Share This Page

Drug Sales Trends for PAXIL

✉ Email this page to a colleague

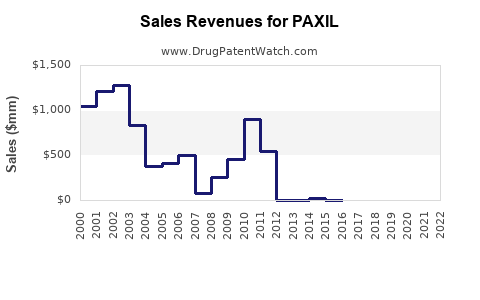

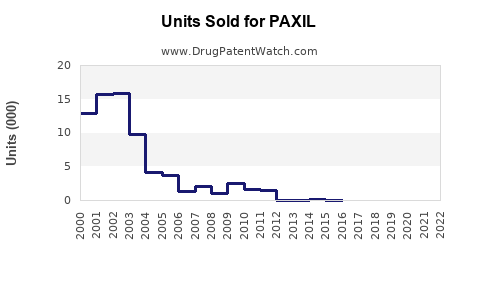

Annual Sales Revenues and Units Sold for PAXIL

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| PAXIL | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| PAXIL | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| PAXIL | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| PAXIL | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| PAXIL | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| PAXIL | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| PAXIL | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for PAXIL (Paroxetine)

Introduction

PAXIL, the brand name for paroxetine, is a selective serotonin reuptake inhibitor (SSRI) developed by GlaxoSmithKline (GSK). Approved initially for major depressive disorder, PAXIL’s indications expanded to include anxiety disorders, obsessive-compulsive disorder (OCD), panic disorder, social anxiety disorder, and post-traumatic stress disorder (PTSD). This comprehensive market analysis examines PAXIL's current standing, competitors, patent landscape, regulatory environment, and sales outlook to aid stakeholders in strategic decision-making.

Market Overview

Global Therapeutic Sector

Antidepressants represent a significant segment within the psychopharmacology market, projected to reach USD 18 billion globally by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 2.5% [1]. The increasing prevalence of mental health conditions, coupled with rising awareness and destigmatization, fuels demand.

PAXIL’s Market Position

Historically a leading SSRI, PAXIL commanded considerable market share during the early 2000s, especially within the U.S. and European markets. Its broad indications bolstered its usage; however, patent expirations and the emergence of generic competitors have eroded its exclusivity and sales.

Patent and Regulatory Timeline

PAXIL's original patent expired in 2003 in the U.S., with additional formulations extending patent protection until 2014. Since then, generic paroxetine products have dominated the market [2]. Regulatory challenges, including FDA safety warnings, have affected its prescribing patterns.

Market Dynamics

Patent Expiry and Generic Competition

The expiration of key patents facilitated the entry of generic versions, which now constitute over 90% of prescriptions. Generics significantly reduce pricing and margins for branded PAXIL, constraining its sales potential [3].

Repositioning and Formulation Strategies

GSK attempted to maintain market relevance through new formulations (e.g., controlled-release) and indications, such as treatment-resistant depression, though success has been limited. Additionally, efforts to expand into combination therapies and specific patient populations have been explored.

Physician and Patient Preferences

Current prescribing patterns favor newer antidepressants like sertraline, escitalopram, and vortioxetine, which boast improved side effect profiles. Moreover, established drugs like fluoxetine and newer agents are often preferred due to evidence of better tolerability.

Market Challenges

-

Safety Warnings: PAXIL faces boxed warnings regarding suicidal ideation, which impacts clinician prescribing behavior [4].

-

Side Effect Profile: Common adverse effects such as sexual dysfunction, weight gain, and withdrawal symptoms limit its attractiveness compared to newer agents.

-

Patent Cliff: The loss of patent protection diminished pricing power and shifted focus to generics.

Emerging Opportunities

Despite challenges, niche markets for PAXIL include its use in pediatric populations, where certain SSRIs retain indications, and in patients resistant to newer agents. Additionally, formulations combining PAXIL with other agents might offer growth avenues, pending regulatory approvals.

