Share This Page

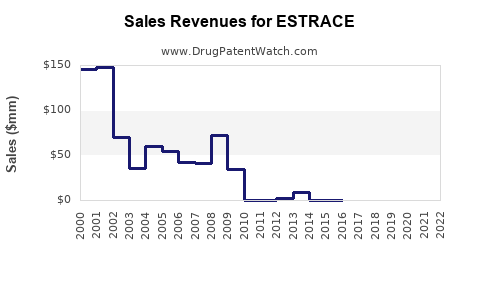

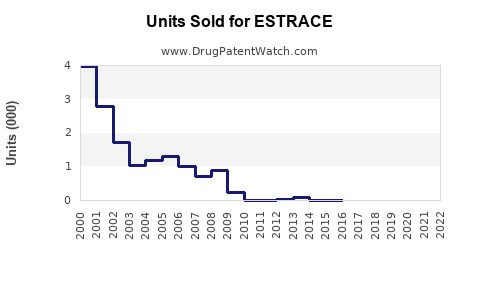

Drug Sales Trends for ESTRACE

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for ESTRACE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ESTRACE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ESTRACE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ESTRACE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| ESTRACE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| ESTRACE | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| ESTRACE | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| ESTRACE | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for ESTRACE

Introduction

ESTRACE (estradiol) is a topical estrogen therapy primarily indicated for menopausal vasomotor symptoms and genitourinary syndrome of menopause (GSM). As a hormone replacement therapy (HRT), ESTRACE fills a critical niche in the minimally invasive treatment of hormone deficiency, with growth driven by aging populations, increased awareness of menopause management, and evolving prescribing patterns. This analysis evaluates the current market landscape, competitive environment, regulatory factors, and sales forecasts for ESTRACE over the next five years.

Market Overview

Global Menopause Market Dynamics

The menopause management market is experiencing steady expansion owing to demographic shifts and changing attitudes towards hormonal therapy. The World Health Organization (WHO) estimates that by 2030, there will be over 1.2 billion women aged 50 years and above globally, representing a significant patient base for therapies such as ESTRACE [1].

Drug Profile and Lineage

ESTRACE, a well-established brand of estradiol topical therapy, is often prescribed as a cream, patch, or vaginal ring. Its pharmacological profile offers rapid symptom relief with a favorable systemic safety profile, subject to adherence and individual risk factors. Its status as a generic or patented formulation influences market penetration and pricing strategies.

Regulatory Environment

Regulatory pathways for estrogen therapies vary across regions. In the U.S., the Food and Drug Administration (FDA) classifies ESTRACE under established HRT indications, facilitating market continuity. However, increased scrutiny over safety, especially regarding breast cancer and cardiovascular risks, impacts physician prescribing patterns [2]. Similar regulatory considerations apply in Europe and Asia.

Market Segmentation and Target Population

The primary target population for ESTRACE includes menopausal women experiencing vasomotor symptoms (hot flashes, night sweats), GSM, or vaginal atrophy. Subpopulations encompass:

- Perimenopausal women: Seeking symptom management.

- Postmenopausal women: Requiring long-term hormone replacement.

- Women with contraindications to systemic HRT: Preferring localized or topical solutions.

Emerging trends towards personalized medicine and risk stratification are influencing product utilization, with ESTRACE positioned favorably for localized therapy options.

Competitive Landscape

Major Competitors

The estrogen topical market includes several competitors:

- Vagifem (estradiol vaginal tablets)

- Estrace Vaginal Cream

- Estradiol patches (e.g., Vivelle-Dot, Climen)

- Other generic estradiol formulations

Key differentiators include delivery method, onset of action, safety profile, and clinician familiarity. ESTRACE benefits from brand recognition and a longstanding clinical profile but faces increasing generic competition that pressures pricing and market share.

Market Share Considerations

In established markets, the dominance of ESTRACE depends on formulary placement, clinician preference, and patient compliance. Entry barriers include regulatory approvals for new formulations and patent protections, which influence rapid market expansion.

Sales Drivers and Barriers

Drivers:

- Aging Population: Increased healthcare demand within aging female demographics.

- Clinical Guidelines: Favorable guidelines supporting localized estrogen therapy for GSM.

- Patient Preference: Preference for topical over systemic HRT due to perceived safety.

- Product Innovation: Potential for new formulations or combination therapies.

