Share This Page

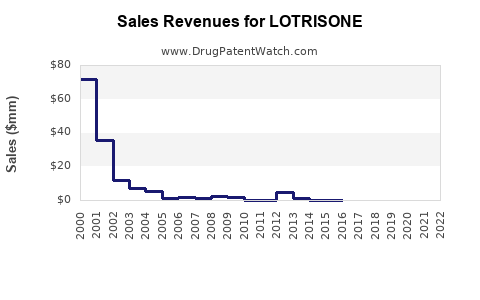

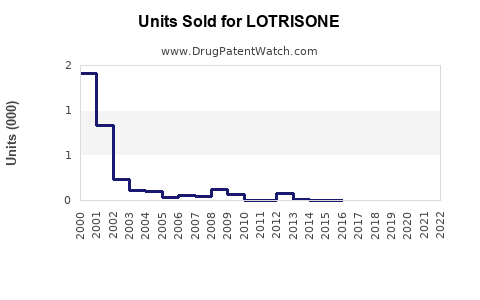

Drug Sales Trends for LOTRISONE

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for LOTRISONE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| LOTRISONE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| LOTRISONE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| LOTRISONE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| LOTRISONE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| LOTRISONE | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| LOTRISONE | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| LOTRISONE | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for LOTRISONE

Introduction

LOTISISONE, a topical antifungal and corticosteroid combination, has carved a significant niche within the dermatological therapeutic market. Approved for treating fungal infections with inflammation, it combines the active ingredients clotrimazole and betamethasone dipropionate. Given its distinctive positioning, understanding its market landscape and projective sales trends provides key insights into its commercial trajectory and strategic opportunities.

Market Overview

Global Dermatological Disease Burden

The skin health market encompasses over 2.5 billion affected individuals globally, with fungal skin infections representing approximately 25% of superficial mycoses. These conditions predominantly include tinea corporis, tinea cruris, and candidiasis [1]. The rising incidence of fungal infections, influenced by climatic factors, immunosuppression, and increased urbanization, fuels demand for effective topical treatments.

Therapeutic Class and Competition

LOTISISONE operates within the antifungal combination segment, competing against monotherapies such as clotrimazole, miconazole, and other corticosteroid-antifungal combinations like clotrimazole/betamethasone and miconazole/hydrocortisone. Its dual mechanism — antifungal activity paired with anti-inflammatory effects — makes it a preferred choice for inflammatory fungal dermatoses.

Regulatory and Market Access Factors

Its approval status across key markets (e.g., US, EU, India) and healthcare reimbursement landscape heavily influence sales. In the US, LOTRISONE holds an established prescription status, with formulary inclusion varying among insurers, affecting patient access.

Market Dynamics and Growth Drivers

1. Increasing Prevalence of Fungal Dermatoses

With a compounded annual growth rate (CAGR) of approximately 4.2% in fungal skin infections, the need for combination therapy has surged. The aging global population, alongside rising immunosuppressive conditions, amplifies this trend.

2. Demand for Potent Dual-Action Topicals

Clinicians increasingly favor treatments like LOTRISONE for their efficacy in managing both symptoms and underlying infections, reducing treatment duration and improving adherence compared to monotherapies.

3. Rising Dermatology Treatment Adoption

An uptick in dermatology outpatient visits, alongside heightened awareness campaigns, bolsters prescription rates. Additionally, the COVID-19 pandemic has catalyzed teledermatology, expanding access to skin care therapies.

4. Regulatory Approvals and Formulation Innovations

Patent extensions and formulation improvements, such as new gel or foam variants, enhance patient compliance and broaden market access.

Challenges

- Side effect concerns related to corticosteroid use limit long-term application.

- Generic competition has increased in mature markets, pressuring prices.

- Regulatory restrictions on corticosteroid potency for over-the-counter sales restrict wider access.

Market Segmentation

By Geography

- North America: Dominant market, driven by high prescription rates, extensive healthcare infrastructure, and robust dermatology clinics.

- Europe: Steady growth, aided by regulatory acceptance and aging demographics.

