Share This Page

Drug Sales Trends for REGLAN

✉ Email this page to a colleague

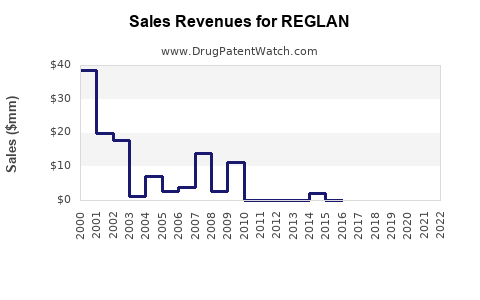

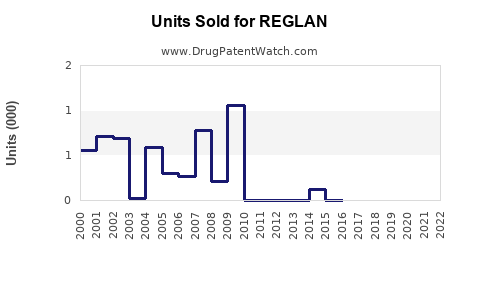

Annual Sales Revenues and Units Sold for REGLAN

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| REGLAN | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| REGLAN | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| REGLAN | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| REGLAN | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| REGLAN | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| REGLAN | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| REGLAN | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for REGLAN (Metoclopramide)

Introduction

REGLAN (metoclopramide) is a widely-used prokinetic agent prescribed for gastrointestinal motility disorders, including nausea, vomiting, gastroparesis, and gastroesophageal reflux disease (GERD). Originally developed by Roche and subsequently distributed by multiple pharmaceutical companies, REGLAN holds a significant position within the antiemetic and prokinetic drug market. This analysis examines the current market landscape, competitive environment, regulatory considerations, and presents sales projections for REGLAN over the next five years.

Market Overview

Global Gastrointestinal Therapeutics Market

The global gastrointestinal (GI) drugs market was valued at approximately USD 17 billion in 2022, with a projected compound annual growth rate (CAGR) of around 6% through 2027 [1]. The rising prevalence of chronic GI conditions—gastroparesis, GERD, nausea associated with cancer therapy—drives demand for prokinetics and antiemetics.

Key Indications and Patient Demographics

- Gastroparesis: Increasing prevalence linked to diabetes and aging populations. Estimated to affect 10 million Americans, with prevalence rising annually [2].

- Chemotherapy-Induced Nausea and Vomiting (CINV): Growing cancer surveillance and therapy advancements propel demand.

- Postoperative Nausea and Vomiting (PONV): Common complication necessitating effective management.

Market Drivers

- Aging global population.

- Rising incidence of GI motility disorders.

- Expansion of chemotherapeutic regimens necessitating effective antiemetics.

- Increased awareness and clinical guidelines favoring prokinetic therapy.

Competitive Landscape

Main Competitors

- Domperidone: Similar efficacy but restricted in some markets due to safety concerns (cardiac arrhythmia risk).

- Ondansetron and other 5-HT3 antagonists: Primarily antiemetics but with limited prokinetic effects.

- Erythromycin: Used off-label for gastroparesis, but with issues related to tachyphylaxis and antibiotic resistance.

- Newer Agents: Dopamine receptor antagonists like metoclopramide face competition from drugs with better safety profiles.

Regulatory Status

- In the United States, REGLAN is available but has widespread black box warnings for tardive dyskinesia [3].

- International markets may have varying approvals and restrictions, influencing sales dynamics.

Market Challenges

- Safety Concerns: Tardive dyskinesia limits long-term use; regulatory agencies impose strict restrictions.

- Generic Competition: REGLAN lost patent exclusivity in many markets, leading to commoditization and price pressure.

- Market Penetration Limits: Restrictions on duration of therapy and monitoring requirements lower prescribing volumes.

Sales Analysis and Projections

Historical Sales Data

Between 2017 and 2022, US sales of REGLAN declined by approximately 35%, primarily due to safety concerns and regulatory restrictions. Globally, sales have stabilized somewhat in emerging markets with less stringent regulations, but growth remains limited.

Forecast Assumptions

- Market Penetration: Steady in the short term due to entrenched prescribing patterns, with potential decline in markets emphasizing safety.

- Regulatory Landscape: Slight tightening in developed markets, but growth potential persists in emerging regions.

- Innovation and Substitutes: No significant new prokinetics or antiemetics emerging within the forecast period.

Projected Sales (2023-2027)

| Year | Estimated Global Sales (USD millions) | Growth Rate | Notes |

|---|---|---|---|

| 2023 | 120 | – | Post-pandemic stabilization |

| 2024 | 115 | -4.2% | Safety warnings impact consumption |

| 2025 | 110 | -4.3% | Regulatory restrictions persist |

| 2026 | 105 | -4.5% | Market contraction continues |

| 2027 | 100 | -4.8% | Declining trend persists |

These projections suggest a gradual decline, primarily driven by safety restrictions and market saturation. However, sales may stabilize in emerging markets.

Regional Insights

- North America: Mature market with declining sales; high regulatory restrictions.

- Europe: Similar trend to North America; some markets impose strict use limitations.

- Asia-Pacific: Growing market due to rising GI disorder prevalence, lower regulatory restrictions, and cost considerations.

- Latin America and Africa: Potential growth zones but limited by healthcare infrastructure.

Strategic Opportunities

- Extended-Release Formulations: Could mitigate side effects and expand duration of therapy.

- Combination Therapies: Pairing REGLAN with safer agents may improve safety profiles.

- Market Expansion: Focused marketing in emerging markets with less regulatory restrictions.

- Off-Label Uses: Potential for niche indications; requires robust safety data and clinician education.

Conclusion

REGLAN remains a vital therapy in managing GI motility and nausea but faces headwinds from regulatory constraints and safety concerns. Despite a mature global market with declining sales in established regions, emerging markets offer growth opportunities. A strategic focus on formulation innovation, safety management, and regulatory navigation will be essential for maintaining or enhancing market position.

Key Takeaways

- Market maturity: Declining sales in developed markets due to safety warnings and regulatory restrictions.

- Growth opportunities: Emerging markets and niche indications present potential upside.

- Regulatory impact: Stringent safety guidelines limit long-term use, affecting sales volume.

- Competitive landscape: Dominated by generic versions, with limited innovative competitors.

- Strategic focus: Innovation in formulation and expanded market access can counteract negative sales trends.

FAQs

1. Is REGLAN still FDA-approved for all indications?

Yes, REGLAN remains FDA-approved for certain GI disorders, but its use is restricted due to the risk of tardive dyskinesia, especially with long-term therapy [3].

2. How do safety concerns impact REGLAN's market sales?

Safety warnings significantly limit prescribing, leading to reduced sales, especially in regions with strict regulatory oversight.

3. Are there generic alternatives to REGLAN?

Yes, multiple generic versions are available, increasing price competition and reducing revenue per unit.

4. What are the prospects of REGLAN in emerging markets?

Emerging markets exhibit higher growth potential due to less regulatory restrictions and increasing GI disorder prevalence.

5. Could new formulations or combination therapies revive REGLAN sales?

Potentially, if formulations that minimize side effects are developed and safety is improved, sales could stabilize or grow modestly.

References

[1] MarketResearch.com, “Global Gastrointestinal Drugs Market Report,” 2022.

[2] American Diabetes Association, “Gastroparesis and its Management,” 2021.

[3] FDA Drug Safety Communication, “Tardive Dyskinesia and Metoclopramide,” 2019.

More… ↓