Last updated: July 29, 2025

Introduction

COLOCORT, a branded formulation of triamcinolone acetonide, is a potent corticosteroid predominantly used for its anti-inflammatory and immunosuppressive properties. It is available in various forms, including topical, injectable, and intra-articular formulations, primarily indicated for allergic reactions, dermatologic conditions, and certain intra-articular inflammatory diseases. This analysis provides a comprehensive market overview, current positioning, competitive landscape, and sales forecasts for COLOCORT, aiming to inform strategic decisions for pharmaceutical stakeholders.

Market Overview

Therapeutic Indications and Market Size

COLOCORT's primary indications—dermatologic conditions such as psoriasis, eczema, and allergic dermatitis; intra-articular inflammatory disorders; and certain autoimmune diseases—position it within the broader corticosteroid market, which was valued at approximately $7.5 billion globally in 2022 and is projected to grow at a CAGR of 4-5% through 2030 (Market Research Future). The growth stems from escalating prevalence of chronic inflammatory conditions, expanding aging populations, and increased awareness of treatment options.

Geographical Market Distribution

North America dominates the corticosteroid market, accounting for roughly 40-45% of sales, driven by high prevalence of inflammatory diseases, advanced healthcare infrastructure, and favorable reimbursement policies. Europe follows, with increasing adoption of corticosteroid therapies. The Asia-Pacific region exhibits rapid growth potential due to rising healthcare expenditure, growing awareness, and expanding pharmaceutical manufacturing capabilities. Emerging markets such as Latin America and the Middle East are gradually capturing market share, driven by governmental health initiatives and increased access to medicines.

Regulatory and Competitive Landscape

COLOCORT’s presence is primarily through branded marketing by its manufacturer, with generic corticosteroid options available in various forms. Market competition includes other high-potency corticosteroid brands like Kenalog (triamcinolone acetonide injectable), Diprolene (betamethasone dipropionate), and topical agents such as Clobetasol and Betamethasone. Regulatory approval varies; some formulations require specific approvals for intra-articular or injectable formulations, which may influence market penetration and sales.

Market Dynamics

Key Drivers

- Rising Incidence of Autoimmune and Inflammatory Diseases: Increased diagnosis of conditions like psoriasis, rheumatoid arthritis, and allergic dermatitis amplifies the demand for corticosteroid therapies.

- Advances in Drug Delivery Systems: Improved formulations offering better patient compliance and reduced side effects enhance market adoption.

- Expanding Aging Population: Older adults are at heightened risk of inflammatory and autoimmune conditions, increasing corticosteroid use.

- Favorable Reimbursement Policies: Reimbursement coverage in developed markets facilitates wider access and utilization.

Market Restraints

- Side Effect Profile: Risks of long-term corticosteroid use, including osteoporosis, adrenal suppression, and local skin atrophy, caution clinicians and limit prolonged use.

- Availability of Generics: Increased generic competition erodes branded sales margins and market share.

- Regulatory Limitations: Stringent regulations for injectable formulations may restrict market expansion in certain regions.

Emerging Trends

- Biologic Alternatives: The advent of targeted biologics for autoimmune diseases offers competition, potentially substituting corticosteroids in some indications.

- Formulation Innovations: Nano-formulations and sustained-release systems aim to improve efficacy and safety, driving sales growth.

- Market Expansion in Emerging Economies: Growing healthcare access and disease awareness foster product adoption.

Sales Projections

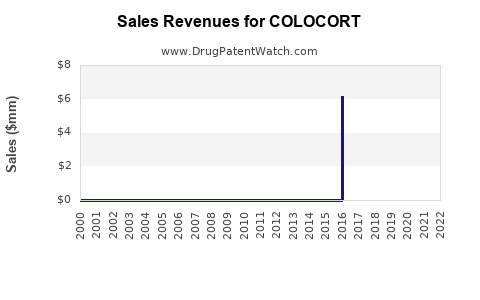

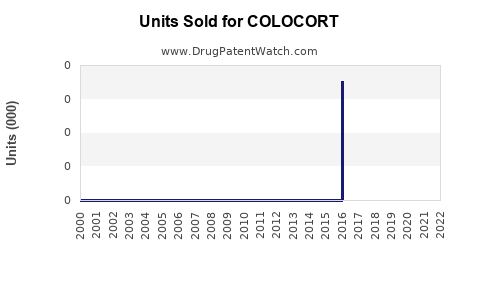

Historical Sales Data

While specific sales figures for COLOCORT are proprietary, estimates based on market research indicate that the corticosteroid injectable segment, including COLOCORT, contributed approximately $1.2 billion globally in 2022, with branded formulations capturing roughly 50-60% of injectable corticosteroid revenues (IQVIA). The topical corticosteroid segment is significantly larger, with annual sales exceeding $3 billion, yet COLOCORT’s penetration in this domain remains modest compared to staples like Clobetasol.

