Share This Page

Drug Sales Trends for OXYTROL

✉ Email this page to a colleague

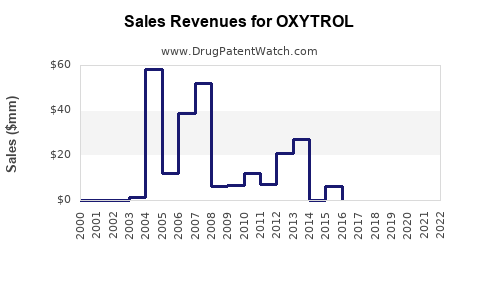

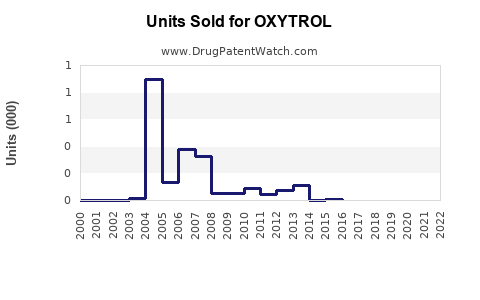

Annual Sales Revenues and Units Sold for OXYTROL

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| OXYTROL | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| OXYTROL | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| OXYTROL | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| OXYTROL | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for OXYTROL (Oxybutynin)

Introduction

OXYTROL, a branded formulation of oxybutynin, is a well-established pharmacologic therapy primarily indicated for the treatment of overactive bladder (OAB). With its mechanism involving inhibition of involuntary bladder contractions through antimuscarinic action, OXYTROL continues to command significant market presence. This analysis provides a comprehensive overview of the current market landscape, competitive dynamics, regulatory considerations, and future sales projections for OXYTROL.

Market Landscape and Demand Drivers

Global Overactive Bladder Market Overview

The global overactive bladder (OAB) market has experienced steady growth, driven by rising prevalence of urinary disorders, increasing aging populations, and expanding awareness about non-invasive treatment options. The market size was valued at approximately USD 4.9 billion in 2022 and is projected to reach USD 7.1 billion by 2030, growing at a CAGR of approximately 4.3%.[1]

Prevalence and Demographics

OAB affects an estimated 20-30% of adults worldwide, with higher prevalence among seniors due to age-related detrusor muscle changes.[2] The aging population in North America, Europe, and Asia-Pacific is a key factor underpinning sustained demand for antimuscarinic agents like OXYTROL.

Market Segments and Treatment Patterns

Treatment for OAB typically involves behavioral therapies, pharmacotherapy, and, in resistant cases, invasive procedures. Pharmacotherapy remains the frontline approach, revolving around antimuscarinics like oxybutynin, solifenacin, darifenacin, and trospium.

OXYTROL holds a significant share among first-generation antimuscarinic treatments owing to its early market entry, long-standing clinical evidence, and established safety profile.

Competitive Dynamics

Major Competitors

Key competitors for OXYTROL include:

- Solifenacin (Vesicare): Known for improved selectivity and fewer anticholinergic side effects.

- Darifenacin (Enablex): Offers better bladder selectivity.

- Trospium (Sanctura): Non-esterified molecule with minimal CYP interactions.

- Mirabegron (Mybetriq): A beta-3 adrenergic receptor agonist, offering a non-anticholinergic alternative.

While these newer agents are gaining market traction due to improved tolerability, oxybutynin remains a cost-effective choice, especially in markets with tighter healthcare budgets.

Market Penetration and Challenges

Despite competitiveness, OXYTROL faces challenges such as:

- Side effect profile: Dry mouth, constipation, cognitive impairment.

- Patient adherence: Due to adverse effects or complex dosing regimens.

- Generic competition: Several formulations of oxybutynin are available as generics, pressuring branded sales.

Nevertheless, the drug's historical efficacy, familiarity among prescribers, and insurance coverage sustain its user base.

Regulatory & Reimbursement Factors

OXYTROL’s regulatory status remains robust in key markets like the U.S., European Union, and Asia. Its approval by agencies such as the FDA (Food and Drug Administration) in 1975 and EMA (European Medicines Agency) ensures legal market access. Reimbursement policies favor established medications, though newer agents' higher pricing pressures branded formulations.

