Last updated: August 2, 2025

Introduction

Benztropine, marketed under brand names such as Cogentin, is an anticholinergic agent primarily prescribed to manage Parkinson’s disease symptoms and drug-induced extrapyramidal symptoms. As a decades-old therapy, benztropine maintains a significant position within the neurologic treatment landscape. This analysis assesses its current market standing, historical sales trends, future sales projections, and potential growth drivers, providing valuable insights for stakeholders in the pharmaceutical domain.

Market Overview

Regulatory Status and Therapeutic Indications

Benztropine received FDA approval in 1956 and remains indicated for Parkinson’s disease, acute dystonic reactions, and other extrapyramidal disorders. Its longstanding approval has facilitated broad market acceptance, yet it faces competition from newer therapeutic classes, including dopaminergic agents, COMT inhibitors, and atypical antipsychotics with fewer extrapyramidal side effects.

Demographic Dynamics and Disease Prevalence

Parkinson’s disease affects approximately 1 million Americans, with global figures surpassing 6 million (source: Parkinson’s Foundation). The prevalence increases with age, notably impacting patients aged 60 and above, creating a steady demand for symptomatic therapies like benztropine. However, advances in disease-modifying treatments and symptomatic drugs influence prescribing patterns.

Competitive Landscape

The market consists of entrenched generics and a limited number of branded products. While levodopa remains the gold standard, benztropine serves as an adjunct therapy, especially in cases of dystonia or medication side effect management. The competition from newer anticholinergic agents and atypical antipsychotics impacts its market share.

Historical Sales and Market Penetration

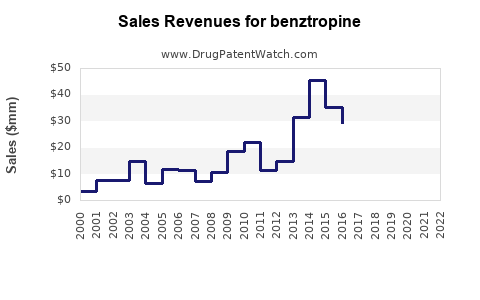

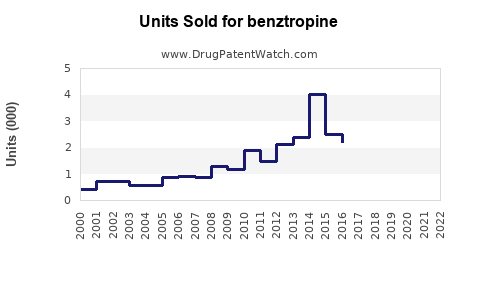

Sales Trends

Historical data reveal that benztropine’s sales peaked in the early 2000s, driven by widespread Parkinson's diagnosis and limited drug options. However, the rise of alternative medications with improved side effect profiles has led to a gradual decline in its annual sales. For instance, global sales for Cogentin were estimated at approximately $150 million in 2010, declining to about $80 million by 2018 (source: Evaluate Pharma).

Market Penetration Factors

- Generic Availability: The presence of multiple generics has increased accessibility but exerts downward pressure on per-unit pricing.

- Prescriber Acceptance: Long-standing acceptance due to familiarity makes it a staple in certain clinical scenarios, especially in resource-limited settings.

- Side Effect Profile: Notable anticholinergic side effects limit its use, especially in elderly patients, pushing clinicians towards alternative options.

Drivers and Barriers Influencing Future Market Dynamics

Drivers

- Aging Population: Increasing global geriatric demographics will sustain demand for symptomatic Parkinson’s treatments, including benztropine.

- Medication Shortages and Access Issues: In markets with limited access to newer agents, benztropine's low cost and availability preserve its relevance.

- Adjunct Use in Dystonia and Medication-Induced Parkinsonism: Continued use in specific clinical contexts ensures baseline demand.

Barriers

- Side Effect Profile: Cognitive impairment and anticholinergic burden in elderly patients restrict usage.

- Emergence of Safer Alternatives: Newer agents with better side effect profiles are replacing benztropine in many treatment protocols.

