Last updated: July 29, 2025

Introduction

Prednisone, a synthetic corticosteroid, has been a mainstay in the treatment of various inflammatory, autoimmune, and allergic conditions for decades. Its broad therapeutic indications include asthma, rheumatoid arthritis, inflammatory bowel disease, and dermatological disorders. As a widely prescribed generic drug, prednisone’s market dynamics are influenced by factors such as patent expirations, healthcare reforms, emerging medical research, and competitive landscape shifts. This analysis offers a comprehensive review of the market landscape, current trends, regulatory environment, and future sales projections for prednisone.

Market Overview

Global Market Size and Trends

The global corticosteroids market, valued at approximately USD 9.8 billion in 2022, is projected to grow at a compound annual growth rate (CAGR) of around 4.2% through 2030, with prednisone accounting for a significant share due to its extensive indications and affordability. Prednisone’s role as a cost-effective first-line treatment continues to underpin its sustained demand in both developed and emerging markets.

Key Therapeutic Areas

Prednisone’s primary applications include:

- Autoimmune disorders: Rheumatoid arthritis, systemic lupus erythematosus (SLE)

- Allergic conditions: Severe allergic reactions, asthma

- Inflammatory diseases: Crohn’s disease, ulcerative colitis

- Dermatology: Eczema, psoriasis

- Other: Cancer adjunct therapy, adrenal insufficiency

The increasing prevalence of autoimmune and inflammatory diseases, coupled with expanding indications, sustains high demand levels.

Market Drivers

- Rising disease prevalence: Email escalations in autoimmune conditions globally augment the need for corticosteroid therapies.

- Cost-effectiveness: As a generic medication, prednisone remains one of the most affordable options, particularly in low- and middle-income countries.

- Expanding healthcare access: Increased healthcare infrastructure facilitates broader distribution and prescription.

- Regulatory approvals and off-label use: Growing acceptance of prednisone for off-label indications broadens market opportunities.

Market Restraints

- Side-effect profile: Long-term use can lead to adverse effects like osteoporosis, hyperglycemia, and immunosuppression, prompting cautious prescribing practices.

- Market saturation: Patent expiration and generic proliferation limit premium pricing.

- Emerging alternatives: Development of targeted biologics offers competitive challenges in autoimmune disease management.

Competitive Landscape

Prednisone’s market is predominantly composed of generic manufacturers, including Teva Pharmaceuticals, Mylan (now part of Viatris), Pfizer, and Sandoz. These players leverage extensive distribution networks and historical manufacturing expertise to maintain leadership positions.

In contrast, branded formulations, such as Rayos (a delayed-release prednisone from Sun Pharmaceutical), aim to address specific patient needs, notably in autoimmune diseases demanding higher compliance.

Regulatory Environment

Most jurisdictions classify prednisone as a generic drug, resulting in rapid approval pathways but stringent post-market surveillance to monitor safety, particularly for long-term use. Countries like the U.S. and EU follow centralized and localized regulatory regimes, emphasizing pharmacovigilance and efficacy data.

Emerging markets are witnessing regulatory harmonization efforts, facilitating faster access but also raising compliance standards for manufacturing and distribution.

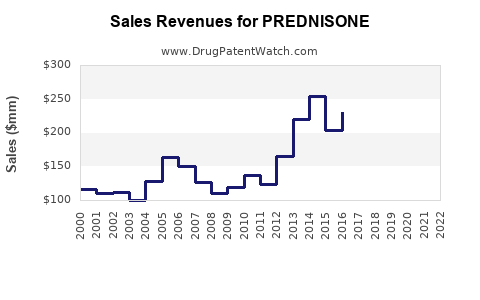

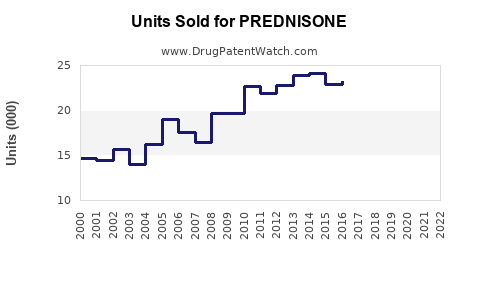

Sales Projections (2023-2030)

Short-term (2023–2025)

Market growth will be driven by increased autoimmune disease prevalence, rising prescriptions, and expanding access in emerging economies. The projected CAGR during this period is approximately 4.0%, with annual sales reaching approximately USD 1.2 billion globally by 2025.

