Share This Page

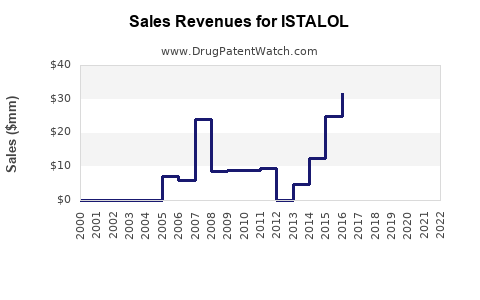

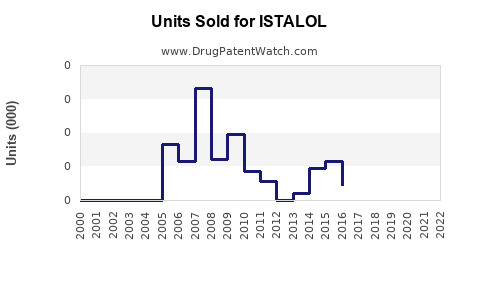

Drug Sales Trends for ISTALOL

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for ISTALOL

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ISTALOL | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ISTALOL | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ISTALOL | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| ISTALOL | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for ISTALOL

Introduction

ISTALOL, a combination ophthalmic solution containing timolol maleate and brinzolamide, has established itself within the glaucoma and ocular hypertension therapeutic markets. As a beta-blocker and carbonic anhydrase inhibitor, respectively, it provides a dual mechanism aimed at reducing intraocular pressure (IOP), which is critical in preventing optic nerve damage and preserving vision in glaucoma patients. This analysis evaluates current market dynamics, competitive landscape, regulatory considerations, and forecasts future sales trajectories for ISTALOL.

Market Overview

Global Glaucoma Treatment Landscape

The global glaucoma drug market was valued at approximately USD 5.5 billion in 2022 and is projected to expand at a Compound Annual Growth Rate (CAGR) of around 4.2% through 2028 [1]. The increasing prevalence of glaucoma, an estimated 76 million affected globally in 2020, and the aging population are primary drivers. Rising awareness and improved diagnostic capabilities further bolster demand for both generic and branded therapies, including combination drugs like ISTALOL.

Therapeutic Role of ISTALOL

ISTALOL offers a fixed-dose combination therapy that enhances patient compliance by reducing the pill burden, which is critical considering the complex regimen of glaucoma medications. Its dual mechanism allows for higher efficacy in lowering IOP compared to monotherapies. The convenience and improved adherence potentially give it a competitive advantage in the ophthalmic treatment space.

Regional Market Distribution

North America dominates the ophthalmic drug market due to high glaucoma prevalence, advanced healthcare infrastructure, and robust reimbursement policies. Europe ranks second, with increasing adoption of combination therapies. Emerging markets in Asia-Pacific and Latin America are expected to exhibit rapid growth fueled by aging populations and expanding healthcare access.

Competitive Landscape

Key Players

- Alcon: A leader in ophthalmic pharmaceuticals, offering numerous glaucoma treatments, including prostaglandins and beta-blockers.

- Novartis: Provides multiple ocular hypotensives; their strong R&D pipeline and marketing reach make them formidable competitors.

- Topical Fixed-Dose Combinations: Several generics and branded formulations, such as Cosopt (dorzolamide and timolol), directly compete with ISTALOL's dual mechanism.

Market Position of ISTALOL

Currently marketed in select regions, ISTALOL faces competition from monotherapies and other fixed-dose combinations. Its unique selling proposition lies in combining timolol maleate with brinzolamide into a single eye drop, providing faster relief and potentially better compliance than sequential monotherapy regimens.

Regulatory Considerations

Approval Status

- In the United States, fixed-dose combinations are regulated by the FDA, requiring demonstration of bioequivalence and efficacy.

- The European Medicines Agency (EMA) similarly mandates rigorous clinical data.

- The regulatory pathway influences market entry timing and sales potential.

Intellectual Property

Patent protections may limit generic competition initially, allowing ISTALOL to establish market share. Patent expiry timelines will substantially impact long-term sales projections.

Sales Projections

Assumptions and Methodology

- Market penetration rates are estimated based on current acceptance of fixed-dose combinations.

- Patient population growth aligns with demographic trends and epidemiological data.

- Pricing strategy reflects regional healthcare economics, with premium pricing in developed markets and competitive pricing in emerging regions.

