Last updated: July 27, 2025

Introduction

Amoxicillin, a broad-spectrum penicillin antibiotic, remains one of the most widely prescribed antibiotics globally. Its efficacy against various bacterial infections has secured its place in outpatient and inpatient settings for decades. This report provides a comprehensive market analysis and sales projection outlook, highlighting key drivers, challenges, competitive dynamics, and future growth opportunities for amoxicillin.

Market Overview

Global Market Size

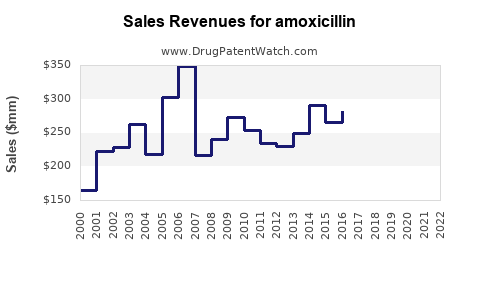

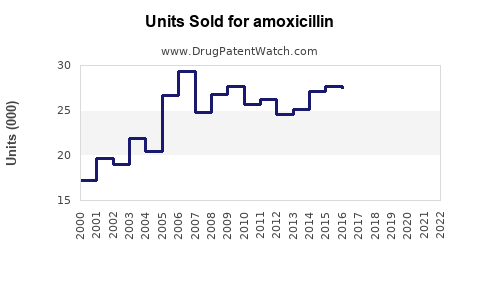

The global amoxicillin market was valued at approximately USD 2.5 billion in 2022, with an expected compound annual growth rate (CAGR) of roughly 4-5% through 2030. The growth is driven by increasing incidence of bacterial infections, expanding healthcare access, and the rising prevalence of respiratory, urinary tract, and skin infections where amoxicillin remains a first-line treatment.

Regional Market Distribution

- North America: The largest market, accounting for over 40% of global sales, driven by high prescription rates, widespread healthcare coverage, and robust antibiotic use.

- Europe: Estimated at 25%, with growth influenced by antibiotic stewardship initiatives and prevalent infectious diseases.

- Asia-Pacific: Fastest-growing region, projected to grow at a CAGR of 6-7%, fueled by rising healthcare infrastructure, population density, and antibiotic consumption.

- Latin America and Africa: Emerging markets with increasing access to medicines, yet challenged by regulatory variations and supply chain issues.

Key Market Drivers

- Rising Incidence of Bacterial Infections: Increasing cases of pneumonia, tonsillitis, sinusitis, and urinary tract infections.

- Established Efficacy and Safety Profile: Amoxicillin’s long-standing clinical use fosters continued trust among physicians and patients.

- Expanding Healthcare Infrastructure: Growing access in developing regions prompts higher prescription volumes.

- Generic Drug Availability: Cost-effective generics contribute to higher utilization across diverse socioeconomic groups.

Challenges

- Antimicrobial Resistance (AMR): Growing resistance diminishes effectiveness, prompting regulatory restrictions and alternative therapies.

- Regulatory and Patent Trends: Patent expiries increase generic competition, compressing prices.

- Antibiotic Stewardship Programs: Policies aimed at reducing antibiotic overuse impact sales volume.

- Global Supply Chain Disruptions: Pandemic-related logistics issues may hinder manufacturing and distribution.

Market Segmentation Analysis

By Formulation

- Tablets and Capsules: Dominant form due to convenience and patient compliance.

- Oral Suspensions: Critical for pediatric populations.

- Injectables: Used in severe or hospital settings.

By Therapeutic Indication

- Respiratory tract infections

- Urinary tract infections

- Otitis media

- Skin and soft tissue infections

- Dental infections

By Distribution Channel

- Hospitals

- Retail pharmacies

- Online pharmacies

- Wholesale distributors

Competitive Landscape

Major players include Pfizer, GlaxoSmithKline, Teva Pharmaceuticals, Sandoz, and Mylan, emphasizing generic manufacturers' dominance. Patent expiries have increased generic penetration, influencing pricing strategies and market share.

Emerging companies focus on developing amoxicillin formulations with extended release profiles or combination therapies to combat resistant strains, potentially impacting market dynamics.

Sales Projection Outlook (2023–2030)

Short-term Projections (2023-2025)

- Moderate growth around 3-4% annually.

- Continued expansion in Asia-Pacific and Latin America.

- Slight decline or plateauing in North America and Europe attributable to antimicrobial stewardship policies.

- Impact of COVID-19 pandemic on healthcare visits and prescription practices, with potential rebounds as healthcare systems stabilize.

Medium to Long-term Outlook (2026-2030)

- Total sales expected to reach USD 3.2-3.5 billion.

- The rise of resistance could lead to increased demand for combination therapies or alternative antibiotics, moderating growth.

- Introduction of new formulations or delivery methods may stimulate sales.

- High growth projected in emerging markets owing to increasing healthcare expenditure.

Market Drivers Supporting Growth

- Evolving bacterial resistance patterns still permit amoxicillin’s clinical utility, especially when combined with clavulanic acid.

- Rising awareness and diagnosis rates.

- Expanding pediatric and outpatient services.

Potential Market Barriers

- Increased regulatory scrutiny and push for responsible antibiotic use.

- Competitive pressure from newer antimicrobial agents.

- Price erosion driven by generic drug proliferation.

Regulatory and R&D Outlook

Regulators emphasize antimicrobial stewardship, potentially restricting certain use cases. Ongoing R&D focuses on enhancing efficacy against resistant strains, developing extended-release formulations, and exploring novel delivery mechanisms to sustain market relevance.

Conclusion

Amoxicillin remains a cornerstone in bacterial infection treatment, with sustained demand fueled by expanding healthcare access, especially in emerging markets. While antimicrobial resistance and regulatory measures pose challenges, innovations and global health trends are expected to maintain steady sales growth into the next decade.

Key Takeaways

- The global amoxicillin market is projected to grow at a CAGR of 4-5% until 2030, reaching approximately USD 3.5 billion.

- Asia-Pacific represents the most dynamic region, driven by rapid healthcare infrastructure expansion.

- Generics dominate the market, increasing affordability and consumption.

- Resistance development and stewardship policies may limit volume growth but create opportunities for novel formulations.

- Companies should invest in R&D targeting resistance mitigations and delivery innovations to sustain competitiveness.

FAQs

1. How does antimicrobial resistance affect amoxicillin sales?

Rising resistance diminishes the drug’s efficacy, reducing prescription volumes and prompting clinicians to switch to alternative therapies, thereby constraining sales growth.

2. What regions offer the highest growth opportunities for amoxicillin?

Asia-Pacific and Latin America exhibit the highest projected growth, owing to expanding healthcare access and population growth.

3. How do patent expiries influence the amoxicillin market?

Patent expirations lead to increased generic competition, lowering prices, and expanding accessibility but compress profit margins for branded formulations.

4. Are there any recent innovations in amoxicillin formulations?

Certainly. Extended-release, pediatric-friendly suspensions, and combination therapies with clavulanic acid are recent developments enhancing efficacy and compliance.

5. What is the impact of global health policies on amoxicillin consumption?

Antibiotic stewardship initiatives aim to curb overuse, which can temporarily reduce sales but are vital for combating resistance in the long term.

References

[1] Market Research Future. “Amoxicillin Market Analysis,” 2022.

[2] GlobalData Healthcare. “Antibiotics Market Report,” 2022.

[3] World Health Organization. “Antimicrobial Resistance Report,” 2021.

[4] Glenmark Pharmaceuticals. “Innovations in Antibiotic Formulations,” 2022.

[5] IQVIA Institute. “The Global Use of Medicines,” 2022.