Sales Projections (2023–2028)

Historical Trends

PAXIL's peak sales occurred pre-2014, with annual revenues exceeding USD 1.5 billion globally. Post-patent expiry, revenues declined sharply, with current global sales estimated at approximately USD 50–100 million annually, predominantly from established markets [5].

Forecast Assumptions

-

Market Share: Given the dominance of generics, PAXIL’s market share is projected to stabilize at roughly 2–3% within the overall antidepressant market by 2028.

-

Pricing: Average pricing per prescription is expected to decrease by 20–30% due to generics and market competition.

-

Patient Population: The prevalent population for PAXIL is expected to decline marginally, as newer SSRIs and SNRIs become standard first-line treatments.

Projected Revenues

Under conservative assumptions, PAXIL's sales may stabilize at USD 50 million annually in mature markets by 2028, with slight variations influenced by regional prescription trends and healthcare policies.

Regional Variations

-

United States: Dominant revenue source, with declining but stable sales in specialized indications.

-

Europe & Asia: Growth potential exists due to increasing mental health awareness; however, generic dominance limits any significant uptick.

-

Emerging Markets: Opportunities for growth, contingent upon regulatory approvals and formulary inclusion.

Key Market Trends Influencing Sales

-

Shift Toward Personalized Medicine: A trend favoring newer agents with better tolerability reduces PAXIL’s attractiveness.

-

Increased Use of Digital Therapeutics: Complementary therapies and telepsychiatry influence prescribing behaviors.

-

Regulatory Environment: Ongoing safety concerns and label updates can further impact sales.

-

Market Consolidation: Larger pharmaceutical companies may seek to acquire or license mid-stage formulations to maintain relevance.

Conclusion

While PAXIL’s historic dominance has waned due to patent expirations, its established efficacy and safety profile still support a niche presence. Strategic repositioning, such as targeted marketing for resistant cases or pediatric indications, may sustain modest sales. Nonetheless, future growth prospects hinge on innovations, regulatory shifts, and competitive dynamics.

Key Takeaways

-

PAXIL’s global sales have declined substantially post-patent expiry, stabilized at approximately USD 50–100 million annually.

-

The proliferation of generic paroxetine limits pricing power and market share; future revenues are expected to remain subdued unless new formulations or indications are developed.

-

Market dynamics favor newer SSRIs with improved side effect profiles, pressuring PAXIL's continued relevance.

-

Regional disparities present growth opportunities in emerging markets, contingent on regulatory and reimbursement landscapes.

-

To optimize value, stakeholders should consider niche indications, combination therapies, or formulation innovation strategies.

FAQs

1. What factors contributed to PAXIL’s decline in market share?

Patent expiry enabled generic competition, significantly reducing prices and prescribing rates. Safety warnings and side effect profiles also shifted clinician preferences toward newer agents.

2. Are there ongoing efforts to reformulate or rebrand PAXIL?

Currently, no major reformulation initiatives are publicly announced. However, development of new formulations or combination therapies could potentially revitalize its market presence.

3. How does PAXIL compare to other SSRIs in safety and efficacy?

PAXIL is effective but has a higher incidence of certain side effects, such as sexual dysfunction and withdrawal symptoms, compared to newer SSRIs like sertraline and escitalopram.

4. What regions offer the most growth potential for PAXIL?

Emerging markets in Asia and Latin America present growth opportunities, driven by increasing mental health awareness and expanding healthcare infrastructure.

5. What is the outlook for PAXIL’s sales over the next five years?

Sales are expected to remain relatively stable at low levels, with slight fluctuations driven by regional market dynamics and clinician prescribing preferences, assuming no major formulation breakthroughs.

References

[1] MarketWatch. “Global Antidepressants Market Size, Share & Trends Analysis Report.” 2022.

[2] US Patent and Trademark Office. Patent filings and expirations for paroxetine.

[3] IQVIA. Prescribing Trends and Generic Market Penetration Reports, 2022.

[4] FDA. “Boxed Warning for Antidepressants and Suicidality,” 2004.

[5] EvaluatePharma. "Top-Selling Drugs and Sales Data," 2022.

More… ↓