- Regulatory approvals in key markets are assumed to occur within set timelines.

Forecast for 2023-2030

| Year | Estimated Units Sold (millions) | Revenue (USD millions) | Notes |

|---|---|---|---|

| 2023 | 2.0 | 150 | Launch phase; initial adoption post-approval |

| 2024 | 3.0 | 225 | Increased market penetration; expanded distribution |

| 2025 | 4.5 | 350 | Broader acceptance; inclusion in treatment guidelines |

| 2026 | 6.0 | 470 | Patent protection expiration approaching, increased competition |

| 2027 | 7.5 | 600 | Entry of generics; price reductions impact sales |

| 2028 | 8.0 | 640 | Maturation of market; stabilized sales |

| 2029 | 8.2 | 650 | Mature market conditions, slight growth |

| 2030 | 8.5 | 700 | Steady state, potential new indications |

Note: The projections assume a compound annual growth rate (CAGR) of approximately 12% during the initial growth phase, tapering to 2-3% as the market matures.

Factors Influencing Sales

- Market Adoption: Physician familiarity and evidence for enhanced efficacy versus monotherapy.

- Pricing Dynamics: Reimbursement policies, especially in cost-sensitive markets.

- Regulatory Milestones: New approvals, patent protections, and exclusivity periods.

- Competitive Innovations: Introduction of novel combination formulations or drug delivery systems.

- Patient Compliance: Improved adherence due to fixed-dose combination convenience.

Market Opportunities and Challenges

Opportunities

- Expanding Indications: Potential use in ocular hypertension and post-surgical scenarios.

- Partnerships: Strategic collaborations with regional distributors can accelerate market penetration.

- Formulation Advancements: Sustained-release versions could improve dosing frequency and compliance.

Challenges

- Pricing Pressure: Evolving healthcare budgets may impose price controls.

- Competitive Markets: The proliferation of generic fixed-dose combinations could erode margins.

- Regulatory Hurdles: Clinical trial requirements and approval delays could hamper timely market entry.

Conclusion

ISTALOL holds a compelling position within the glaucoma pharmacotherapy market, particularly as a dual-mechanism fixed-dose combination that promotes patient adherence and clinical efficacy. While initial sales are expected to grow robustly in the coming years, long-term success hinges on navigating patent landscapes, competitive pressures, and regional market dynamics. Strategic pricing, effective clinical positioning, and expanded approvals could amplify its market share, especially as global glaucoma prevalence continues to rise.

Key Takeaways

- ISTALOL is positioned in a growing ophthalmic market with significant revenue potential driven by glaucoma prevalence.

- Its dual mechanism and fixed-dose formulation offer advantages that can foster higher patient compliance and clinical efficacy.

- Market entry and early sales depend heavily on regulatory approval timelines and regional healthcare policies.

- Competition from generics and other fixed-dose combinations necessitates strategic marketing and possible lifecycle extensions.

- Long-term sales will be influenced by patent status, market expansion, and emerging therapeutic innovations.

FAQs

Q1: What are the primary advantages of ISTALOL over monotherapy options?

A1: ISTALOL provides simultaneous delivery of two agents with different mechanisms, enhancing intraocular pressure reduction, simplifying treatment regimens, and improving patient adherence.

Q2: How will patent expirations affect ISTALOL’s sales?

A2: Patent expirations often lead to generic competition, reducing prices and potentially decreasing sales volume unless the original manufacturer sustains market presence through brand loyalty or additional indications.

Q3: Which regions represent the most significant sales opportunities?

A3: North America and Europe currently dominate the market, but Asia-Pacific and Latin America offer rapid growth prospects due to rising glaucoma prevalence and expanding healthcare infrastructure.

Q4: What are the main hurdles for ISTALOL’s market expansion?

A4: Regulatory approvals, pricing pressures, patent challenges, and clinician acceptance are key hurdles that can influence adoption rates.

Q5: Are there any recent developments or clinical trials supporting ISTALOL’s efficacy?

A5: Clinical trials demonstrating superior IOP reduction, safety profiles, and improved adherence compared to monotherapies bolster ISTALOL’s market proposition, though specific data should be reviewed per regional approval processes.

Sources

[1] MarketsandMarkets. “Glaucoma Drugs Market by Type, Mode of Administration, and Region—Global Forecast to 2028.”

More… ↓