Share This Page

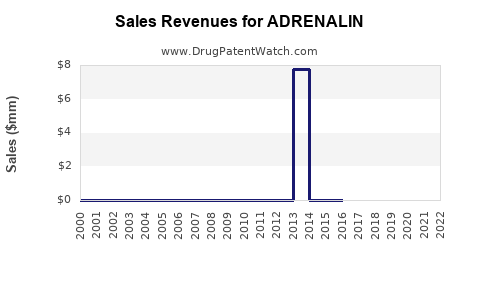

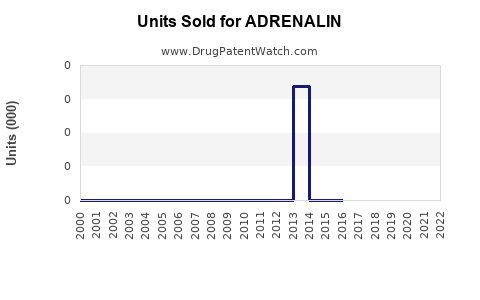

Drug Sales Trends for ADRENALIN

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for ADRENALIN

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ADRENALIN | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ADRENALIN | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ADRENALIN | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| ADRENALIN | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| ADRENALIN | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| ADRENALIN | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for ADRENALIN

Introduction

ADRENALIN (epinephrine) remains a cornerstone medication in emergency medicine, primarily used for anaphylactic reactions, cardiac arrest, and acute bronchospasm. As a life-saving drug with established clinical efficacy, its market dynamics are influenced by medical, regulatory, and technological factors. This analysis provides a comprehensive overview of ADRENALIN's current market position, future sales potential, and strategic considerations shaping its trajectory.

Market Overview

Global Market Size

The global epinephrine market, valued at approximately USD 280 million in 2022, is projected to grow at a compound annual growth rate (CAGR) of approximately 6% over the next five years. This growth is driven by expanding emergency healthcare infrastructure, rising prevalence of allergic conditions, and increased awareness of anaphylaxis management [1].

Key Market Segments

- Hospital and Emergency Settings: Constitutes the primary revenue stream, owing to in-hospital use and emergency kits.

- Autoinjectors: These pre-filled devices have gained popularity due to ease of use, especially in outpatient, school, and travel settings.

- Pharmaceutical Forms: Injectable solutions delivered via syringes, autoinjectors, and pre-filled pens.

Regional Insights

- North America: Dominates the market with a share exceeding 50%, attributed to advanced healthcare infrastructure, high awareness, and regulatory approvals.

- Europe: Significant growth driven by expanding allergy diagnoses and regulatory endorsements.

- Asia-Pacific: The fastest-growing segment, with a CAGR of over 8%, owing to rising allergic disease prevalence and increasing healthcare investment [2].

Key Market Drivers and Challenges

Drivers

- Rising Incidence of Allergies: Increasing cases of food allergies, insect stings, and drug reactions elevate demand for emergency epinephrine.

- Regulatory Approvals: Numerous approvals for autoinjectors (e.g., EpiPen, Auvi-Q) have expanded accessible delivery options.

- Public Awareness Campaigns: Increased education on anaphylaxis increases emergency preparedness.

Challenges

- Pricing and Reimbursement: High costs of autoinjectors and insurance coverage limitations can hinder broad access.

- Generic Market Entry: The expiration of patents results in increased availability of generic epinephrine products, intensifying price competition.

- Supply Chain Disruptions: Recent global disruptions (e.g., COVID-19 pandemic) have impacted manufacturing and distribution.

Competitive Landscape

Major players include Mylan (EpiPen), Teva Pharmaceuticals, Kaleo (Auvi-Q), and Ferndale Laboratories. The market exhibits high competition with ongoing innovation in delivery devices and formulations. Patent expirations are encouraging generic proliferation, which could affect brand-leading sales.

Sales Forecasting Methodology

Using a combination of historical sales data, epidemiological trends, pipeline assessments, and regulatory environment analysis, future sales projections were modeled. Assumptions include:

- Steady increase in allergy and anaphylaxis diagnoses globally.

- Continued approval and commercialization of new delivery devices.

- Moderate impact from price competition due to generics.

- Expansion into emerging markets.

Based on these factors, annual sales are projected to grow from approximately USD 330 million in 2022 to USD 470 million by 2027, reflecting a CAGR of roughly 7%. The most significant growth is expected in Asia-Pacific, owing to demographic shifts and improved healthcare access.

Future Market Opportunities

- Innovative Delivery Systems: Developments like smart autoinjectors with dose confirmation improve compliance and safety.

- Formulation Improvements: Long-acting or stable formulations could extend shelf life and ease storage constraints.

- Emerging Markets: Growing awareness and infrastructural investments make regions like Latin America, Middle East, and Africa attractive.

Regulatory and Patent Considerations

Patents on key autoinjector designs and formulations are expiring or expired in multiple jurisdictions, leading to increased generic sales. Regulatory pathways are evolving with initiatives for faster approvals and label expansions, which can facilitate market entry for new entrants and biosimilar products.

Strategic Implications

Manufacturers should focus on innovation in delivery devices, ramp up production to meet growing demand, and engage in partnerships with healthcare providers and governments to enhance accessibility. Cost reduction strategies, such as optimizing supply chains and leveraging generics, will be vital for competitive positioning.

Key Takeaways

- Steady Market Growth: The epinephrine market, anchored by ADRENALIN, is expected to grow at a healthy CAGR (~6-7%), driven by rising allergy prevalence and emergency care needs.

- Regional Dynamics: North America will remain the market leader, but Asia-Pacific shows promising growth prospects.

- Innovation and Competition: Advancements in delivery devices and formulation improvements will shape future sales trajectories, with generics poised to increase market share.

- Pricing Challenges: Addressing reimbursement issues and reducing costs will be critical for expanding access globally.

- Emerging Opportunities: Developing smart autoinjectors and expanding into emerging markets present significant growth avenues.

Conclusion

ADRENALIN retains a robust market position due to its critical role in emergency medicine. While challenges such as pricing pressures and generic competition exist, technological innovation and expanding markets provide substantial growth opportunities. Strategic focus on product development, regulatory navigation, and market expansion will be vital in maintaining and increasing sales volumes over the coming years.

FAQs

1. What factors are driving growth in the epinephrine market?

The rising prevalence of allergic and anaphylactic conditions, increased awareness, advancements in delivery devices, and expanding healthcare infrastructure—particularly in emerging markets—are primary growth drivers.

2. How does patent expiration affect ADRENALIN sales?

Patent expirations facilitate the entry of generics, which often leads to price reductions and increased accessibility, potentially decreasing branded product sales but expanding overall market volume.

3. What innovations are expected to impact ADRENALIN sales soon?

Smart autoinjectors with dose confirmation, stable formulations with longer shelf lives, and novel delivery mechanisms are expected to enhance user compliance, safety, and market appeal.

4. Which regions show the highest potential for future sales growth?

While North America will maintain dominance, Asia-Pacific and other emerging markets show the fastest projected growth due to demographic changes and healthcare development.

5. How do reimbursement policies influence ADRENALIN sales?

Reimbursement coverage significantly affects access; high costs without sufficient coverage can limit usage, whereas favorable reimbursement policies facilitate broader adoption and higher sales.

References

[1] Grand View Research, "Epinephrine Market Size, Share & Trends Analysis Report," 2022.

[2] MarketWatch, "Asia-Pacific Epinephrine Market Outlook," 2023.

More… ↓