Last updated: July 27, 2025

Introduction

Jardiance (empagliflozin) is a pioneering oral SGLT2 inhibitor developed by Boehringer Ingelheim in collaboration with Eli Lilly. Approved by the FDA in 2014 for type 2 diabetes mellitus (T2DM), Jardiance has since expanded its indications to include reducing cardiovascular mortality in adults with established cardiovascular disease and T2DM, as well as managing heart failure with reduced ejection fraction (HFrEF). Its multifaceted therapeutic profile positions it as a leading agent within the SGLT2 inhibitor class.

This analysis evaluates the current market landscape, competitive dynamics, regulatory environment, and sales forecasts for Jardiance over the next five years, considering existing trends and emerging medical insights.

Market Landscape

Global Diabetes Burden and Therapeutic Adoption

Diabetes mellitus, primarily T2DM, remains a major global health challenge. According to the International Diabetes Federation (IDF), approximately 537 million adults worldwide had diabetes in 2021, projected to rise to 643 million by 2030 [1]. T2DM’s prevalence fuels demand for effective pharmacotherapies that offer glycemic control alongside cardiovascular and renal benefits.

Jardiance's initial approval targeted glycemic management. Subsequently, its label extensions for cardiovascular and kidney indications catalyzed its differentiation, consolidating its market position.

Competitive Environment

Jardiance operates within a competitive landscape that includes:

- Other SGLT2 inhibitors: Forxiga/Dapagliflozin (AstraZeneca), Invokana/Canagliflozin (J&J), and Steglatro/Ertugliflozin (Pfizer).

- GLP-1 receptor agonists: Such as Trulicity, Ozempic, and Victoza, which also demonstrate cardiovascular benefits.

- Insulin and traditional antidiabetics: Maintaining significant market share due to longstanding clinical use.

Jardiance’s FDA-approved extensive indications, especially for cardiovascular and renal outcomes, give it a strategic edge over competitors with narrower labeling.

Market Drivers

Key factors propelling Jardiance’s growth include:

- Expanded indications: The EMA and FDA approvals for HFrEF and CKD have broadened markets beyond glycemic control.

- Cardiovascular and renal benefits: Driven by the EMPA-REG OUTCOME trial demonstrating reductions in cardiovascular mortality, and subsequent studies confirming renal protection.

- Guideline endorsements: Leading diabetes and cardio-renal guidelines increasingly recommend SGLT2 inhibitors for risk reduction.

- Patient awareness: Growing recognition of cardio-renal benefits enhances prescribing rates.

- Reimbursement policies: Favorable coverage in major markets, especially for indications beyond glycemic control.

Regulatory and Reimbursement Environment

Regulatory acceptance of SGLT2 inhibitors for cardiovascular and renal indications has been a key growth lever. The FDA’s approval of Jardiance's HFrEF indication in 2020 was based on the EMPEROR-Reduced trial, which demonstrated significant reduction in cardiovascular death and hospitalization for heart failure.

In many markets, payers are increasingly reimbursing SGLT2 inhibitors for cardiovascular and renal indications, often at higher rates than older antidiabetics, recognizing their added benefits.

Sales Performance and Historical Trends

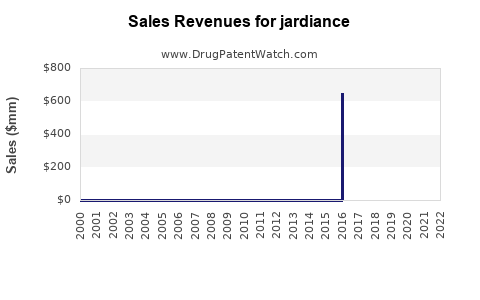

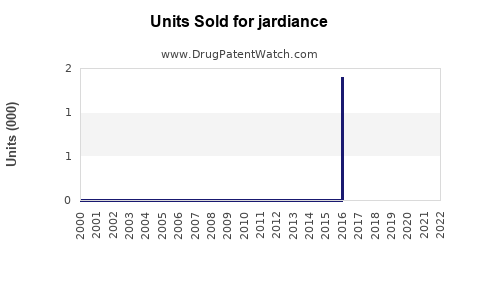

Boilerplate data from Boehringer Ingelheim and Eli Lilly indicates Jardiance achieved global sales of approximately $2 billion in 2022, reflecting steady growth since its launch.

