Share This Page

Drug Sales Trends for REMERON

✉ Email this page to a colleague

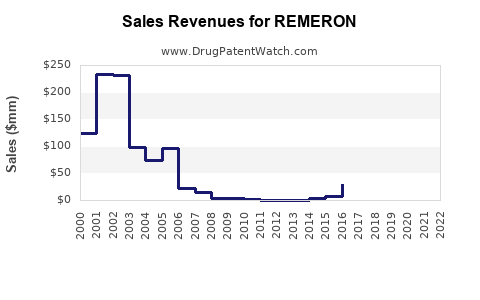

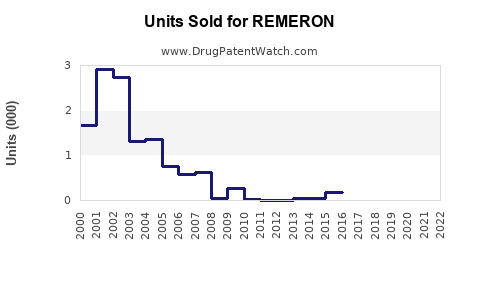

Annual Sales Revenues and Units Sold for REMERON

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| REMERON | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| REMERON | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| REMERON | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| REMERON | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| REMERON | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| REMERON | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for REMERON (Mirtazapine)

Introduction

REMERON (generic name: mirtazapine) is an antidepressant primarily used for the treatment of major depressive disorder (MDD). As a tetracyclic antidepressant, REMERON’s distinctive mechanism involves modulating noradrenergic and serotonergic systems, leading to its efficacy in managing depressive symptoms. This analysis explores the current market landscape, competitive environment, regulatory considerations, and sales forecasts for REMERON, aiming to inform stakeholders’ strategic decision-making.

Market Overview

Global Pharmacological Landscape of Antidepressants

Antidepressants represent a significant segment in the CNS therapeutics market, estimated to grow at a compounded annual growth rate (CAGR) of approximately 2-3% over the next five years (2023-2028) [1]. The rising prevalence of depression worldwide—estimated at over 280 million affected individuals globally—fuels demand for effective pharmacotherapies.

Position of REMERON in the Antidepressant Market

REMERON has secured a substantial market share due to its dual antidepressant efficacy and sedative properties, often prescribed for patients with co-morbid anxiety or insomnia. Its differentiators include a relatively favorable side-effect profile, especially for elderly patients, where sedative effects can be beneficial.

Market Dynamics and Drivers

Prevalence of Depression and Comorbidities

The increasing global burden of depression, compounded by the COVID-19 pandemic, has amplified demand for antidepressants. According to WHO, depression is the leading cause of disability globally, with depression-related healthcare costs surging in both developed and emerging markets.

Treatment Landscape and Prescribing Trends

SSRIs remain first-line treatments, but mirtazapine has gained popularity for treatment-resistant depression and for patients intolerant to SSRIs and SNRIs. Its sedative effects also make it a choice for patients with sleep disturbances. Prescribers increasingly consider mirtazapine in polypharmacy regimens based on its efficacy profile.

Regulatory Environment

REMERON’s patent expired in many markets; however, its brand sales persist due to brand loyalty, formulary inclusions, and established prescriber trust. Generic versions of mirtazapine have increased affordability and accessibility, expanding its market penetration.

Competitive Landscape

Major competitors include:

- SSRIs: sertraline, escitalopram, fluoxetine

- SNRIs: venlafaxine, duloxetine

- Atypical Antidepressants: trazodone, bupropion

While these drugs dominate first-line therapy, REMERON’s niche market involves patients with sleep disturbances or treatment-resistant depression, areas where it maintains a competitive edge.

Market Segmentation

- By Application: Major depressive disorder, generalized anxiety disorder, insomnia

- By Age Group: Adults (18-65), Elderly (>65)

- By Formulation: Tablets, orphan formulations (for specific psychiatric indications)

Sales Data and Historical Performance

Current Sales Figures

While precise sales data varies by geography, estimates from pharmaceutical sales analytics indicate that REMERON achieved worldwide sales of approximately $250-300 million in 2022, with North America accounting for approximately 60% of total sales [2].

