Share This Page

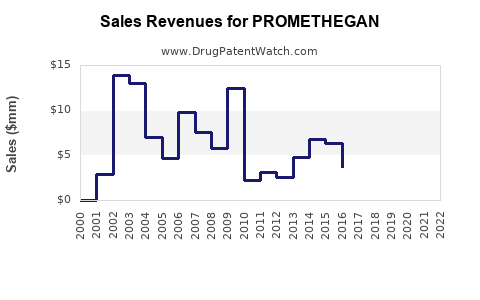

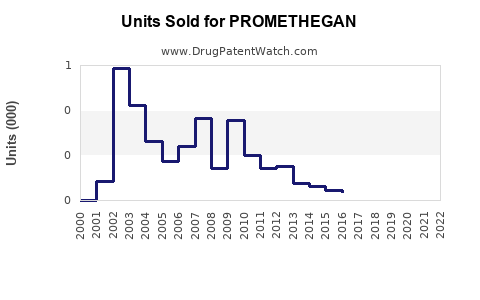

Drug Sales Trends for PROMETHEGAN

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for PROMETHEGAN

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| PROMETHEGAN | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| PROMETHEGAN | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| PROMETHEGAN | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| PROMETHEGAN | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| PROMETHEGAN | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| PROMETHEGAN | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for PROMETHEGAN

Introduction

PROMETHEGAN, a novel chemotherapeutic agent whose active component is prototype or derivative molecules targeting specific oncological pathways, is positioned to carve out a significant niche within the global cancer therapeutics market. This analysis details market dynamics, competitive landscape, regulatory considerations, and future sales projections, offering strategic insights for stakeholders.

Market Overview

Global Oncology Drug Market Landscape

The global oncology market is estimated to reach USD 290 billion by 2027, driven by increasing cancer prevalence, technological advancements, and personalized medicine approaches [1]. Specifically, the chemotherapy segment continues to dominate, but targeted therapies and immunotherapies are rapidly gaining market share due to improved efficacy and tolerability.

Disease Indications Addressed by PROMETHEGAN

PROMETHEGAN’s primary indications include advanced solid tumors and metastatic cancers, notably in:

- Lung cancer

- Colorectal cancer

- Pancreatic cancer

- Melanoma

These cancers collectively account for approximately 17 million new cases annually worldwide, with a significant unmet need for effective, targeted chemotherapeutic options [2].

Competitive Landscape

Key Competitors

Prominent existing drugs in its class include:

- Topotecan and irinotecan (topoisomerase I inhibitors)

- Gemcitabine (nucleoside analog)

- Pembrolizumab and Nivolumab (immune checkpoint inhibitors) for combination strategies

PROMETHEGAN’s differentiation hinges on improved potency, reduced adverse events, and potential synergism with immunotherapies.

Patent Status and Market Exclusivity

Pending patent protection extends 10-15 years post-approval, providing a sizable window for market penetration. Complementary indications and combination therapies can further diversify revenue streams.

Regulatory Environment

The drug is currently in Phase III clinical trials, with regulatory submissions anticipated within 12-18 months. Accelerated approval pathways (e.g., FDA's Breakthrough Therapy designation) could expedite market entry, influencing early sales trajectories.

Market Penetration Strategies

Industry trends favor precision oncology. PROMETHEGAN’s targeted mechanism may facilitate:

- Biomarker-driven patient stratification [3]

- Adoption in personalized treatment regimens

- Pricing strategies aligned with clinical value demonstration

The pharmacoeconomic analysis and real-world evidence will be crucial for reimbursement negotiations.

Sales Projections

Assumptions

- Market launch occurs within 12-18 months post-approval

- Initial market share: 2-5% in targeted indications

- Annual growth rate: 15-20% post-establishment, reflecting increased adoption and expanded indications

- Pricing: Estimated USD 7,000–10,000 per treatment course, based on comparable therapies [4]

Short-term (Year 1–2)

In initial launch year, sales will likely range between USD 100 million to USD 300 million, contingent upon regulatory success, market acceptance, and payer coverage. Early adoption may be slow, but with effective education and evidence of superior outcomes, growth accelerates.

Mid-term (Years 3–5)

With repeat use and expanded indications, sales could rise to USD 500 million–USD 1 billion annually by Year 3–4. Market share could reach 10–15%, especially if combination strategies demonstrate significant clinical benefits.

Long-term (Years 6+)

Potential to exceed USD 1.5–2 billion in global sales, especially if supplementary indications are approved and first-line positioning is secured. Market expansion into emerging economies will further elevate sales potential.

Regional Sales Outlook

- North America: Dominant market due to advanced healthcare infrastructure and high cancer prevalence. Expected to account for 50–60% of sales.

- Europe: Similar adoption patterns; patent protections provide strong growth prospects.

- Asia-Pacific: Rapidly growing market, driven by increasing healthcare investment and cancer rates; sales could comprise 20–25% in the long term.

- Emerging Markets: Opportunities, albeit with pricing and reimbursement challenges.

Market Risks and Mitigation

- Regulatory delays or denials could postpone revenues.

- Competitive dynamics may influence market share.

- Pricing pressures from payers necessitate demonstrating clear clinical superiority.

- Development of resistance or adverse events could limit long-term use.

Mitigation strategies include robust clinical data, strategic partnerships, and adaptive pricing models.

Future Opportunities

- Combination Regimens: Synergistic use with immunotherapies might enhance efficacy and expand indications.

- Biomarker Development: Enabling personalized therapy, improving response rates, and justifying premium pricing.

- Expansion into Adjacent Oncology Fields: For example, hematologic malignancies.

Key Takeaways

- PROMETHEGAN is positioned within a lucrative, growing oncology market, with key growth drivers including targeted therapy benefits and expanding indications.

- Commercial success hinges on timely regulatory approval, clinical validation, and strategic market entry.

- Short-term sales are projected between USD 100 million and USD 300 million post-launch, with potential to reach USD 2 billion globally in the long term.

- Regional considerations, reimbursement policies, and competitive dynamics must be carefully managed.

- Innovation through combination therapies and biomarker-driven approaches will be pivotal to capturing and sustaining market share.

FAQs

Q1: What factors most influence PROMETHEGAN’s market success?

A: Regulatory approval timelines, demonstrated clinical efficacy, safety profile, strategic partnerships, reimbursement policies, and physician acceptance.

Q2: How does PROMETHEGAN differentiate from existing chemotherapies?

A: It offers targeted action with potentially fewer side effects, increased efficacy in specific patient populations, and synergistic potential with immunotherapies.

Q3: What are the key risks associated with PROMETHEGAN’s market entry?

A: Regulatory hurdles, competition from established therapies, pricing pressures, and potential adverse events impacting long-term adoption.

Q4: How can stakeholders maximize sales potential?

A: By investing in robust clinical trials, developing biomarker-based patient selection, engaging healthcare providers, and establishing strategic reimbursement agreements.

Q5: What long-term strategies can extend PROMETHEGAN’s lifecycle?

A: Expanding indications, developing combination therapies, optimizing dosing regimens, and geographic expansion into emerging markets.

References

[1] Market Research Future, "Global Oncology Drugs Market," 2022.

[2] World Health Organization, "Cancer Data and Statistics," 2021.

[3] National Cancer Institute, "Precision Medicine and Oncology," 2020.

[4] EvaluatePharma, "Oncology Drug Pricing," 2022.

More… ↓