Last updated: July 29, 2025

Introduction

Risperidone, marketed under brand names such as Risperdal, is a second-generation antipsychotic widely prescribed for schizophrenia, bipolar disorder, and irritability associated with autism spectrum disorders. Since its approval by the FDA in 1993, Risperidone has established a significant presence in both hospital and outpatient pharmacies worldwide. Its market dynamics are influenced by clinical needs, patent status, competitive landscape, regulatory changes, and emerging therapeutics. This analysis explores current market trends and provides comprehensive sales projections for Risperidone over the coming five years.

Market Overview

Global Market Size and Growth Trends

The global antipsychotics market was valued at approximately USD 14 billion in 2022, with second-generation antipsychotics (SGAs) like Risperidone constituting a substantial segment. The increasing prevalence of schizophrenia (affecting roughly 20 million people globally) and bipolar disorder (estimated at 45 million) fuels demand for effective pharmacotherapies [1]. The rising recognition of mental health issues, coupled with expanding healthcare infrastructure, underpins the growth trajectory.

Key Therapeutic Indications

- Schizophrenia: Risperidone’s primary indication, supported by extensive clinical trials demonstrating efficacy in positive and negative symptoms.

- Bipolar disorder: Effective in managing manic episodes.

- Irritability in autism spectrum disorder: Approved for pediatric use, expanding its target demographic.

Increased diagnosis and broader acceptance of mental health treatments augment sales potential.

Market Drivers

- Expanding Patient Demographics: Growing awareness and diagnosis rates in emerging markets.

- Regulatory Approvals: Patent extensions and line extensions (e.g., Risperdal Consta for long-acting injectables) prolong market exclusivity.

- Formulation Advancements: The development of long-acting injectables improves compliance and broadens usage.

- Reimbursement and Healthcare Policy: Reimbursement decisions favoring childhood and elderly mental health treatment support continued prescriptions.

- Newer Competition: Though newer SGAs like aripiprazole and olanzapine offer alternatives, Risperidone remains competitive due to established efficacy and cost benefits.

Market Constraints

- Side Effect Profile: Risks of metabolic syndrome, extrapyramidal symptoms, and hyperprolactinemia impact prescribing behaviors.

- Generic Competition: Patent expirations have led to a proliferation of generic Risperidone, impacting branded sales.

- Regulatory Scrutiny: Growing regulations concerning side effect management influence prescribing patterns and marketed formulations.

Competitive Landscape

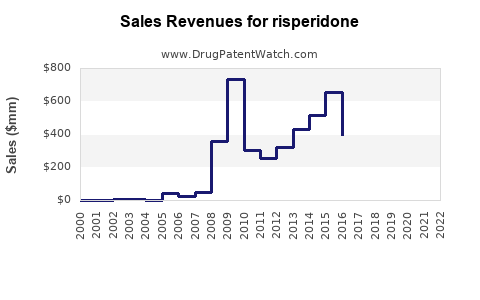

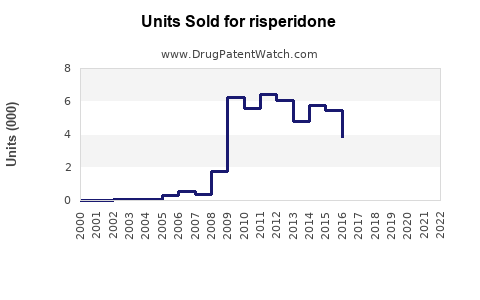

Major players include Johnson & Johnson (original manufacturer), Teva Pharmaceuticals (biosimilars), Sandoz, and Mylan. The availability of generics since 2008 substantially diluted the market for branded Risperdal. Yet, branded formulations like Risperdal Consta maintain premium pricing in certain markets due to their long-acting formulation advantages.

Sales Projections (2023-2028)

Assumptions

- Post-Patent Expiry Impact: Generic penetration stabilizes, maintaining baseline sales but with diminishing growth in mature markets.

- Global Expansion: Emerging markets see accelerated adoption owing to rising mental health burdens.

- Formulation Diversification: Increased sales from long-acting injectables and pediatric formulations.

Forecast Summary

| Year |

Estimated Global Sales (USD Billion) |

Growth Rate (YoY) |

| 2023 |

2.2 |

4% |

| 2024 |

2.4 |

9% |

| 2025 |

2.6 |

8% |

| 2026 |

2.8 |

8% |

| 2027 |

3.0 |

7% |

| 2028 |

3.2 |

7% |

These projections consider the gradual stabilization of generic sales, with notable growth driven by emerging markets and new formulations.

Regional Insights

- North America: Continues as the largest market but faces pricing pressures due to generics. Growth driven by long-acting formulations.

- Europe: Market saturation; modest growth expected.

- Asia-Pacific: Rapid expansion with increased mental health awareness and healthcare access; expected to account for over 30% of global sales by 2028.

- Latin America & Africa: Emerging markets showing early-stage growth potential.

Revenue Streams

- Branded Risperdal Sales: Declining due to patent expiry.

- Generic Risperidone: Dominant volume driver, with lower margins.

- Long-Acting Injectables: Higher prices and growing adoption increase revenue contribution.

- Pediatric and Special Populations: Increasing prescriptions in autism and elderly populations.

Regulatory and Market Entry Opportunities

- Line Extensions: Developing novel delivery methods (e.g., transdermal) to sustain market interest.

- New Indications: Exploring off-label uses and expanding approved indications could generate additional revenues.

- Biosimilar Competition: Anticipated biosimilar entries could further erode prices but may also stimulate market growth via increased accessibility.

Risks and Opportunities

Risks

- Growing competition from newer or adjunctive therapies.

- Side effect management costs influencing prescribing.

- Regulatory hurdles delaying new formulations or indications.

Opportunities

- Strategic partnerships to expand into underserved markets.

- Innovation in formulations for better compliance.

- Focused marketing on existing favorable safety profiles.

Key Takeaways

- Market maturity is evident in North America, with growth driven primarily by formulations and emerging markets.

- Sales growth remains steady, with projections of reaching USD 3.2 billion globally by 2028.

- Generic penetration reduces revenue from original formulations but opens access through lower-cost options.

- Long-acting injectables and pediatric formulations are crucial growth drivers.

- Regulatory and clinical landscape will dictate the pace of adoption and new formulation development.

FAQs

1. How has patent expiration impacted Risperidone sales?

Patent expiry in 2008 led to a surge in generic Risperidone availability, significantly reducing branded sales but expanding overall usage due to lower prices and increased accessibility.

2. What differentiates Risperidone in the current antipsychotic market?

Its proven efficacy, established safety profile, and availability in long-acting injectable formulations position Risperidone as a versatile option, especially for adherence-challenged populations.

3. Are there upcoming formulations or indications that could boost Risperidone sales?

Developments in transdermal delivery systems and broader approval for pediatric indications may enhance market penetration. Ongoing research into adjunctive therapies could further expand its utility.

4. What regional markets present the greatest growth opportunities?

Asia-Pacific and Latin America, driven by increased healthcare infrastructure and mental health awareness, offer expansive growth prospects over the next decade.

5. How are side effects influencing the future of Risperidone?

While side effects remain a concern, advances in dosing, monitoring, and formulation improvements mitigate risks, maintaining its therapeutic profile and market relevance.

References

[1] World Health Organization. "Mental disorders." https://www.who.int/news-room/fact-sheets/detail/mental-disorders

[2] MarketWatch. "Global Antipsychotics Market Size, Share & Trends Analysis Report." 2022.