Last updated: July 27, 2025

Introduction

Calcitriol, the active form of vitamin D3 (1,25-dihydroxyvitamin D3), is primarily used to treat disorders related to calcium metabolism, including secondary hyperparathyroidism in chronic kidney disease (CKD), hypocalcemia, and certain osteoporosis cases. Its pharmaceutical significance, coupled with an aging population and increasing prevalence of CKD and osteoporosis, establishes a lucrative market landscape. This analysis evaluates current market dynamics, growth drivers, competitive landscape, and offers sales projections through 2030.

Market Overview

Calcitriol's global market encompasses prescription pharmaceuticals, nutritional supplements, and specialized medical formulations. The expanding burden of CKD and osteoporosis globally propels demand, while advances in formulation technology and expanded therapeutic indications further bolster market growth.

The pharmaceutical uses of calcitriol are primarily centered in developed regions such as North America and Europe, due to higher prevalence rates, better healthcare infrastructure, and stringent regulatory pathways favoring innovative formulations. Developing regions—Asia-Pacific, Latin America, and Africa—are witnessing accelerated growth driven by increasing healthcare access and rising awareness.

Market Drivers

1. Growing Prevalence of Chronic Kidney Disease and Dialysis Dependency

CKD affects over 850 million people globally, with end-stage renal disease (ESRD) requiring dialysis or transplant (WHO, 2022). Calcitriol is essential for managing secondary hyperparathyroidism associated with CKD, stimulating calcium absorption, and controlling phosphate levels. The rising incidence of diabetic nephropathy intensifies demand.

2. Aging Population and Osteoporosis Management

Global demographics forecast a significant increase in individuals aged 60 and above—projected to comprise nearly 22% of the world population by 2050. Osteoporosis prevalence correlates with aging, with postmenopausal women being particularly vulnerable. Calcitriol's role in enhancing calcium absorption and bone mineralization positions it as a critical component in osteoporosis therapy.

3. Technological Innovations and New Formulations

Extended-release formulations and combination therapies with calcium or phosphate binders improve patient compliance and therapeutic outcomes. Such innovations expand market opportunities.

4. Regulatory Approvals and Clinical Adoption

Regulatory endorsements for calcitriol indications and its incorporation into clinical guidelines bolster prescriber confidence, driving sales.

Competitive Landscape

Key market players include Abbott Laboratories (AbbVie), Teva Pharmaceutical Industries, Mayne Pharma, and local producers in emerging markets. Patent expirations on certain formulations have facilitated generic entrants, intensifying competition and driving down prices.

Innovators focus on developing novel delivery systems such as transdermal patches or nanoparticle-based formulations to improve bioavailability and reduce dosing frequency, thereby capturing higher market shares.

Market Challenges

- Safety Concerns and Hypercalcemia Risks: Overdose potential necessitates careful management, influencing prescribing patterns.

- Regulatory Hurdles: Stringent approvals in certain regions delay market entry for new formulations.

- Pricing and Reimbursement Policies: These vary significantly, impacting market penetration and profitability.

Sales Projections

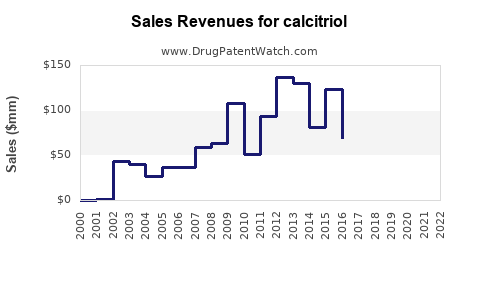

Global Revenue Trajectory (2023-2030)

