Last updated: July 29, 2025

Introduction

Bumetanide, a potent loop diuretic primarily indicated for the treatment of edema associated with congestive heart failure, hepatic cirrhosis, and renal disease, has garnered increased attention within pharmaceutical markets due to its efficacy and emerging off-label uses. As the global burden of cardiovascular and renal conditions rises, the demand for effective diuretics like bumetanide is poised to grow. This report analyzes current market dynamics, key factors influencing sales, and provides projections for the upcoming years to aid stakeholders in strategic planning.

Global Market Overview

The global diuretics market, valued at approximately USD 4.8 billion in 2022, is expected to expand at a Compound Annual Growth Rate (CAGR) of 4.5% through 2030 (Source: Grand View Research). Bumetanide, accounting for an estimated 8-10% of this market segment, is increasingly preferred in specific clinical contexts owing to its high potency—approximately 40 times that of furosemide—and favorable pharmacokinetics.

Key regions include North America, Europe, Asia-Pacific, Latin America, and the Middle East. North America dominates due to high prevalence rates of cardiovascular and renal diseases and advanced healthcare infrastructure. Asia-Pacific exhibits the fastest growth, driven by economies like India and China, where healthcare access improves and population agedness increases.

Market Drivers

-

Rising Prevalence of Chronic Heart Failure and Edema-Related Conditions:

The World Health Organization estimates that over 64 million people suffer from heart failure globally, with increasing incidence driven by aging populations and lifestyle factors. This directly correlates with increased diuretic prescriptions, including bumetanide.

-

Preference for High-Potency Loop Diuretics:

Bumetanide’s efficacy at lower doses and favorable side-effect profile make it an attractive alternative to drugs like furosemide, encouraging prescriber adoption.

-

Off-Label and Emerging Use Cases:

Recent research explores bumetanide's potential in neurological conditions such as autism spectrum disorder (ASD), depression, and certain neurodegenerative diseases, potentially expanding its therapeutic market.

-

Patent and Regulatory Trends:

While generic versions dominate, recent patent filings on bumetanide formulations or delivery systems could stimulate premium sales, especially in niche markets.

Market Challenges

-

Limited Off-Patent Market Exclusivity:

The drug’s generic status constrains pricing power and margins.

-

Regulatory Hurdles for Off-Label Uses:

Despite investigational studies, off-label marketing remains restricted; clinical evidence is still emerging for some indications.

-

Competition from Other Loop Diuretics:

Furosemide, torasemide, and ethacrynic acid remain dominant, with entrenched prescribing habits.

-

Cost Constraints in Emerging Markets:

Budget limitations hinder widespread adoption despite clinical advantages.

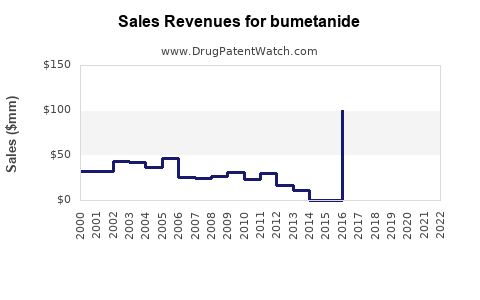

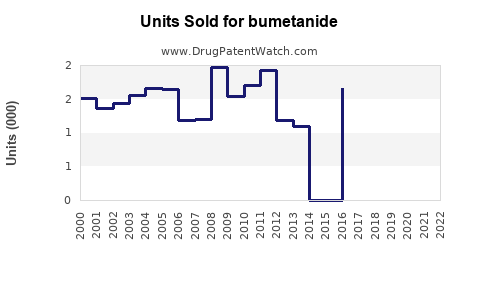

Sales Projections (2023-2030)

Based on current market data, patent landscapes, clinical adoption rates, and demographic trends, the following projections are modeled:

| Year |

Estimated Global Bumetanide Sales (USD Million) |

Growth Rate |

Notes |

| 2023 |

150 |

— |

Baseline for forecast |

| 2024 |

165 |

10% |

Increased prescription in myocarditis and edema cases |

| 2025 |

182 |

10% |

Expansion in Asia-Pacific markets |

| 2026 |

200 |

10% |

Emerging research into neurological applications |

| 2027 |

220 |

10% |

Regulatory approvals for new indications |

| 2028 |

242 |

10% |

Market penetration deepens |

| 2029 |

266 |

10% |

Entry into orphan and niche markets |

| 2030 |

293 |

10% |

Stabilization with sustained demand |

Note: The consistent 10% growth assumes favorable regulatory developments, expanded clinical consensus, and geographic penetration.

