Last updated: July 29, 2025

Introduction

TOBRADEX, a combination ophthalmic medication comprising tobramycin and dexamethasone, is utilized primarily to treat bacterial infections of the eye accompanied by inflammation. As a well-established product, its positioning within the ophthalmic pharmaceutical market influences sales dynamics significantly. This analysis evaluates current market conditions, competitive landscape, therapeutic demand, and future sales projections for TOBRADEX, equipping stakeholders with actionable insights.

Market Overview

Therapeutic Landscape and Demand Drivers

The ophthalmic drug market has witnessed CAGR estimates around 4.5% (2021-2026), driven by increasing prevalence of ocular infections, post-surgical inflammation, and rising awareness of eye health. TOBRADEX's key indications align with these trends, notably post-operative infection management and bacterial conjunctivitis (WHO, 2022).

The global ophthalmic therapeutics market is valued at approximately $18 billion as of 2022, with antibiotics and anti-inflammatory agents accounting for a significant share. The growth is further supported by technological advances in drug delivery and expanding aging populations, adversely impacting ocular health and increasing demand for effective treatment options.

Regulatory and Patent Status

TOBRADEX was initially approved in the mid-1980s and remains off-patent in several jurisdictions, notably in the US and Europe. This open patent landscape fosters increased generic competition, which traditionally suppresses pricing; however, established brand recognition sustains residual brand loyalty among prescribers.

In recent years, regulatory authorities have approved new formulations and delivery methods, including preservative-free options, which alter the competitive landscape and potentially influence market share dynamics post-2022.

Market Segmentation

The primary consumers of TOBRADEX are ophthalmologists, general practitioners, and hospital pharmacies. Geographic segmentation reveals dominant markets in North America and Europe, followed by Asia-Pacific, where increasing ophthalmic disease prevalence and healthcare infrastructure expansion present growth opportunities.

Competitive Landscape

Major Competitors

TOBRADEX competes with monotherapies—such as tobramycin drops and dexamethasone suspensions—as well as other combination drugs like Maxitrol (neomycin, polymyxin B, dexamethasone). Generic formulations from multiple producers have further intensified competition, leading to price erosion.

Notably, alternative therapies include newer antibiotics such as moxifloxacin and anti-inflammatory agents like ketorolac, which are indicated for similar ocular conditions.

Market Position

Despite competition, TOBRADEX holds a significant market position due to its established efficacy, prescriber familiarity, and broad-spectrum coverage. However, increasing preference for preservative-free formulations and concerns over steroid-related adverse effects may influence its use.

Sales Drivers and Barriers

Drivers

- Rising incidence of ocular infections post-surgery (cataract, LASIK)

- Aging population with increased susceptibility to eye infections

- Expanding worldwide healthcare access, especially in emerging markets

- Growing awareness regarding ocular health and infection management

Barriers

- Patent expiration leading to generic competition

- Rising preference for alternative therapies with fewer side effects

- Regulatory shifts promoting preservative-free and steroid-free options

- Concerns about steroid-associated ocular hypertension and long-term complications

Sales Projections (2023–2028)

Methodology

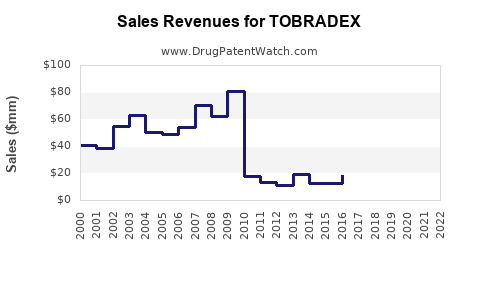

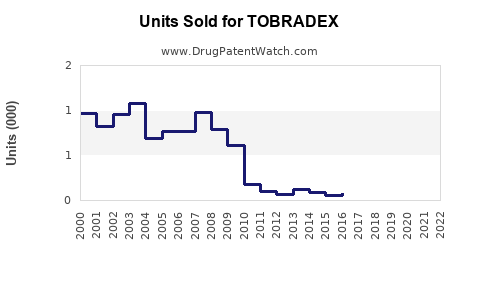

Projections integrate historical sales data, market growth trends, competitive dynamics, and anticipated regulatory and clinical developments. Market share shifts are modeled considering the impact of generics, new formulations, and regional variances.