Mid to Long-term (2026–2030)

Despite market saturation and commoditization, sales are expected to sustain growth due to:

- Enhanced diagnostic capabilities: Leading to earlier and increased prescriptions.

- Expanded indications: Off-label and adjunct uses continue to emerge.

- Market diversification: Entry into newer geographies and channels.

Forecasts estimate a CAGR of approximately 3.8% during this period, reaching USD 1.4 billion in global sales by 2030.

Regional Outlook

- North America: Remains the largest market, driven by advanced healthcare infrastructure and high disease prevalence.

- Europe: Stable, with growth fueled by aging populations and regulatory efforts encouraging generic use.

- Asia-Pacific: Fastest-growing segment due to expanding healthcare access, population growth, and rising autoimmune disease incidence.

Future Market Trends

Innovations and Formulation Developments

While no new chemical entities are expected for prednisone, formulation innovations such as controlled-release and combination therapies could enhance compliance and therapeutic outcomes, subtly influencing sales.

Impact of Biosimilars and Generics

The proliferation of biosimilars in related therapeutic classes may influence corticosteroid markets indirectly through competitive pricing strategies.

Patient-centric Approaches

Focus on personalized medicine and management of long-term corticosteroid therapy side effects may spur demand for adjunct therapies, impacting prednisone sales.

COVID-19 Pandemic Influence

The pandemic underscored corticosteroids' importance; however, prednisone's role remains supportive rather than definitive. Supply chain disruptions were temporarily noted but have since stabilized.

Regulatory and Market Challenges

The primary challenges involve managing the side-effect profile, optimizing dosing regimens, and navigating regulatory requirements across diverse markets. The emergence of steroid-sparing agents and biologics presents a long-term competitive threat, necessitating strategic positioning for manufacturers.

Risk Factors

- Regulatory policy shifts and reimbursement reforms.

- Increasing scrutiny of corticosteroid-associated adverse effects.

- Competition from newer immunomodulatory agents.

Conclusion

Prednisone remains a pivotal drug within the corticosteroid market, supported by its affordability, broad indications, and entrenched prescribing patterns. While competition from biologics and targeted therapies intensifies, prednisone’s role as a cost-effective mainstay continues to underpin steady sales growth driven by rising autoimmune and inflammatory disease burdens globally.

Key Takeaways

- The prednisone market is projected to grow at a CAGR of approximately 3.8% through 2030, reaching US$1.4 billion.

- Growing prevalence of autoimmune diseases and expanding indications sustain demand.

- Cost advantages and healthcare access expansion in emerging markets are key growth catalysts.

- Competition from biologics and newer therapies pose long-term challenges.

- Strategic innovation in formulations may influence future market dynamics positively.

FAQs

1. How does patent expiration affect prednisone's market?

Patent expiration has led to a surge in generic manufacturing, significantly reducing prices and increasing accessibility, especially in low-income regions, but also intensifying market competition.

2. What are the main safety concerns associated with prednisone?

Long-term use can cause osteoporosis, hyperglycemia, hypertension, immunosuppression, and psychological effects, prompting cautious prescribing and monitoring.

3. Are there emerging alternatives to prednisone?

Yes, targeted biologics and immunomodulators are increasingly used for autoimmune diseases, but they are generally costlier and reserved for severe cases, leaving prednisone as a first-line therapy.

4. How will healthcare reforms impact prednisone sales?

Reforms promoting generic drug utilization and cost containment will positively influence sales, especially in countries emphasizing affordable treatment options.

5. What role will formulations like controlled-release prednisone play?

Enhanced formulations could improve patient compliance and reduce side-effects, potentially supporting incremental sales growth and market differentiation.

Sources:

[1] Grand View Research, "Corticosteroids Market Size, Share & Trends Analysis," 2022.

[2] IQVIA, "Global Prescription Drug Market Data," 2022.

[3] World Health Organization, "Noncommunicable Diseases Country Profiles," 2022.

[4] U.S. Food and Drug Administration, "Drug Approvals and Market Data," 2023.