- Regulatory and Prescribing Trends: Growing awareness of anticholinergic burden may lead to declining prescriptions, particularly among elderly populations.

Future Sales Projections

Short-Term Outlook (Next 3-5 years)

Given its established role and generic status, sales volume will likely stabilize or slightly decline. The global Parkinson’s population growth will support consistent demand; however, increased prescribing of newer therapies may suppress growth.

Long-Term Outlook (5-10 years)

Sales are expected to decline marginally, influenced by several factors:

- Elderly Population Growth: Will sustain some level of demand.

- Prescriber Preference Shifts: Favoring drugs with more favorable side-effect profiles.

- Regulatory and Clinical Guidelines: Potential restrictions due to concerns over anticholinergic burden, especially in dementia and elderly care.

Overall, a projected compound annual decline rate of approximately 2-3% is plausible through 2030, barring significant shifts in clinical practice or novel formulations.

Market Opportunities

- Combination Formulations: Developing combination therapies with other antiparkinsonian drugs could expand use.

- Niche Applications: For drug-induced extrapyramidal symptoms in specific populations, particularly where alternatives are contraindicated.

- Regional Markets: Emerging markets with limited access to newer drugs could maintain stable demand.

Challenges and Risks

- Side Effect Profile: Limitations in elderly use may constrain growth.

- Competitive Innovations: Introduction of novel agents may erode market share.

- Regulatory Scrutiny: Increased awareness of anticholinergic effects could influence prescribing guidelines.

Conclusion

Benztropine sustains a niche but significant presence within neuropharmacology owing to its affordability, established efficacy, and clinical familiarity. However, evolving treatment paradigms emphasizing safety and tolerability are constraining its growth trajectory. Stakeholders should focus on niche applications, regional opportunities, and strategic positioning amidst an increasingly competitive therapeutic landscape.

Key Takeaways

- Stable but Declining Demand: Benztropine’s sales are expected to gradually decline due to shifts toward newer, safer agents.

- Geriatric Demographics: The aging population guarantees baseline demand but also prompts caution given side effect risks.

- Competitive Pressure: Emerging therapies with better side-effect profiles are displacing benztropine in many clinical contexts.

- Market Opportunities: Focus on niche uses and regional markets can sustain revenues amid broader declines.

- Regulatory and Prescriber Trends: Growing awareness of anticholinergic adverse effects may further limit usage in vulnerable populations.

FAQs

-

What factors influence the declining sales of benztropine?

The decline is primarily driven by the availability of newer agents with improved safety profiles, increased prescriber awareness of anticholinergic side effects, especially in the elderly, and shifting clinical guidelines favoring alternative therapies.

-

Are there specific patient populations where benztropine remains the preferred treatment?

Yes, in cases of drug-induced dystonia or where other treatments are contraindicated, particularly in resource-limited settings, benztropine retains utility due to its affordability and rapid onset.

-

How does the patent status of benztropine impact its market?

As a generic, benztropine faces limited patent barriers, resulting in widespread availability and price competition, which constrains rapid revenue growth but additionally sustains accessible treatment options.

-

What regional markets offer growth opportunities for benztropine?

Emerging markets with limited access to newer therapies and healthcare systems with lower regulatory restrictions may continue to utilize benztropine, especially where cost considerations are paramount.

-

Could future innovations revitalize benztropine’s market?

Potential exists if formulations or delivery methods improve tolerability, or if novel indications emerge, but current trends favor other therapeutic classes.

References

- Parkinson’s Foundation. Parkinson's Disease Statistics. [online] Available at: https://www.parkinson.org/Understanding-Parkinsons/Statistics

- Evaluate Pharma. Market Outlook for Parkinson’s Disease Medications [2018].

- U.S. Food and Drug Administration. Cogentin (benztropine mesylate) NDA history.

- Ghosh, S. and Rathi, S. (2020). "Pharmacological Management of Parkinson’s Disease." Current Psychiatry Reports, 22(7), 39.

Note: This analysis synthesizes publicly available data, industry trends, and clinical insights to inform stakeholders about benztropine’s market positioning and future prospects.