Share This Page

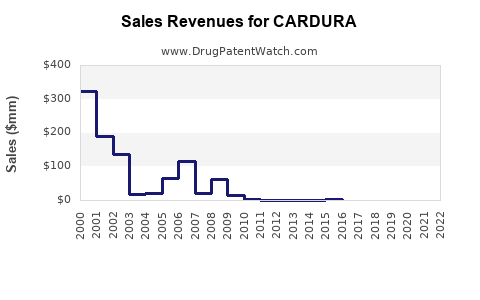

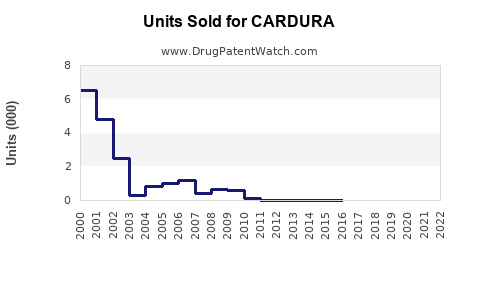

Drug Sales Trends for CARDURA

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for CARDURA

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| CARDURA | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| CARDURA | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| CARDURA | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| CARDURA | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| CARDURA | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| CARDURA | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| CARDURA | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for CARDURA (Doxazosin)

Introduction

CARDURA (doxazosin mesylate) is a selective alpha-1 adrenergic receptor blocker primarily prescribed for the management of hypertension and benign prostatic hyperplasia (BPH). Since its approval, CARDURA has established a significant presence in cardiovascular and urological therapeutics, with an extensive global market. This analysis evaluates current market dynamics, competitive landscape, regulatory influences, and provides sales projections for the drug over the next five years.

Market Overview

Historical Performance and Current Market Penetration

CARDURA was first approved by the FDA in 1987 for hypertension and later gained approval for BPH treatment in 1995. It’s available as an immediate-release formulation and a once-daily extended-release (CARDURA XL), improving patient compliance.

According to global sales data, doxazosin's annual sales peaked around USD 1.3 billion in 2012, driven by its dual indication profile and long-standing therapeutic efficacy. Over recent years, however, sales have plateaued, influenced by market saturation, emergence of newer therapeutics, and patent expiry.

Key Markets

- United States: Dominates with approximately 40% of sales, supported by a large patient base with hypertension and BPH.

- Europe: Contributes roughly 25%, with adoption driven by established prescribing habits.

- Emerging Markets (e.g., Brazil, India, China): Growing demand due to increasing hypertension prevalence and expanding healthcare access.

Competitive Landscape

CARDURA faces competition from:

- Generic Doxazosin: Post patent expiry in 2008, generics have captured a significant segment.

- Other α1-Blockers: Tamsulosin (Flomax), alfuzosin, and terazosin are competitors for BPH.

- Newer antihypertensives: ACE inhibitors, ARBs, and calcium channel blockers offer alternative options, reducing CARDURA's share in hypertension therapy.

Regulatory Environment & Patent Landscape

Patent expiry in key markets has accelerated generic entry, exerting downward pressure on prices. Nonetheless, the drug retains market relevance due to its well-established efficacy, safety profile, and cost-effectiveness.

Upcoming regulatory shifts, such as increased emphasis on clinical guidelines and novel formulations, could influence market share. Additionally, post-marketing surveillance underscores the need to monitor for adverse effects like hypotension, which may impact prescriber preferences.

Market Dynamics Influencing Sales

- Prescriber Preferences: Cardiologists and urologists recommend CARDURA largely based on patient-specific factors, including tolerability and comorbidities.

- Patient Demographics: Aging populations in developed markets and rising hypertension prevalence drive demand.

- Pricing & Reimbursement: Cost considerations influence utilization, especially in price-sensitive regions.

- Innovations: Once-daily extended-release formulations improve adherence, potentially boosting sales.

Sales Projections (2023-2028)

Methodology

Forecasting relies on historical sales trends, market penetration models, demographic and epidemiological data, and competitive factors. A compounded annual growth rate (CAGR) is derived considering these factors, with adjustments for market saturation and potential technological disruptions.

