, with CAGR estimated at 8–10%. Factors include increasing urbanization, improved healthcare access, and higher fungal disease prevalence, especially in tropical countries like India, China, and Southeast Asia.

Latin America and Middle East & Africa

Growing markets driven by expanding healthcare services, increased self-medication, and government initiatives for healthcare inclusion.

Market Opportunities and Future Outlook

-

Product Innovation: Development of combination formulations (e.g., antifungal with anti-inflammatory agents) could enhance efficacy and increase sales.

-

Expanded Indications: Investigating new indications and pediatric formulations may broaden market reach.

-

Regulatory Approvals: Streamlining approval processes in emerging markets will facilitate quicker product launches.

-

Digital and E-commerce Channels: Leveraging online platforms for OTC distribution offers new avenues for growth.

Regulatory and Patent Landscape

While many formulations are generic, patent protections on specific formulations or delivery systems may influence competitive dynamics temporarily. Once patent expirations occur, generic competition usually intensifies, exerting downward pressure on prices and revenues.

Key Takeaways

-

Market Stability: Clotrimazole remains a cornerstone antifungal therapy with a resilient sales outlook driven by its efficacy, affordability, and OTC availability.

-

Growth in Emerging Markets: Asia Pacific and Latin America offer substantial growth potential due to rising healthcare access and increasing fungal disease burden.

-

Competitive Dynamics: The market's fragmentary nature emphasizes generic competition and price sensitivity, necessitating strategic marketing and formulation differentiation.

-

Innovation and Diversification: Opportunities exist in developing combination therapies, novel formulations, and expanding indications to sustain market share.

-

Regulatory Environment: Monitoring global regulatory developments is crucial, especially for OTC classification changes and patent expirations.

Conclusion

The clotrimazole market is poised for steady growth over the next five years, with projected global sales reaching approximately USD 2 billion by 2028. Continued demand, especially in emerging markets, combined with product innovation and strategic positioning, will be critical for stakeholders aiming to capitalize on this mature yet expanding antifungal segment.

FAQs

1. What factors are driving demand for clotrimazole globally?

The primary drivers include the rising incidence of superficial fungal infections, increased diagnostic awareness, OTC product availability, and cost-effectiveness compared to alternative therapies.

2. How is the competitive landscape shaping for clotrimazole?

The market is dominated by generic manufacturers with limited differentiation. Patent expirations and increased competition lead to price pressures, but opportunities lie in expanding indications and formulations.

3. What regions are expected to see the highest sales growth?

Emerging markets in Asia Pacific and Latin America are projected to exhibit the highest CAGR, driven by improving healthcare infrastructure and rising fungal infection rates.

4. Are there upcoming innovations in clotrimazole formulations?

Potential innovations include combination therapies, sustained-release formulations, and pediatric-friendly options, which can enhance therapeutic efficacy and patient adherence.

5. How might regulatory changes impact the clotrimazole market?

Regulatory shifts regarding OTC status, patent protections, or approval processes can influence market dynamics, either enabling expanded access or increasing competition.

References

[1] MarketsandMarkets, "Antifungal Drugs Market," 2022.