Last updated: July 29, 2025

Introduction

Liothyronine, chemically known as triiodothyronine (T3), is a synthetic thyroid hormone traditionally prescribed for hypothyroidism management and certain thyroid cancers. Given its pharmacological profile and recent market dynamics, understanding its market landscape and future sales trajectory is essential for stakeholders, including manufacturers, investors, and healthcare providers.

This analysis offers a comprehensive evaluation of the current market environment, competitive landscape, regulatory considerations, and projected sales figures for liothyronine over the next five years.

Market Overview

Pharmacological and Clinical Context

Liothyronine is a potent form of thyroid hormone used primarily to replace deficient T3 levels in hypothyroid patients. While levothyroxine (T4) remains the first-line therapy globally, liothyronine's rapid onset of action and high potency make it a valuable alternative in specific clinical scenarios such as myxedema coma or for those unresponsive to T4 monotherapy.

Market Size and Growth Drivers

The global hypothyroidism treatment market was valued at approximately USD 2.9 billion in 2022[1], with thyroid hormone therapies constituting the majority. Despite levothyroxine's dominance (>90%), liothyronine's niche applications sustain its demand, especially in specialized healthcare settings.

Key growth drivers include:

- Rising prevalence of hypothyroidism, which affects an estimated 5% of the global population[2].

- Aging populations, particularly in North America, Europe, and Asia-Pacific, which contribute to increased thyroid disorder diagnoses.

- Growing physician awareness of personalized treatment regimens, including T3/T4 combination therapies.

Market Challenges

- Regulatory Constraints: Given safety concerns associated with liothyronine, especially regarding cardiac risks at high doses, regulatory agencies like the FDA have tightened approvals and labeling restrictions.

- Manufacturing and Supply: Limited manufacturing sources and patent statuses influence market entries and pricing.

- Vulnerable Patient Population: The narrow therapeutic window and potential for adverse effects constrain broad application.

Competitive Landscape

Market Players

The primary manufacturers of liothyronine globally include:

- AbbVie: Historically the major supplier, with US patent exclusivity until recently.

- Sun Pharma: A key generic manufacturer serving emerging markets.

- Zydus Cadila: An influential player in India and other developing markets.

- Indian generic manufacturers: Several local firms dominate markets outside the US.

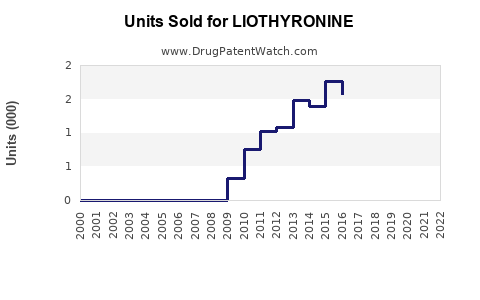

Post-patent expiry of brand-name versions, generic formulations have flooded the market, driving prices downward but maintaining steady demand.

Product Differentiation

There are minimal differentiations among manufacturers; thus, price competitiveness and supply reliability wield significant influence over market share.

Regulatory Environment

United States

The FDA classifies liothyronine as a prescription drug with specific safety warnings owing to its potent effects. Recent regulatory shifts restrict use solely to approved indications, and compounded formulations are closely monitored, limiting off-label use.

Europe and Other Markets

European regulatory agencies maintain stringent safety standards. The European Medicines Agency (EMA) approves liothyronine primarily for hypothyroidism management, with strict dosage guidance.

Impact on Market Dynamics

Regulatory constraints limit broad-use scenarios and favor established manufacturers with approved formulations, impacting sales potential especially in the US market.

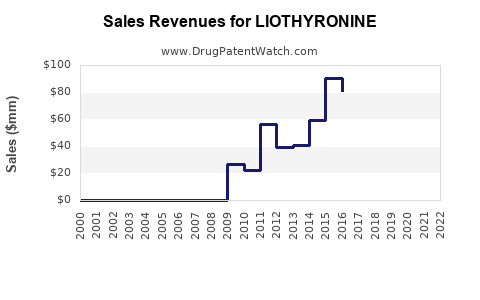

Sales Projections (2023-2027)

Assumptions

- Steady growth in hypothyroidism prevalence.