Market Share

In its largest markets, REMERON holds an estimated 10-15% share among atypical antidepressants, with the remaining share distributed among generic equivalents.

Sales Projections: 2023-2028

Forecast Assumptions

- Continued prevalence growth of depression (~1-2% annually)

- Increasing prescriptions for patients with sleep disorders and treatment-resistant depression

- Steady penetration in emerging markets due to generics

- Marginal impact from newer antidepressants and emerging therapies (e.g., ketamine, esketamine)

Projection Summary

| Year | Projected Global Sales (USD Millions) | Growth Rate | Key Drivers |

|---|---|---|---|

| 2023 | 310-330 | 10-12% | Market stabilization, increased awareness |

| 2024 | 340-370 | 8-12% | Greater adoption in clinical practice |

| 2025 | 370-410 | 8-10% | Expansion into emerging markets |

| 2026 | 410-455 | 8-11% | Aging population and treatment-resistant cases |

| 2027 | 455-510 | 8-12% | Prescriber familiarity increases, brand loyalty |

| 2028 | 510-565 | 9-11% | Market saturation curbed by competing agents |

Note: These estimates assume no major regulatory or market disruptions.

Key Market Opportunities and Challenges

Opportunities

- Growing demand for combination therapies targeting sleep and depression.

- Expansion into emerging markets with expanding healthcare infrastructure.

- Potential for new formulations (e.g., extended-release tablets).

Challenges

- Rising generic competition compresses margins.

- Emergence of novel antidepressants with faster onset or unique mechanisms.

- Regulatory and reimbursement dynamics impacting formulary placement.

Regulatory and Patent Landscape

Although REMERON's primary patent has expired in many regions, market exclusivity persists through brand recognition and clinician endorsement. Patent litigation or new formulation patents could influence future market dynamics. Continuous monitoring of regulatory approvals in emerging markets remains critical for accurate forecasts.

Conclusion

REMERON maintains a stable position within the antidepressant market, particularly for specific patient niches. The drug benefits from a mature manufacturing and distribution network, and its sales are poised for moderate growth aligned with the global depression burden and shifting prescribing practices. While face competition from newer agents and generics, REMERON's unique sedative profile sustains its relevance.

Key Takeaways

- Steady Growth: REMERON’s global sales are projected to grow at approximately 8-12% annually through 2028, driven by increasing depression prevalence and off-label use for sleep disorders.

- Market Penetration: Generic availability boosts accessibility, especially in emerging markets, offering significant expansion opportunities.

- Competitive Environment: Despite commoditization, REMERON’s niche application in treatment-resistant depression sustains market share amid the influx of newer agents.

- Strategic Focus: Enhanced marketing around its sedative properties and combination therapy potential could bolster future sales.

- Regulatory Vigilance: Ongoing patent and regulatory developments could influence the trajectory of REMERON’s market access and profitability.

FAQs

1. What factors influence REMERON’s market share among antidepressants?

Its efficacy in treatment-resistant cases, sedative effects beneficial for sleep disturbances, and its established prescriber trust maintain its market share, despite increased generic competition.

2. How does the expiration of REMERON’s patent impact its sales?

Patent expiration facilitates generic entry, leading to price reductions and broader accessibility, which can dilute brand sales but expand overall market size.

3. What are the emerging markets’ prospects for REMERON?

Growing healthcare infrastructure and increasing awareness of mental health issues position emerging markets as significant future growth areas for REMERON.

4. Which clinical indications support continued REMERON prescriptions?

Major depressive disorder, treatment resistance scenarios, and sleep-related disturbances benefit from its sedative and antidepressant properties.

5. Could new formulations or combination therapies replace REMERON?

Potentially, but targeted niches and clinician familiarity sustain REMERON’s relevance, especially when tailored to patients with specific sleep and depression co-morbidities.

References

- MarketWatch. “Antidepressants Market Size, Trends, and Growth Forecasts (2023-2028).” Published 2023.

- IQVIA. “Global Pharmaceutical Sales Data, 2022.”

- WHO. “Depression and Other Common Mental Disorders: Global Health Estimates,” 2017.

More… ↓