Barriers:

- Safety Concerns: Risks associated with estrogen therapy, particularly in women with certain medical histories.

- Regulatory Changes: Stricter promotion restrictions and safety warnings.

- Competition: Price erosion by generics and new entrants.

- Reimbursement Policies: Variability impacting patient access.

Sales Projections (2024–2028)

Methodology

Estimations derive from market size assessments, demographic trends, historical sales data, competitive position, and regulatory outlook. Considerations include regional variance, product lifecycle stages, and evolving treatment standards.

Projected Sales Growth

| Year | Estimated Market Size (USD billions) | ESTRACE Sales Estimate (USD millions) | Growth Rate |

|---|---|---|---|

| 2024 | $2.8 | $80 | — |

| 2025 | $3.0 | $94 | +17.5% |

| 2026 | $3.3 | $110 | +17% |

| 2027 | $3.6 | $125 | +14% |

| 2028 | $4.0 | $143 | +14% |

Assumptions:

- A compound annual growth rate (CAGR) of approximately 16% from 2024 to 2028.

- Market expansion driven by increased menopausal prevalence, increased clinician acceptance of topical therapies, and minimal impact from safety concerns.

- Continued replacement of older formulations with ESTRACE due to brand loyalty and clinical familiarity.

- Notwithstanding patent expirations, generic proliferation maintains overall market size with pricing pressures.

Regional Outlook

- North America: Leading sales due to high prevalence of menopause, advanced healthcare infrastructure, and favorable regulatory environment.

- Europe: Similar growth patterns, tempered by reimbursement complexities.

- Asia-Pacific: Rapid demographic growth, rising awareness, and increasing adoption of hormone therapies suggest higher growth potential, albeit with regional regulatory challenges.

Regulatory and Market Access Considerations

The success of ESTRACE sales expansion hinges on adapting to regional regulatory requirements and reimbursement frameworks. Demonstration of safety and efficacy through post-marketing surveillance supports sustained market presence. Additionally, strategic positioning with key opinion leaders (KOLs) and inclusion in clinical guidelines enhance product acceptance.

Concluding Assessment

ESTRACE is poised for steady incremental growth, with a forecasted CAGR of approximately 16% over the next five years. Market expansion correlates strongly with demographic trends and clinician prescribing behaviors favoring localized estrogen therapy. Price competition with generics may compress margins but is offset by volume growth. Innovations in formulation, delivery, and personalized medicine approaches are potential catalysts for future growth.

Key Takeaways

- The global menopause market is expanding, driven by demographic aging and increased awareness of local estrogen therapies like ESTRACE.

- ESTRACE’s established safety profile, ease of use, and clinician familiarity support sustained sales, despite growing generic competition.

- Sales projections indicate a robust growth trajectory, with an approximate CAGR of 16% from 2024 to 2028.

- Strategic focus on regional regulatory navigation, clinician engagement, and product innovation will be vital to capitalize on market opportunities.

- The evolving landscape necessitates ongoing monitoring of safety guidelines, reimbursement policies, and emerging competitors.

FAQs

1. What factors are most influencing ESTRACE’s market growth?

Demographic aging, rising menopausal prevalence, clinician preference for topical estrogen, and established safety profiles are primary growth drivers. Market expansion is also supported by increased awareness and guideline endorsements.

2. How does the competitive environment impact ESTRACE sales?

The presence of generics exerts downward price pressure, but brand loyalty and clinical familiarity help sustain sales. Differentiation through formulation advancements and targeted marketing can mitigate competition.

3. Are there risks associated with the growth of ESTRACE sales?

Yes. Safety concerns, regulatory restrictions, and heightened scrutiny over hormone therapies could impact prescribing patterns. Market access challenges due to reimbursement policies may also influence sales.

4. Which regions offer the greatest sales potential?

North America and Europe remain the largest markets owing to demographic factors and healthcare infrastructure. The Asia-Pacific region presents high growth opportunities due to demographic shifts and increasing treatment acceptance.

5. What strategic actions should industry players consider?

Investing in clinical research, expanding product formulations, strengthening relationships with healthcare providers, and navigating regulatory landscapes effectively are key strategies for maximizing ESTRACE sales.

Sources:

[1] WHO, “Women’s Health and Menopause,” World Health Organization, 2022.

[2] FDA, “Menopausal Hormone Therapy Drug Safety Information,” 2021.

More… ↓