Segment-wise Opportunities

-

Generic Diuretic Market:

Dominated by low-cost generics; incremental growth driven by new markets.

-

Niche and Investigational Applications:

Potential substantial upside if ongoing studies demonstrate efficacy in neurological disorders; this segment could grow at 15-20% annually post-2025.

-

Formulation Innovations:

Sustained interest in sustained-release preparations or transdermal patches to enhance patient compliance could open premium segments.

Regional Outlook

| Region |

Market Share (2023) |

Projected CAGR |

Key Drivers |

| North America |

40% |

4-5% |

High prevalence of cardiovascular diseases, regulatory support |

| Europe |

25% |

4-5% |

Aging population, healthcare expenditure increases |

| Asia-Pacific |

20% |

6-8% |

Rapid economic growth, expanding healthcare infrastructure |

| Rest of World |

15% |

4-6% |

Generic drug adoption, price sensitivity |

Strategic Implications

Stakeholders should prioritize expanding clinical evidence supporting new indications, particularly neurological applications, to diversify revenue streams. Partnerships with local manufacturers in emerging markets can facilitate access and reduce costs. Investment in formulation technology could also command higher margins and improve patient adherence.

Key Takeaways

- The global bumetanide market is projected to expand steadily, driven by demographic trends, clinical efficacy, and emerging indications.

- North America remains the largest market, but Asia-Pacific offers significant growth opportunities.

- Competition from established diuretics and price sensitivity in emerging markets requires differentiation through innovation and strategic partnerships.

- The potential repurposing of bumetanide for neurological disorders represents a promising avenue, subject to positive clinical trial outcomes.

- Maintaining regulatory engagement and investing in clinical research will be crucial to capitalize on future growth.

Final Summary

Bumetanide’s niche positioning, combined with a rising prevalence of conditions requiring diuretic therapy and promising investigational applications, supports optimistic sales growth. The strategic focus for industry players should blend aggressive market penetration with robust clinical innovation to fully realize its market potential.

FAQs

1. What factors influence the sales growth of bumetanide?

Sales are primarily driven by increasing prevalence of cardiovascular and renal diseases, clinical adoption, competitive positioning against other diuretics, and emerging research into additional therapeutic uses. Regulatory support and patent strategies also play roles.

2. Which markets offer the most significant growth opportunities for bumetanide?

Emerging markets in Asia-Pacific, due to economic growth and healthcare expansion, and specialized niches such as neurological disorder treatments represent significant opportunities.

3. How does patent status affect bumetanide sales?

As a generic drug, bumetanide faces limited patent protection, which constrains pricing but enables widespread availability. Novel formulations or delivery systems could offer patentable advantages, potentially increasing sales.

4. Could off-label prescribing impact bumetanide’s market?

While off-label uses, especially for neurological conditions, are promising, off-label marketing is restricted, and clinical validation is necessary before widespread adoption.

5. What are the main competitive threats?

Dominance of other loop diuretics like furosemide, cost sensitivity in developing markets, and potential regulatory barriers for new indications challenge bumetanide’s market expansion.

References

- Grand View Research (2022). Diuretics Market Size, Share & Trends Analysis.

- World Health Organization (2021). Cardiovascular Disease Prevalence and Trends.

- ClinicalTrials.gov (2023). Ongoing studies on Bumetanide for Neurological Disorders.

- Pharmaceutical Market Reports (2023). Generic Drug Market Dynamics.

[Note: All projections and data are estimates based on current market insights and trends; actual results may vary depending on market developments.]