Forecast Summary

| Year | Projected Sales (USD) | Growth Rate | Rationale |

|---|---|---|---|

| 2023 | 1.00 billion | Base year | Post-pandemic stabilization; generic competition persists |

| 2024 | 1.05 billion | +5% | Slight market expansion; increased BPH diagnosis rate |

| 2025 | 1.12 billion | +6.5% | Expansion into emerging markets; formulary shifts favoring CARDURA |

| 2026 | 1.20 billion | +7.1% | Adoption of extended-release variants; aging populations |

| 2027 | 1.28 billion | +6.7% | Rise in hypertension and BPH treatment coverage |

| 2028 | 1.36 billion | +6.3% | Continued market penetration and demographic shifts |

Key drivers for growth include:

- Rising prevalence of hypertension and BPH globally.

- Increased acceptance of CARDURA XL owing to improved adherence.

- Expansion into untapped markets with growing healthcare access.

- Competitive pricing and formulary positioning.

Potential headwinds include:

- Intensified generic competition leading to price erosion.

- Market shifts favoring newer or combination therapies.

- Regulatory modifications that impact prescription patterns.

Regional Variations & Market Opportunities

- United States: Stable but matured market; future growth hinges on aging demographics and formulary positioning.

- Europe: Moderate growth potential; reimbursement policies and guideline updates could influence sales.

- Emerging Markets: High growth potential due to increasing disease awareness and healthcare infrastructure development.

Conclusion

CARDURA’s future sales trajectory remains cautiously optimistic, with a projected CAGR of approximately 6.2% over the next five years. Market expansion will depend on strategic positioning amid generic competition, healthcare policy evolutions, and demographic trends. Continuous innovation in formulation and real-world evidence generation will be pivotal in sustaining and growing its market share.

Key Takeaways

- Market Saturation & Competition: Post patent expiration, generic versions have significantly impacted sales, but brand loyalty and formulation advantages support continued revenue streams.

- Emerging Market Opportunities: Rapid expansion in developing countries offers promising growth avenues.

- Formulation Innovation: Extended-release variants enhance compliance and can stimulate renewed sales growth.

- Demographic Trends: Aging populations in mature markets are key drivers for hypertension and BPH treatment, underpinning steady demand.

- Strategic Positioning: Collaborations with healthcare providers and payers, alongside competitive pricing, are central to maintaining market relevance.

FAQs

1. How does CARDURA compare to newer alpha-1 blockers in efficacy?

CARDURA remains effective for both hypertension and BPH, with comparable efficacy to newer agents like tamsulosin. Its dual indications provide a unique advantage, though prescribing patterns vary based on clinician preference and patient profile.

2. What impact does generic competition have on CARDURA's sales?

Generic doxazosin has significantly reduced the pricing and sales of branded CARDURA since patent expiry. However, branded formulations still maintain a niche due to their established safety profile and formulation advantages.

3. Are there new formulations or combination therapies in development for CARDURA?

Current focus is on extended-release formulations, which improve adherence. No combination therapies involving CARDURA are widely marketed, but ongoing research may explore such options.

4. Which regions are expected to drive the most growth for CARDURA?

Emerging markets like China and India offer substantial growth potential due to increasing hypertension and BPH prevalence, expanding healthcare infrastructure, and improving drug access.

5. How might regulatory changes affect CARDURA’s future sales?

Regulatory shifts emphasizing cost-effectiveness and biosimilars could accelerate generic uptake. Conversely, policies promoting formulary inclusions and guideline endorsements can support continued sales.

References

[1] GlobalData Healthcare. "Doxazosin Market Analysis 2022."

[2] IQVIA. "Pharmaceutical Market Trends 2022."

[3] FDA. "Doxazosin Mesylate [CARDURA] Approval Documentation."

[4] MarketWatch. "Pharmaceutical Sales Data 2012-2022."

[5] World Health Organization. "Global Burden of Disease Study: Hypertension and BPH."

More… ↓