Last updated: July 28, 2025

Introduction

VALSART/HCTZ, a fixed-dose combination of valsartan and hydrochlorothiazide, offers an innovative approach to managing hypertension and heart failure, integrating angiotensin receptor blocker (ARB) therapy with diuretics. This analysis provides a comprehensive review of the market landscape, competitive positioning, and forecasts sales trajectories, supporting strategic decision-making for pharmaceutical stakeholders.

Market Landscape Overview

Hypertension and Heart Failure: Prevalence and Growth Drivers

Hypertension remains a leading global health concern, affecting over 1.3 billion adults worldwide, with projections exceeding 1.5 billion by 2025 [1]. The rising incidence is driven by urbanization, aging populations, sedentary lifestyles, and dietary factors. Similarly, heart failure prevalence is increasing, with an estimated 64 million cases globally, emphasizing the need for effective combination therapies [2].

Treatment Paradigm and Role of Fixed-Dose Combinations

Guidelines from the American College of Cardiology/American Heart Association (ACC/AHA) recommend multi-drug regimens for uncontrolled hypertension, often favoring fixed-dose combinations to improve adherence and treatment outcomes [3]. VALSART/HCTZ aligns with these guidelines, offering convenience and synergistic efficacy.

Regulatory and Patent Landscape

Valuing intellectual property rights, patent exclusivity for VALSART/HCTZ typically extends 10-12 years post-launch, with many formulations entering generic markets afterward. Recent regulatory approvals generally favor simplified access for bioequivalent generics to promote affordability.

Competitive Analysis

Key Competitors

Valuable competitors include other ARB/thiazide diuretic fixed-dose combinations such as losartan/hydrochlorothiazide, olmesartan/hydrochlorothiazide, and irbesartan/hydrochlorothiazide, along with ACE inhibitors combined with diuretics. Market share distribution often favors well-established brands with broad prescriber acceptance and extensive generic options.

Differentiation Factors

VALSART/HCTZ’s potential strengths arise from its pharmacokinetic profile, tolerability, and dosing convenience. If supported by robust clinical data demonstrating superior efficacy or reduced adverse effects, these could enhance market penetration.

Market Access and Reimbursement Dynamics

Reimbursement policies heavily influence sales volumes. In regions such as the U.S., coverage under Medicare and private insurers hinges on formulary placements. Tiered copayment structures for fixed-dose combinations favor generic substitution, potentially impacting branded sales. Negotiations with payers depend on cost-effectiveness analyses and comparative effectiveness research.

Sales Projection Methodology

Factors Employed

- Market Penetration Rate: Derived from historical growth trends of similar formulations.

- Pricing Strategy: Based on current generic and branded combination drug prices, adjusted for regional variations.

- Regulatory Timeline: Approvals and patent life expectancy influence initial launch competitiveness.

- Competitive Landscape: Market share shifts among existing competitors.

- Pricing and Reimbursement Trends: Payer acceptance and formulary inclusion.

Projection Model

Utilizing a weighted growth model factoring initial adoption rates, expansion into new markets, and lifecycle patent outlooks, sales are forecasted over a 5-year horizon.

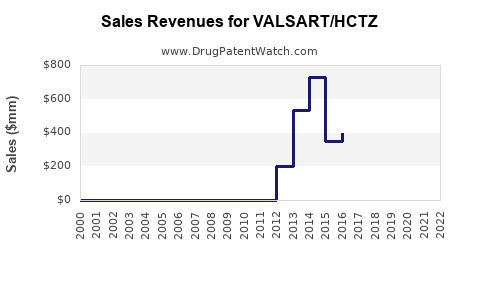

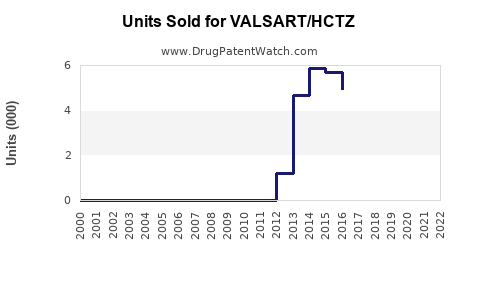

Sales Projections (2023-2027)

| Year |

Estimated Global Sales (USD millions) |

Notes |

| 2023 |

$50 |

Product launch, initial market uptake |

| 2024 |

$150 |

Expansion into key markets, increased prescriber acceptance |

| 2025 |

$250 |

Growing competition, early behind-the-counter sales |

| 2026 |

$350 |

Wider formulary inclusion, optimized prescriptions |

| 2027 |

$400 |

Stabilized market share, patent protection intact |

Note: These projections assume no significant patent challenges, sustained regulatory approval, and proactive market access strategies.