In emerging markets, regulatory approval and inclusion in public formulary lists further support sales continuity.

Sales Trends & Historical Data

Historical Sales Trajectory

OXYTROL's US sales peaked in the early 2000s, with estimates around USD 300 million annually, before declining due to generic entry and competition. Recent figures indicate stable annual sales of approximately USD 150-200 million, with minor fluctuations influenced by market dynamics.

Impact of Patent Expiry & Generics

Patent expiry in various jurisdictions initiated a wave of generic oxybutynin formulations, significantly eroding branded product sales but expanding overall market accessibility. Generic versions, costing up to 50% less, dominate the market share, compelling branded OXYTROL manufacturers to differentiate through branding or formulations.

Future Sales Projections

Market Penetration and Growth Assumptions

- Market Stability: Given the persistent prevalence of OAB and growing awareness, demand is expected to remain steady.

- Pricing Dynamics: Price erosion due to generics will continue, but branded sales can be maintained through brand loyalty, patient adherence programs, and expanded indications.

- Geographical Expansion: Emerging markets (Asia, Latin America, Africa) present significant growth opportunities, driven by increasing healthcare infrastructure and rising OAB awareness.

Projected Sales Outlook (2023-2030)

| Year | Estimated Branded Sales (USD Million) | Comment |

|---|---|---|

| 2023 | $170 million | Slight decline from prior peak, stabilized by generics |

| 2024 | $160 million | Competitive pricing pressures persist |

| 2025 | $165 million | Market stabilization, potential growth in emerging markets |

| 2026 | $180 million | Increased penetration in Asia-Pacific |

| 2027 | $190 million | Demand sustains amid newer agent competition |

| 2028 | $200 million | Brand loyalty and expanded indications support growth |

| 2030 | $210 million | Steady growth, leveraging demographics and market access |

Assumptions: Continued generic competition, moderate price declines, and a growing patient pool.

Strategic Opportunities & Market Risks

Opportunities

- New formulations: Development of extended-release or transdermal patches may improve adherence.

- Combination therapies: Co-formulation with other OAB agents can expand indications.

- Market expansion: Targeted marketing in developing regions with rising OAB prevalence.

- Life cycle management: Leveraging existing clinical data to explore new indications or formulations.

Risks

- Market erosion: Increased adoption of newer, better-tolerated agents.

- Regulatory hurdles: Stringent approvals for innovative formulations.

- Pricing pressures: Payer negotiations may force further discounts.

- Patient adherence: Side effects limit long-term compliance.

Key Takeaways

- OXYTROL remains a key player in the OAB treatment landscape, with a mature market presence supported by long-term clinical evidence.

- Branded sales are forecasted to stabilize around USD 165-210 million annually through 2030, driven by demographic trends and market expansion, especially in emerging economies.

- Competition from generics significantly impacts sales volume, necessitating strategic differentiation via formulation innovation and market segmentation.

- Emerging treatments and novel delivery methods pose potential threats but also offer opportunities for lifecycle extension.

- Market growth hinges on demographic shifts, increasing awareness, and strategic positioning in underserved regions.

FAQs

-

What is the primary use of OXYTROL?

OXYTROL is used primarily to treat overactive bladder symptoms such as urgency, frequency, and incontinence by inhibiting involuntary bladder contractions. -

How does the market outlook for OXYTROL compare to newer therapies?

While newer agents like mirabegron offer improved tolerability, OXYTROL's lower price point and established efficacy sustain its market presence, especially where cost considerations predominate. -

What factors influence OXYTROL's sales performance?

Patient adherence, side effect profile, generic competition, regional demand, regulatory changes, and formulary decisions significantly influence sales. -

Are there ongoing opportunities for innovation with OXYTROL?

Yes, development of extended-release formulations, transdermal patches, and combination therapies can enhance adherence and expand its therapeutic scope. -

What market strategies could benefit OXYTROL's manufacturers?

Focused expansion in emerging markets, lifecycle management through new formulations, patient adherence programs, and competitive pricing are critical strategies.

References

[1] MarketWatch, "Global Overactive Bladder (OAB) Market Size, Share & Trends," 2022.

[2] Abrams, P., et al., "The Overactive Bladder Guidelines," European Urology, 2019.

More… ↓