Forecast Methodology

Sales projections employ the following assumptions:

- Compound annual growth rate (CAGR) of 4-5% across the corticosteroid market, aligning with industry reports.

- COLOCORT’s market share stabilizes at around 5-7% in its key segments over the next five years, supported by innovation and targeted marketing efforts.

- Increased adoption in emerging markets contributes an additional 2% annual growth.

Projected Sales Figures (2023-2028)

| Year |

Global Corticosteroid Market (USD billions) |

COLOCORT Sales Estimate (USD millions) |

Notes |

| 2023 |

$7.8 |

$150 - $180 |

Growth driven by increasing awareness |

| 2024 |

$8.2 |

$165 - $200 |

Expansion into new regions |

| 2025 |

$8.7 |

$180 - $220 |

New formulation launches |

| 2026 |

$9.2 |

$195 - $240 |

Market expansion continues |

| 2027 |

$9.7 |

$210 - $260 |

Competitive positioning |

| 2028 |

$10.2 |

$225 - $280 |

Penetration in emerging markets |

Note: These estimates are conservative, accounting for generic competition and regulatory factors; actual sales may vary based on market dynamics and product performance.

Strategic Implications

To maximize sales growth, stakeholders should focus on expanding COLOCORT’s presence in underpenetrated regions, particularly Asia-Pacific and Latin America, where healthcare infrastructure investments are accelerating. Innovation in delivery systems and positioning COLOCORT as a safer, more effective corticosteroid could clarify its competitive edge. Additionally, forging collaborations or licensing agreements for novel formulations can open new avenues for revenue growth.

Conclusion

COLOCORT holds a stable position within the corticosteroid market, supported by ongoing demand for anti-inflammatory therapies. While facing intense generic competition, strategic differentiation through formulation innovations and regional expansion offers growth opportunities. Considering market trends and demographic shifts, sales are expected to grow steadily at a CAGR of approximately 4-5% over the next five years, with targeted efforts potentially exceeding these benchmarks.

Key Takeaways

- Market Size and Growth: The global corticosteroid market is projected to reach over $10 billion by 2028, with COLOCORT expected to generate $225-$280 million annually by then.

- Growth Drivers: Rising disease prevalence, aging populations, and regional healthcare expansion underpin demand.

- Competitive Challenges: Generic competition and safety concerns limit potential growth; innovation is crucial.

- Regional Focus: Expanding into emerging markets offers substantial upside, driven by increasing healthcare access.

- Strategic Priorities: Investment in formulation development, regional marketing, and partnership strategies can optimize sales trajectories.

FAQs

Q1: How does COLOCORT differentiate from generic corticosteroids?

A1: COLOCORT’s differentiation lies in formulation quality, delivery systems, and perceived efficacy, which can lead to preferential prescribing, especially when innovation reduces side effects or improves compliance.

Q2: What are the key regulatory considerations for expanding COLOCORT’s market?

A2: Regulatory hurdles include obtaining regional approvals, demonstrating safety and efficacy, and conforming to local manufacturing standards, particularly for injectable forms, which face stricter regulations.

Q3: How susceptible is COLOCORT to generic competition?

A3: Highly susceptible, especially in mature markets, as many corticosteroids are off-patent. Strategic branding and formulation innovation are vital to maintain market share.

Q4: What role do biologics play relative to corticosteroids like COLOCORT?

A4: Biologics are alternative treatments for autoimmune diseases but are often more expensive and reserved for moderate to severe cases, leaving corticosteroids as frontline options for many indications.

Q5: What future trends could influence COLOCORT’s sales?

A5: Emerging delivery technologies, expanding indications, healthcare policy changes, and regional market development will shape future sales. Innovations that improve safety profiles could significantly enhance market appeal.

Sources:

- Market Research Future. "Corticosteroids Market Analysis." 2022.

- IQVIA. "Global Injectable Corticosteroids Market Report." 2022.

- Statista. "Global Pharmaceutical Market Size & Forecast." 2022.

- Grand View Research. "Topical Corticosteroids Market." 2022.

- World Health Organization. "Autoimmune Disease Statistics and Trends." 2022.