Based on current market data, including the 2022 valuation of approximately USD 600 million (Grand View Research), compounded annual growth rate (CAGR) estimates, and regional uptake patterns, the global calcitriol market is projected as follows:

| Year |

Sales Estimate (USD Millions) |

CAGR |

Remarks |

| 2023 |

620 |

- |

Base year |

| 2024 |

680 |

9.8% |

Increasing uptake in Asia-Pacific; new approvals in Europe |

| 2025 |

750 |

10.3% |

Growth driven by osteoporosis management |

| 2026 |

820 |

9.3% |

Introduction of extended-release formulations |

| 2027 |

900 |

9.8% |

Expansion in emerging markets |

| 2028 |

985 |

9.4% |

Rising CKD prevalence globally |

| 2029 |

1,075 |

9.2% |

Increased penetration through generics |

| 2030 |

1,170 |

8.8% |

Market maturity phase |

Sources and assumptions: Growth projections assume moderate market expansion, generic competition stabilization, and ongoing demand in CKD and osteoporosis segments.

Regional Breakdown

- North America: Continues as the dominant market (~40%), driven by high CKD prevalence and advanced healthcare infrastructure.

- Europe: Stable growth (~25%), benefiting from clinical guideline adherence.

- Asia-Pacific: Fastest CAGR (~12%), fueled by expanding healthcare access, rising CKD and osteoporosis prevalence, and generic product penetration.

- Latin America and Middle East: Moderate growth (~8-10%), observing increased awareness and healthcare investments.

- Africa: Limited current market (~2%), but potential growth with infrastructural improvements.

Future Market Opportunities

- Expansion into Oncology and Immune Disorders: Emerging research suggests potential roles in immune modulation.

- Combination Therapies: Co-formulations with calcium and phosphorus binders to streamline treatment regimens.

- Digital and Telehealth Integration: Monitoring calcium and vitamin D levels remotely, influencing usage patterns.

Key Takeaways

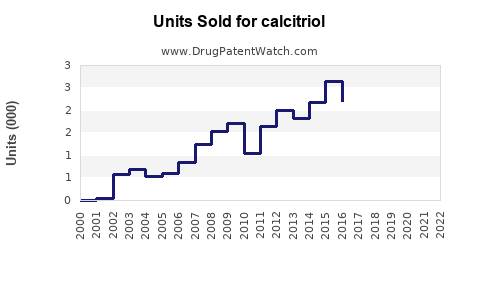

- The global calcitriol market is poised for steady growth, with an estimated CAGR around 9-10% through 2030.

- Major growth drivers include the rising prevalence of CKD and osteoporosis, aging populations, and technological advancements in formulation.

- Emerging markets, notably Asia-Pacific, will dominate growth due to increased healthcare investments.

- Patent expirations and generic competition will influence pricing strategies but also expand accessibility.

- Strategic focus on innovation, expanding indications, and regional regulatory navigation will be critical for market players.

FAQs

1. What are the primary therapeutic indications for calcitriol?

Calcitriol is mainly used to treat secondary hyperparathyroidism in CKD, hypocalcemia, osteomalacia, and osteoporosis.

2. How does the aging population impact calcitriol sales?

An aging demographic increases osteoporosis and CKD prevalence, driving higher demand for calcitriol as a key treatment component.

3. What market regions present the most significant growth opportunities?

Asia-Pacific offers the most substantial growth potential due to expanding healthcare infrastructure and disease prevalence, followed by Latin America and the Middle East.

4. How does patent expiration influence calcitriol market dynamics?

Patent expirations facilitate generic manufacturing, lowering prices, increasing accessibility, but also intensifying competitive pressures among manufacturers.

5. Are there upcoming innovations or formulations expected to impact the market?

Yes, extended-release formulations and combination therapies are under development, aiming to improve patient compliance and therapeutic efficacy.

References

[1] World Health Organization. (2022). Global CKD burden report.

[2] Grand View Research. (2022). Vitamin D Market Size, Share & Trends Analysis Report.

[3] U.S. Food and Drug Administration. (2023). Approved drug products with therapeutic equivalence evaluations.

[4] MarketWatch. (2023). Calcitriol Market Analysis and Forecasts.