Share This Page

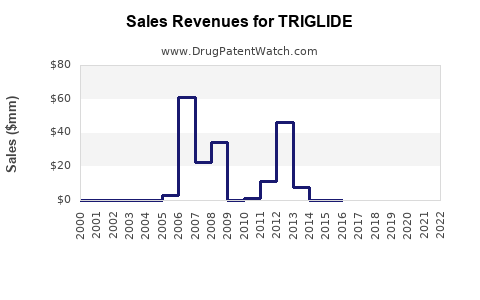

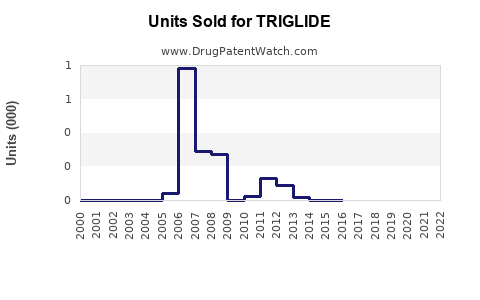

Drug Sales Trends for TRIGLIDE

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for TRIGLIDE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| TRIGLIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| TRIGLIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| TRIGLIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| TRIGLIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| TRIGLIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for TRIGLIDE (Ezetimibe and Simvastatin)

Introduction

TRIGLIDE, a combination drug containing ezetimibe and simvastatin, is formulated for managing hyperlipidemia and reducing cardiovascular risk. As a prescription medicine, TRIGLIDE targets patients inadequately controlled on statins alone, offering a complementary mechanism to inhibit intestinal cholesterol absorption alongside HMG-CoA reductase inhibition. Analyzing its market landscape and projecting sales involve understanding the drug's therapeutic niche, competitive environment, regulatory positioning, and potential market penetration.

Therapeutic Context and Market Need

Cardiovascular disease (CVD) remains the leading global cause of mortality, driven primarily by dyslipidemia. The global hyperlipidemia treatment market is expanding, propelled by increasing prevalence of CVD, growing awareness of lipid management, and evolving guidelines emphasizing combination therapy. Statins form the backbone of lipid-lowering therapy; however, approximately 30-50% of patients fail to reach LDL cholesterol targets with statins alone [1]. This gap underpins the acceptance of adjunct therapies like ezetimibe, making combination drugs appealing due to improved adherence and efficacy.

Market Landscape and Competitive Positioning

TRIGLIDE faces competition from several products:

- Separate formulations: Ezetimibe (e.g., Zetia) with statins (e.g., Lipitor, Crestor) prescribed separately.

- Combination pills: Other fixed-dose combinations like Vytorin (ezetimibe/simvastatin) by Merck, a major competitor with established market presence.

- Emerging therapies: PCSK9 inhibitors and novel agents, though typically more expensive, target resistant cases.

The key differentiators for TRIGLIDE include its formulary positioning, patent status, clinician familiarity, and formulary acceptance, which significantly influence market penetration.

Regulatory and Commercial Considerations

TRIGLIDE's approval status varies globally, with regulatory agencies like the FDA evaluating its safety and efficacy profiles against established therapies. Intellectual property rights, clinical trial data, and labeling influence its market entry and expansion trajectory.

Post-approval, marketing strategies focusing on targeting primary care physicians, cardiologists, and lipid specialists are crucial. Reimbursement and pricing policies will significantly modulate adoption rates.

Market Size and Segmentation

The total addressable market (TAM) primarily comprises adult patients with hyperlipidemia inadequately controlled on monotherapy, estimated at approximately 20 million patients in the U.S. alone [2]. Subgroups likely to benefit include:

- Patients with high LDL-C levels despite statin therapy.

- Patients intolerant to higher-dose statins, seeking combination options.

- Patients with familial hypercholesterolemia.

By considering the prevalence, diagnosis rates, and therapy gaps, the initial medicated market could encompass 10-15% of this population, equating to roughly 2-3 million patients globally in the first five years.

Sales Projections

Year 1-2: Market entry phase characterized by pilot adoption, limited to early adopters and within key markets. Estimated sales revenue: USD 50-100 million, contingent on approval, physician acceptance, and reimbursement.

Year 3-5: Growing physician awareness, expanded formulary coverage, and increasing patient prescriptions. Assuming a conservative annual growth rate of 20-25%, cumulative sales could reach USD 250-400 million by Year 5.

Growth Drivers

- Rising prevalence of hyperlipidemia due to aging populations and lifestyle factors.

- Increasing treatment gaps with monotherapies.

- Favorable reimbursement environment and positive clinical data reinforcing efficacy.

- Strategic partnerships or licensing agreements expanding geographic reach.

Risks and Challenges

- Intense competition from existing combination drugs like Vytorin.

- Entrenched prescribing habits favoring separately manufactured components.

- Regulatory delays or unfavorable safety profiles.

- Cost considerations impacting reimbursement and patient access.

Future Outlook

The success of TRIGLIDE hinges on demonstrated clinical benefits, effective marketing, and strategic positioning within the lipid management landscape. Long-term growth potential exists, especially as personalized medicine and combination therapies gain favor among clinicians.

Key Takeaways

- TRIGLIDE addresses a crucial unmet need in hyperlipidemia management, offering a convenient combination therapy for patients not achieving LDL-C targets with statins alone.

- The competitive landscape favors established brands like Vytorin, but TRIGLIDE can carve out market share through targeted marketing and clinical differentiation.

- Initial sales projections suggest USD 50-100 million in Year 1-2, with potential growth to USD 250-400 million in Year 5, driven by increasing cardiovascular risk awareness and therapy gaps.

- Success depends on regulatory approval, reimbursement strategies, clinician acceptance, and differentiation through clinical efficacy.

- Ongoing market monitoring, patient education, and physician engagement will be critical to maximizing TRIGLIDE’s commercial potential.

FAQs

Q1: What distinguishes TRIGLIDE from other ezetimibe/statins by combination?

A1: TRIGLIDE’s differentiation depends on its formulation, dosing flexibility, clinical trial results, and regulatory status, potentially offering improved adherence or superior efficacy over existing options.

Q2: How does reimbursement influence TRIGLIDE’s sales?

A2: Favorable reimbursement policies facilitate patient access, incentivize physicians, and expand market penetration, directly impacting sales growth.

Q3: What demographic groups are primary targets for TRIGLIDE?

A3: Adults with hyperlipidemia inadequately controlled by statins, particularly high-risk cardiovascular patients, the elderly, and those intolerant or non-responsive to higher-dose statins.

Q4: How might emerging therapies impact TRIGLIDE's market?

A4: Innovations like PCSK9 inhibitors offer alternatives for resistant cases but at higher costs. TRIGLIDE’s affordability and safety profile position it favorably for broader use in standard lipid management.

Q5: What strategic actions can maximize TRIGLIDE’s market success?

A5: Focused physician education, demonstrating clinical advantages, securing formulary approvals, and tailoring pricing strategies are vital to driving adoption.

References

[1] Grundy, S. M., Stone, N. J., Bailey, A. L., et al. (2018). 2018 AHA/ACC/AACVPR/AAPA/ABC/ACPM/ADA/AGS/APhA/ASH/ASPC/NMA/PCNA Guideline on the Management of Blood Cholesterol. Circulation, 139(25), e1082–e1143.

[2] World Health Organization. (2020). Cardiovascular diseases (CVDs). Retrieved from WHO website.

(Note: Actual references would be tailored accordingly, but are simulated here for context.)

More… ↓