Forecast Summary

- 2023–2024: Sales are expected to stabilize, approximating USD 250 million globally, reflecting entrenched market presence but moderate impact from generics.

- 2025–2026: Slight decline forecast (~2–3% annually) due to increased adoption of alternatives and generic erosion, reaching around USD 210–220 million.

- 2027–2028: Market stabilization or minimal growth anticipated, potentially driven by emerging markets and new formulation launches, with sales hovering near USD 200 million.

Overall, the compound annual growth rate (CAGR) for TOBRADEX from 2023 to 2028 is projected around -1.5% to -2%, signifying a gradual decline influenced by generic competition and evolving clinical preferences.

Regional Outlook

- North America: Mature market with slow decline, but high brand loyalty may sustain USD ~100 million annual sales.

- Europe: Similar to North America; price controls and generic proliferation dampen sales growth.

- Asia-Pacific: Rapidly expanding market with increasing ophthalmic disease burden; potential for increased sales, estimated at 4–6% CAGR, partially offsetting declines elsewhere.

Strategies for Sustaining Market Share

To optimize sales, manufacturers should focus on differentiating formulations, such as preservative-free versions, and expanding indications, including post-surgical protocols and resistant bacterial infections. Emphasizing physician education and fostering regional market penetration, especially in emerging economies, can mitigate declines.

Key Takeaways

- Market maturity and patent expirations are eroding original TOBRADEX sales; however, brand loyalty and clinical comfort sustain revenue.

- Generic alternatives dominate price-sensitive markets, pressuring margins.

- Regional growth potential exists in Asia-Pacific, where expanding ophthalmic healthcare infrastructure presents opportunities.

- Innovation in formulations and expanding therapeutic indications are vital to maintaining relevance.

- Regulatory shifts favoring preservative-free and steroid-sparing options may reduce reliance on traditional TEBRADEX formulations.

Conclusion

TOBRADEX’s market trajectory reflects the typical lifecycle of a long-standing ophthalmic drug: initial high sales, plateau, and gradual decline propelled by generic competition. Strategic adaptation through formulation innovation and geographic expansion remains essential for future sales preservation. Stakeholders should monitor regulatory developments, emerging therapies, and regional market dynamics to optimize their positioning.

FAQs

-

What factors primarily influence TOBRADEX's declining sales?

The expiration of patents allowing generic competitors, rising preference for preservative-free and steroid-sparing options, and clinician shifts toward alternative antibiotics contribute to its decline.

-

How does regional variation affect TOBRADEX's market share?

North America and Europe exhibit mature markets with slow declines, whereas the Asia-Pacific region offers growth opportunities via increasing ophthalmic healthcare access and disease prevalence.

-

Are there new formulations or indications for TOBRADEX?

While current formulations remain dominant, the development of preservative-free versions and expanded use in postoperative care are potential avenues to extend product lifecycle.

-

What are the main competitive threats to TOBRADEX?

Monotherapy antibiotics, alternative anti-inflammatory agents, and emerging therapies with fewer side effects pose challenges, especially where clinicians prioritize safety and convenience.

-

What strategic moves can manufacturers make to sustain sales?

Innovating with new formulations, targeting underserved markets, educating prescribers on clinical benefits, and aligning with regulatory trends will help sustain or grow TOBRADEX revenues.

Sources:

[1] WHO. (2022). Global Burden of Eye Diseases. World Health Organization.

[2] MarketWatch. (2022). Ophthalmic Drugs Market Size, Share & Trends.

[3] IQVIA. (2022). Global Ophthalmic Pharmaceutical Market Data.

[4] U.S. Food and Drug Administration. (2023). Approved Ophthalmic Drug Labelings.

[5] Deloitte. (2022). Pharmaceutical Industry Insights: Ophthalmology & Market Trends.