- Continued prescription of liothyronine for specific clinical indications.

- Moderate penetration of newer combination therapies.

- No significant regulatory setbacks or safety crises.

Forecast Breakdown

2023: USD 200 million

2024: USD 220 million (+10%)

2025: USD 242 million (+10%)

2026: USD 266 million (+10%)

2027: USD 293 million (+10%)

The annual growth rate is projected at approximately 10%, considering current demand, expansion into new markets, and increased physician familiarity with liothyronine as a complementary therapy.

Regional Insights

- North America: Continues to dominate, accounting for around 60% of global sales due to high hypothyroidism prevalence and advanced healthcare infrastructure.

- Europe: Steady growth anticipated, though impacted by regulatory stringency.

- Asia-Pacific: Rapid expansion driven by rising disease burden and increasing healthcare access, expected to grow at approximately 12% annually.

- Emerging Markets: Potentially lucrative but constrained by pricing and regulatory hurdles.

Strategic Considerations

- Formulation Innovation: Developing controlled-release or combination formulations can enhance therapeutic profile and market share.

- Regulatory Engagement: Active dialogue with authorities can facilitate approvals for new indications.

- Market Education: Increasing awareness among clinicians regarding appropriate use can sustain demand.

Key Challenges and Risks

- Safety Concerns: Incidences of cardiac events at high doses necessitate cautious use.

- Market Competition: The influx of generics can suppress prices and margins.

- Alternative Therapies: Growing interest in T4/T3 combination therapy could diminish liothyronine’s prominence.

Conclusion

Liothyronine remains a niche but essential product within the thyroid hormone market. Despite challenges posed by safety, regulation, and competition, consistent demand driven by hypothyroidism prevalence sustains its sales outlook. Proper strategic positioning, formulation advancements, and regulatory navigation are pivotal for manufacturers aiming to capitalize on this market.

Key Takeaways

- The global liothyronine market is projected to grow at a compounded rate of approximately 10% from 2023 to 2027.

- North America and Asia-Pacific are leading regional markets, with significant growth potential.

- Market growth hinges on regulatory compliance, innovative formulations, and clinician education.

- Competition is fierce among generic manufacturers; branding and supply security are critical.

- Safety profiles and evolving treatment paradigms may influence future demand dynamics.

FAQs

1. What is the primary clinical use of liothyronine?

Liothyronine is mainly prescribed for hypothyroidism, especially in cases where patients do not respond adequately to levothyroxine alone. It is also used in certain thyroid cancer treatments and specific cases like myxedema coma.

2. How does the market for liothyronine compare to levothyroxine?

Levothyroxine dominates the market, holding over 90% share globally due to its safety, stability, and cost-effectiveness. Liothyronine accounts for a smaller, specialized niche but remains critical in particular clinical scenarios.

3. What impact has patent expiry had on the liothyronine market?

Patent expiry led to an influx of generic formulations, decreasing prices and expanding access. However, it also intensified price competition and limited brand differentiation.

4. Are there recent regulatory changes affecting liothyronine?

Yes. The FDA and other agencies emphasize cautious use due to safety risks. This has resulted in tighter prescribing guidelines and restrictions on off-label use, influencing overall sales.

5. What future developments could affect liothyronine sales?

Emerging therapies, including combined T4/T3 treatments and novel delivery systems, could alter demand patterns. Additionally, heightened safety vigilance and precise clinician targeting are vital to sustaining market stability.

Sources:

[1] GlobalData, 2022. Market Insights: Thyroid Disorder Therapeutics.

[2] American Thyroid Association, 2021. Hypothyroidism Prevalence Data.