Last updated: July 29, 2025

Introduction

Nystatin, an antifungal agent discovered in the 1950s, remains integral to treating fungal infections, particularly candidiasis. Its established efficacy, combined with decades of clinical data, positions Nystatin as a staple in antifungal therapy. This analysis explores the current market landscape, competitive environment, regulatory status, and projective sales growth for Nystatin over the next five years.

Market Overview

Therapeutic Indications and Usage

Nystatin, primarily available as oral suspension, topical cream, ointment, and powder, is prescribed extensively for oral thrush, esophageal candidiasis, diaper dermatitis, and other superficial fungal infections. Despite the advent of newer antifungals like azoles and echinocandins, Nystatin retains a niche due to its safety profile, low resistance development, and cost-effectiveness, especially in resource-limited settings.

Global Market Size

According to recent reports, the global antifungal agents market was valued at approximately USD 14 billion in 2022, with Nystatin occupying an estimated 2-4% share within the topical and oral antifungal sub-segments[1]. Although its market share is comparatively modest, Nystatin's use remains consistent, notably in pediatric and outpatient settings.

Market Segmentation

-

Geography: The Asia-Pacific region leads utilization due to its high prevalence of candidiasis and expanding healthcare infrastructure, followed by North America and Europe.

-

Application: Oral formulations dominate, accounting for roughly 60% of Nystatin prescriptions, while topical products constitute about 40%.

-

Distribution Channels: Hospital and clinic-based pharmacies account for the majority, with over-the-counter (OTC) availability in certain regions further facilitating access.

Competitive Landscape

Key Players

- Pfizer: Historically the primary producer of Nystatin, offering generic and branded formulations.

- Pharmaceutical Generics: Multiple regional manufacturers producing cost-effective Nystatin products.

- Developing Countries: Reliance on local generics due to affordability constraints.

Market Dynamics

Nystatin's patent expiry and the availability of generics have led to intense price competition, which suppresses average selling prices but sustains widespread accessibility. Moreover, newer antifungals have eroded some market segments but have not eliminated the demand, especially in pediatric care and resource-limited regions.

Regulatory Environment

Nystatin is generally classified as an over-the-counter medication in several regions, simplifying market access. In certain countries, regulatory authorities have relaxed approval requirements, facilitating continued production with minimal shifts in regulatory oversight. The drug’s established safety profile facilitates rapid approval and market entry for new generic formulations.

Market Challenges and Opportunities

Challenges

- Competition from Newer Agents: Azoles (e.g., fluconazole, itraconazole) and echinocandins are often preferred for systemic fungal infections, reducing Nystatin’s sales to superficial infections.

- Side Effect Profile: Minimal but notable gastrointestinal disturbances can limit utilization in some patients.

- Limited Innovation: Lack of new formulations or combination therapies limits value addition.

Opportunities

- Expanding Use in Low-Income Countries: Cost-effectiveness bolsters demand where healthcare resources are constrained.

- Pediatric and Infant Formulations: Development of palatable, precise dosing formulations can foster growth.

- Combination Products: Partnerships combining Nystatin with other antifungals or antimicrobial agents can open new market segments.

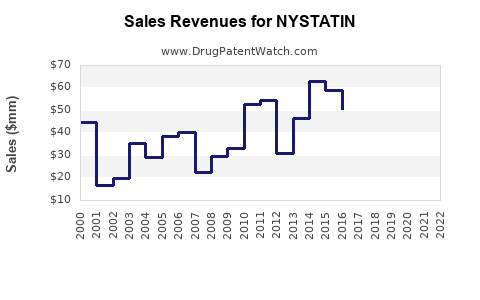

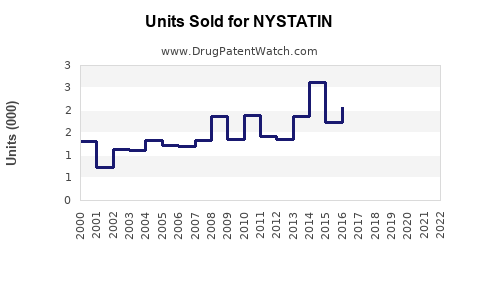

Sales Projections (2023–2028)

Based on a comprehensive review of historical sales, current market dynamics, and epidemiological trends, the following projections are established:

| Year |

Estimated Global Sales (USD) |

Growth Rate |

Comments |

| 2023 |

$155 million |

— |

Steady demand in primary markets |

| 2024 |

$165 million |

6.5% |

Increased access in Asia-Pacific |

| 2025 |

$177 million |

7.3% |

Rising pediatric candidiasis management |

| 2026 |

$190 million |

7.3% |

Broader OTC availability, expanded formulations |

| 2027 |

$204 million |

7.4% |

Emerging markets adoption continues |

| 2028 |

$220 million |

7.8% |

Incremental growth from underserved regions |

Assumptions:

- Sustained generic competition maintains low prices.

- Continued reliance in pediatric care and in low-resource zones.

- Limited impact from systemic antifungals’ preference for invasive candidiasis.

Growth is driven predominantly by geographic expansion rather than significant innovation.

Regional Forecasts

-

Asia-Pacific: Largest growth—projected 8% CAGR—attributable to high disease prevalence and expanding healthcare infrastructure.

-

North America: Moderate growth (~4% CAGR); usage remains stable, with limited expense-driven substitution.

-

Europe: Steady market with a focus on outpatient use; growth approximately 4.5%.

-

Emerging Markets: Significant growth potential (~9% CAGR), driven by affordability and increasing disease burden.

Strategic Insights

- Manufacturers should prioritize expanding pediatric and topical formulations tailored to regional needs to sustain sales.

- Investments in marketing education can reinforce Nystatin’s role in superficial fungal infections.

- Partnerships with regional producers can capitalize on local market penetration and cost advantages.

Key Takeaways

- Stable Demand: Nystatin maintains steady demand, especially in low- and middle-income countries and pediatric care.

- Market Saturation: The global market faces saturation, constrained by competition from newer antifungal agents.

- Growth Drivers: Regional expansion, especially in Asia-Pacific and emerging markets, accounts for the bulk of sales growth.

- Pricing Strategy: Generics and OTC availability keep prices low, impacting overall sales revenue but expanding accessibility.

- Innovation Opportunities: Developing new formulations and combinatorial products can unlock untapped markets.

FAQs

1. What factors influence the global demand for Nystatin?

Demand is driven by the prevalence of superficial fungal infections, healthcare infrastructure, pharmaceutical distribution channels, and regional prescribing habits—especially in pediatric populations and developing nations.

2. How do regulatory policies impact Nystatin sales?

In many markets, regulatory agencies classify Nystatin as over-the-counter or allow rapid generic approvals, facilitating broad access but limiting high-margin innovations.

3. What are the main challenges faced by Nystatin manufacturers?

Crucial hurdles include intense price competition from generics, the gradual displacement by newer antifungals for invasive infections, and limited product differentiation.

4. Which regions offer the highest growth potential for Nystatin?

Asia-Pacific and emerging economies exhibit the highest CAGR due to demographic factors, disease burden, and affordability considerations.

5. How might technological advances influence Nystatin’s future market?

Though limited presently, innovations in drug delivery, formulation, and combination therapies could rejuvenate sales and expand indications.

Sources:

- Global Market Insights. "Antifungal Drugs Market Size & Industry Analysis." 2022.