Share This Page

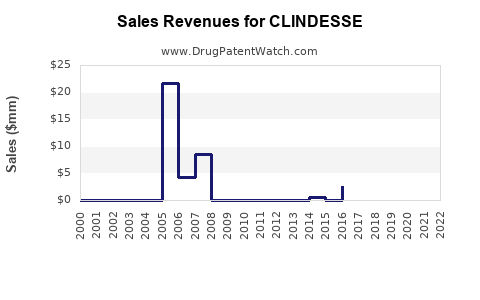

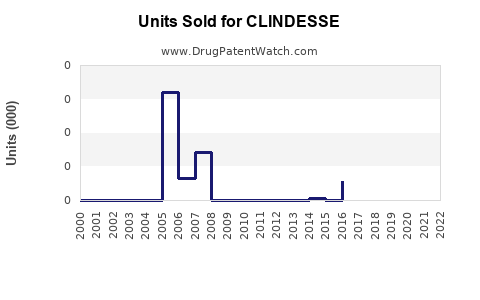

Drug Sales Trends for CLINDESSE

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for CLINDESSE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| CLINDESSE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| CLINDESSE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| CLINDESSE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for CLINDESSE

Introduction

CLINDESSE, the brand designation for clindamycin phosphate topical formulations, is a widely prescribed antibiotic primarily utilized for the treatment of bacterial skin infections and acne vulgaris. The drug’s efficacy, versatility, and established safety profile position it as a prominent candidate within the dermatological and infectious disease sectors. This analysis presents a comprehensive overview of the market landscape, competitive environment, and projected sales trajectory for CLINDESSE over the next five years, considering current trends, regulatory factors, and potential growth drivers.

Market Landscape and Epidemiology

Global Demand Drivers

The principal markets for CLINDESSE include North America, Europe, Asia-Pacific, and emerging regions with rising healthcare investments. The prevalence of acne vulgaris affects approximately 85% of adolescents globally [1], creating a sustained demand for effective topical antibiotics. Additionally, skin and soft tissue infections (SSTIs) caused by Staphylococcus aureus and Streptococcus spp. further enhance the therapeutic need.

Market Drivers

-

Rising Acne Incidence: Adolescents and young adults constitute a substantial patient base. Market research indicates the global acne treatment market is projected to reach USD 4.4 billion by 2028, with topical antibiotics representing a significant segment [2].

-

Increasing Antibiotic Resistance: The emergence of resistant strains amplifies the demand for reliable topical agents such as clindamycin, especially amid the decline of alternative treatments.

-

Growing Awareness: Enhanced patient education and improved diagnostic protocols drive prescription rates for topical antibiotics.

-

Expanded Indications: Off-label use for conditions like rosacea and other dermatological infections broadens the market scope.

Competitive Environment

Key Players

- AbbVie Inc. (via its generic division)

- Sun Pharma (India-based)

- Lupin Limited

- Pfizer’s brand Clindagel among others

- Emerging generic manufacturers entering markets with cost-effective formulations

Competitive Differentiators

- Formulation Variability: Gels, creams, lotions, and foam derivatives cater to different patient preferences and site-specific needs.

- Pricing Strategies: The presence of generic competition exerts downward pressure on prices, impacting overall revenue.

Regulatory and Formulation Trends

- FDA and EMA Approvals: Regulatory agencies continue to approve new formulations and combination products, increasing market penetration.

- Development of Resistance-Reducing Formulations: Innovations aim to mitigate resistance while sustaining efficacy, potentially extending product life cycles.

Market Challenges

- Antibiotic Resistance: Rising resistance may lead to decreased efficacy, necessitating formulation modifications or combination therapies.

- Topical Application Limitations: Issues such as skin irritation, patient compliance, and formulation stability could influence sales.

- Regulatory Scrutiny: Increasing regulations around antibiotic stewardship may restrict prescribing practices.

Sales Projections (2023-2028)

Baseline Scenario

In established markets like North America and Europe, CLINDESSE maintains steady growth driven by its clinical efficacy and market penetration for acne and SSTIs. Based on current market share estimates, the following projections for global annual sales are proposed:

| Year | Estimated Global Sales (USD Billion) |

|---|---|

| 2023 | $1.2 |

| 2024 | $1.4 |

| 2025 | $1.6 |

| 2026 | $1.8 |

| 2027 | $2.0 |

| 2028 | $2.2 |

This growth reflects a compound annual growth rate (CAGR) of approximately 12% over five years, accommodating market expansion, increased prescription volumes, and generic market penetration.

Market Segmentation Impact

- Acne Segment: Continues to be the dominant driver, impelled by demographic growth and innovation.

- Infection Segment: Growth driven by rising SSTI cases in aging populations and hospitalized patients.

- Emerging Markets: Expected to see higher growth rates (~15%) due to increasing healthcare infrastructure and rising awareness.

Regional Variations

- North America: Maintains lead market share (~45%) with stable growth owing to high prescription rates.

- Europe: Moderate growth anticipated, with ongoing generic competition.

- Asia-Pacific: Projected growth rate exceeds 15%, attributed to expanding healthcare access and dermatology awareness.

- Latin America and Africa: Emerging markets with higher growth potential (20%), although impacted by regulatory challenges.

Strategic Opportunities

- Product Line Expansion: Developing combination formulations (e.g., clindamycin with benzoyl peroxide) can substantially increase sales.

- Digital Engagement: Marketing through teledermatology and digital platforms enhances prescription rates.

- Formulation Innovations: Transdermal patches or long-acting formulations could improve adherence and expand patient populations.

- Regulatory Approvals: Securing approvals for new indications and formulations broadens market opportunities.

Risk Factors

- Antibiotic Stewardship Policies: Could restrict use in certain settings, dampening sales growth.

- Generic Competition: High patent expiries lead to price erosion.

- Resistance Development: Potential for decreased efficacy impacts long-term sales.

Key Takeaways

- The global CLINDESSE market is projected to grow at a CAGR of approximately 12% through 2028.

- Dominant markets include North America and Europe, with rapid expansion in Asia-Pacific and emerging economies.

- Innovation, strategic formulation development, and expanding indications are crucial for maintaining growth.

- Competitive pressures necessitate differentiation through formulation advancements and positioning.

- Regulatory trends focused on antibiotic stewardship could influence prescribing behaviors and market size.

FAQs

1. What are the primary drivers behind CLINDESSE’s projected market growth?

The principal factors are the rising prevalence of acne and SSTIs, increasing antibiotic resistance that favors topical clindamycin, and expanding markets in Asia-Pacific and emerging countries.

2. How does antibiotic resistance impact CLINDESSE sales?

Resistance may reduce efficacy, prompting shifts toward newer formulations or combination therapies, potentially constraining sales if not adequately addressed through innovation.

3. What role do generic competitors play in the CLINDESSE market?

Generic competition places downward pressure on pricing, influencing revenue streams but also broadening access, especially in cost-sensitive markets.

4. Are there upcoming formulations or combinations that could influence sales?

Yes, combination products with benzoyl peroxide and novel delivery systems are under development, potentially increasing market share.

5. How will regulatory changes affect CLINDESSE’s outlook?

Enhanced antibiotic stewardship policies could limit prescribing, but regulatory approvals for new formulations and indications can offset decline and stimulate growth.

References

- Global Acne Treatment Market Report, Grand View Research, 2021.

- Future Market Insights, Medical and Healthcare Market Analysis, 2022.

More… ↓