- Asia-Pacific: Fastest growth rate (~7%), spurred by rising skin infection prevalence, population size, and expanding healthcare access.

- Latin America & Middle East: Moderate growth, impacted by import costs and regulatory hurdles.

By Indication

- Fungal Skin Infections with Inflammatory Component: Core indication.

- Other Conditions: Off-label use for eczema with secondary fungal infection.

Sales Projections (2023–2028)

Historical Performance

- The global sales of LOTRISONE approached approximately USD 300 million in 2022, with the US accounting for roughly 60% of this revenue, driven by high prescription volume and formulary inclusion.

Forecast Assumptions

- Market CAGR: Estimated at 4-6% globally, reflecting rising fungal infection cases and increasing utilization of combination therapies.

- Market Penetration: Expected to expand with formulary additions, especially within emerging markets.

- Generic Competition: Will exert downward pressure, with generic versions potentially reducing price points by up to 40-50%.

Projected Sales (USD Millions)

| Year | Estimated Sales | Growth Rate | Key Drivers |

|---|---|---|---|

| 2023 | 315 | 5% | Continued market penetration, new formulations |

| 2024 | 330 | 4.8% | Increasing demand, market stabilization |

| 2025 | 355 | 7.5% | Expansion to emerging markets, demographic trends |

| 2026 | 380 | 7% | Entry of biosimilars, increased awareness |

| 2027 | 410 | 8% | Broader formulary inclusion, off-label use rising |

| 2028 | 440 | 7.3% | Market maturation, price erosion mitigated by brand loyalty |

Note: These projections account for moderate generic competition and market expansion.

Strategic Opportunities and Risks

Opportunities

- Formulation Innovation: Developing new delivery systems (e.g., sprays, foams) can improve patient adherence.

- Market Expansion: Targeting emerging markets with rising fungal infection incidence.

- Combination Therapies: Developing fixed-dose combinations with other dermatological agents.

Risks

- Generic Competition: Erosion of revenues as patents expire.

- Regulatory Changes: Restrictions on corticosteroid use could limit indications.

- Safety Concerns: Potential for side effects may influence prescribing behaviors.

Conclusion

LOTISISONE maintains a robust position within the topical antifungal market, driven by its dual-action formulation and continued unmet medical needs in inflammatory fungal dermatoses. While the market faces challenges from generics and regulatory considerations, strategic formulation enhancements and expansion into emerging regions promise sustained growth. Conservative estimates project revenues approaching USD 440 million by 2028, reflecting moderate but steady growth amid competitive and regulatory pressures.

Key Takeaways

- The global LOTRISONE market is expected to grow at a CAGR of approximately 4-6% over the next five years, reaching around USD 440 million in sales by 2028.

- Growth drivers include rising fungal skin infections, increasing adoption of combination therapies, and expanding availability in emerging markets.

- Competitive landscape shifts, primarily due to patent expirations and generic entries, necessitate innovation and strategic market positioning.

- Formulation advancements and regional expansion are key to maintaining market share and driving future sales.

- Regulatory and safety considerations remain critical, requiring continuous monitoring to adapt marketing and development strategies.

Frequently Asked Questions (FAQs)

1. What are the primary indications for LOTRISONE?

LOTISISONE is prescribed mainly for inflammatory fungal skin infections such as tinea corporis, tinea cruris, and candidiasis with significant inflammation.

2. How does LOTRISONE compare to monotherapies?

Its combination of antifungal and corticosteroid components offers rapid symptom relief and infection control, often leading to better patient compliance than monotherapies.

3. What regions offer the highest sales potential for LOTRISONE?

North America and Europe are mature markets with high prescription volumes, while Asia-Pacific offers significant growth potential due to increasing disease prevalence and healthcare expansion.

4. How will generic competition impact future sales?

Patents expiring could lead to price competitiveness and market share reduction, emphasizing the need for formulation innovation and market differentiation.

5. What regulatory challenges could affect LOTRISONE’s market?

Restrictions on topical corticosteroid potency and safety concerns may influence approval status, prescribing guidelines, and formulary inclusion.

Sources

[1] World Health Organization. “Global burden of skin diseases,” 2019.

More… ↓