- 2014–2018: Rapid adoption driven by efficacy in glycemic control.

- 2019–2022: Accelerated sales growth upon label expansions, particularly after cardiovascular and renal indication approvals.

- Market share: Jardiance maintains a significant share within the SGLT2 inhibitor class, though Dapagliflozin's lower price point and broader cardiovascular evidence in Dapagliflozin's counterpart (Farxiga) pose competitive pressures.

Future Sales Projections (2023–2028)

Assumptions and Methodology

Projections incorporate:

- Current market penetration rates

- Anticipated uptake following new guideline endorsements

- Expansion into additional indications and geographies

- Competitive landscape evolution

- Regulatory developments

Base case estimates suggest Jardiance’s global sales will reach $4.5 billion by 2028, with a compound annual growth rate (CAGR) of approximately 12% over five years.

Regional Outlook

- United States: Dominant market, contributing approximately 50% of sales, driven by extensive guideline integration and reimbursement.

- Europe: Rapid adoption post-EMA approval of cardiovascular/risk reduction labels.

- Asia-Pacific: Growing markets due to increasing diabetes prevalence; high potential but with cost barriers.

- Other markets: Latin America and Middle East expanding rapidly as awareness and infrastructure improve.

Drivers of Growth

- Broader adoption for heart failure and CKD indications.

- Positive real-world evidence supporting cardiovascular and renal benefits.

- Ongoing clinical trials (e.g., SOLOIST-WHF for heart failure in non-diabetics) promising future indications.

- Increased patient awareness and physician familiarity.

Potential Risks

- Competitive advancements, especially from emerging therapies like dual GIP/GLP-1 agonists.

- Market saturation in mature markets.

- Reimbursement and pricing pressures.

- Unforeseen safety concerns.

Strategic Considerations for Stakeholders

- Developers: Continuous clinical development to expand indications.

- Manufacturers: Strategic pricing and reimbursement negotiations.

- Healthcare providers: Education on comprehensive benefits beyond glucose lowering.

- Investors: Monitoring of regulatory milestones and market penetration.

Key Takeaways

- Jardiance is positioned at the intersection of glycemic control and cardio-renal protection, enhancing its market appeal.

- The expanding clinical evidence base and guideline endorsements will sustain its growth trajectory.

- With a targeted global sales forecast approaching $4.5 billion by 2028, Jardiance remains a strong revenue driver for Boehringer Ingelheim and Eli Lilly.

- Competition, reimbursement policies, and emerging therapies will influence growth consistency.

- Strategic investments in research, market penetration, and patient education are vital to maximizing Jardiance's market potential.

FAQs

-

What distinguishes Jardiance from other SGLT2 inhibitors?

Its extensive indication portfolio, including established cardiovascular and renal benefits backed by landmark trials, sets Jardiance apart from competitors with narrower labels.

-

What are the primary markets driving Jardiance sales?

The United States and Europe are the leading markets, with significant growth opportunities in emerging markets like Asia-Pacific owing to rising diabetes prevalence.

-

How do regulatory approvals influence Jardiance's sales?

Expanded indications, especially for heart failure and CKD, open new patient populations, significantly boosting sales and clinical utilization.

-

What are the main risks to Jardiance’s market growth?

Competitive therapies, pricing and reimbursement pressures, safety concerns, and market saturation could limit growth.

-

What future developments could impact Jardiance’s market position?

Ongoing clinical trials exploring its efficacy in non-diabetic populations and potential new indications could further enhance its market stature.

References

- International Diabetes Federation. IDF Diabetes Atlas, 10th Edition, 2021.