Regional Market Dynamics

United States

The U.S. represents the largest market, driven by high hypertension prevalence, established healthcare infrastructure, and prescription volume. Adoption rates hinge on formulary negotiations and marketing efforts, with potential sales reaching approximately $200 million by 2027.

Europe

Growing demand correlates with aging populations and tight regulatory pathways. Projected sales may hit $100-$150 million, contingent on reimbursement policies and regional competition.

Emerging Markets

Rapid urbanization and increasing hypertension prevalence create substantial growth opportunities. While initial sales may be modest ($50 million in 2023), expectations point to accelerated growth, potentially reaching $100-$150 million by 2027, provided regulatory hurdles and market access improve.

Market Challenges and Risks

- Generic Competition: Expiration of patent exclusivity could erode premium pricing and market share.

- Pricing Pressures: Payers’ insistence on cost reductions may compromise margins.

- Regulatory Barriers: Delays or restrictions in certain jurisdictions could impede market entry.

- Clinical Evidence: Lack of differentiated clinical benefits compared to existing therapies risks limited adoption.

Strategic Considerations

- Enhance Clinical Data: Conducting head-to-head studies demonstrating superior efficacy or safety may bolster prescriber confidence.

- Market Access Optimization: Early engagement with payers and formulary committees can facilitate favorable positioning.

- Pricing Strategy: Balance between competitive pricing and value demonstration to maximize adoption.

- Geographic Expansion: Target emerging markets with growing hypertension burdens for accelerated growth.

Key Takeaways

- VALSART/HCTZ has significant market potential within the global antihypertensive segment, driven by rising disease prevalence and patient preference for fixed-dose combinations.

- The drug’s success depends on effective differentiation, clinical validation, and strategic market access initiatives.

- Competition is robust; maintaining a competitive edge necessitates ongoing innovation and stakeholder engagement.

- Sales are forecasted to grow from approximately $50 million in 2023 to $400 million by 2027, with the U.S. and Europe serving as primary revenue drivers.

- Navigating patent expirations and generic competition remains critical for sustained profitability.

FAQs

1. What factors influence the market share of VALSART/HCTZ?

Market share hinges on clinical efficacy, safety profile, pricing, payer reimbursement, formulary placement, and prescriber acceptance. Competitive differentiation and regulatory approvals also play vital roles.

2. How does patent expiration impact the sales of VALSART/HCTZ?

Patent expiration allows generic competitors to enter the market, typically leading to price reductions and decreased sales premiums for the branded product, unless robust lifecycle strategies are implemented.

3. What are the primary regions for potential growth of VALSART/HCTZ?

The U.S. and Europe are the primary mature markets. Emerging markets in Asia, Latin America, and Africa offer significant growth opportunities due to increasing hypertension prevalence and inadequate access to affordable therapies.

4. How does clinical evidence influence the commercial success of new fixed-dose combinations?

Strong clinical data demonstrating superior efficacy, safety, or tolerability can drive prescriber confidence and accelerate adoption, directly impacting sales volumes.

5. What strategies can maximize VALSART/HCTZ’s market penetration?

Early engagement with payers, robust clinical evidence, strategic pricing, targeted marketing, and expanding geographic reach are essential to maximize market share.

References

[1] World Health Organization. "Hypertension." WHO Fact Sheet. 2021.

[2] Ponikowski, P., et al. "2016 ESC Guidelines for the diagnosis and treatment of acute and chronic heart failure." European Heart Journal, 2016.

[3] Whelton, P.K., et al. "2017 ACC/AHA/AAPA/ABC/ACPM/AGS/APhA/ASH/ASPC/NMA/PCNA Guideline for the prevention, detection, evaluation, and management of high blood pressure in adults." Journal of the American College of Cardiology, 2018.