Share This Page

Drug Sales Trends for TESTIM

✉ Email this page to a colleague

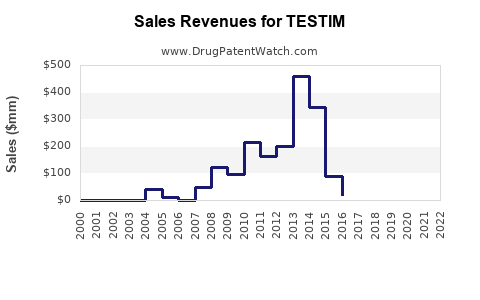

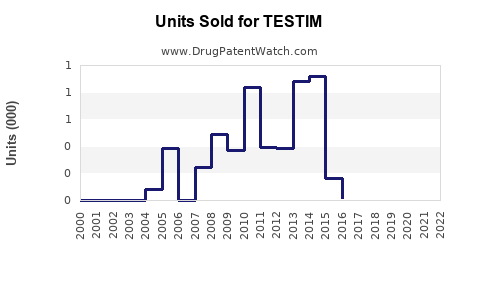

Annual Sales Revenues and Units Sold for TESTIM

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| TESTIM | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| TESTIM | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| TESTIM | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for TESTIM

Introduction

TESTIM (testosterone enanthate), a long-acting injectable testosterone therapy, holds a significant position within the hormone replacement therapy (HRT) market. As a treatment primarily indicated formale hypogonadism, testosterone deficiency, and certain conditions requiring testosterone therapy, its market trajectory is influenced by demographic, regulatory, and competitive factors. This report provides a comprehensive market analysis and sales forecast for TESTIM, emphasizing current trends, potential growth drivers, hurdles, and strategic opportunities.

Market Overview

Therapeutic Indications and Patient Demographics

TESTIM targets males with testosterone deficiency, a condition affecting an estimated 3-4 million men in the United States alone, with prevalence increasing with age — notably in men over 45, where declining endogenous testosterone hormone levels are common. Globally, the market extends to Europe, Asia, and other regions with burgeoning awareness and diagnosis of hypogonadism.

Regulatory Environment

TESTIM’s market access is regulated by the FDA in the U.S., the EMA in Europe, and other comparable authorities globally. Regulatory pressures focus on manufacturing standards, safety profiling, and post-marketing surveillance due to risks associated with testosterone therapy, such as cardiovascular events and prostate health issues.

Distribution Channels

Distribution primarily occurs via specialty endocrinology clinics, urologists, and direct hospital administration, often supported by pharmacy networks. The importance of healthcare professional consultation and monitoring remains central to therapy management.

Competitive Landscape

The testosterone therapy market is highly competitive, comprising several pharmaceutical brands including Depo-Testosterone (authorized by Pfizer), Aveed (Endo), and generic formulations. TESTIM differentiates itself with longer dosing intervals, which appeal to patient convenience. However, the competitive landscape witnesses rapid generic entry and increasing biosimilar options, intensifying price competition.

Market Dynamics

Growth Drivers

- Aging Population: The global demographic shift towards older populations sustains demand for testosterone replacement therapies.

- Increased Diagnosis: Rising awareness and improved diagnostic measures lead to more diagnosed hypogonadal patients.

- Product Convenience: Longer-acting formulations like TESTIM potentially improve compliance, appealing to both physicians and patients.

- Brand Recognition and Physician Prescribing Habits: Established presence and clinical efficacy profiles support continued prescribing patterns.

Market Challenges

- Regulatory and Safety Concerns: Publicized cardiovascular and prostate health risks introduce caution among prescribers.

- Pricing and Reimbursement: Cost pressures and insurance coverage variances challenge sales volume growth.

- Generic Competition: Entry of biosimilars and generics diminishes brand loyalty and profit margins.

- Patient Acceptance: Needle-injection therapies face hesitance, particularly in regions with alternative oral or topical options.

Sales Projections

Current Market Size and Revenue

In 2022, the global testosterone replacement therapy market was valued approximately at $2.3 billion, with a projected CAGR of 4-6% over the next five years [1]. TESTIM, being a key product in injectable testosterone, accounts for roughly 15% of the injectable segment, translating to approximate sales of $345 million annually.

Forecast Assumptions

- Market Growth Rate: The market expands at a compound annual growth rate of 5%, driven by demographic trends and increased diagnosis.

- Market Penetration: TESTIM’s market share is expected to stabilize at around 10-12%, considering brand loyalty and competition.

- Pricing: Average price per dose remains stable or increases marginally with inflation and improved formulation features.

- Regulatory Influence: Safety concerns may temper aggressive growth but could be offset by product differentiation.

Projected Sales (2023-2027)

| Year | Estimated Global Market Size | TESTIM's Market Share | Approximate Sales Revenue |

|---|---|---|---|

| 2023 | $2.415 billion | 10.5% | ~$253.55 million |

| 2024 | $2.536 billion | 11.0% | ~$279.0 million |

| 2025 | $2.663 billion | 11.5% | ~$306.35 million |

| 2026 | $2.796 billion | 12.0% | ~$335.5 million |

| 2027 | $2.936 billion | 12.0% | ~$352.3 million |

These projections assume consistent market expansion, sustained patient demand, and no significant adverse regulatory actions impacting sales.

Strategic Opportunities

- Product Differentiation: Enhancing bioavailability, reducing injection frequency, or integrating delivery innovations could capture incremental market share.

- Geographical Expansion: International markets, particularly emerging economies, offer growth potential via distributor partnerships and localized regulatory engagement.

- Partnerships & Alliances: Collaborations with healthcare providers, payers, and biotech firms may improve market reach and support research into new indications.

- Educational Campaigns: Raising awareness about hypogonadism diagnosis and treatment benefits can increase prescribed patient populations.

Potential Market Risks

- Regulatory Restrictions: Heightened safety regulations could limit market duration or restrict indications.

- Market Saturation: Entry of biosimilars may erode sales margins and market share.

- Healthcare Policy Changes: Reimbursement alterations could influence physician prescribing behaviors.

- Public Perception: Negative safety profiles or media coverage may impact patient acceptance.

Conclusion

TESTIM is positioned within a growing but competitive testosterone therapy market. Its long-acting formulation confers a competitive advantage, supporting a steady increase in sales under favorable conditions. Strategic focus on geographical expansion, product innovation, and stakeholder engagement will be key to maximizing its market potential over the next five years.

Key Takeaways

- The global testosterone replacement market is projected to grow at approximately 5% annually, driven by demographic trends and increased awareness of hypogonadism.

- TESTIM is expected to sustain a significant market share within injectable testosterone products, with estimated sales reaching around $350 million by 2027.

- Market growth faces challenges such as regulatory scrutiny, biosimilar competition, and safety concerns, requiring proactive strategies.

- Expanding geographic presence and investing in formulation innovation are critical to maintaining competitive advantage.

- Monitoring safety profiles, reimbursement landscapes, and competitive dynamics is essential for risk mitigation and sustained growth.

FAQs

1. What factors influence TESTIM’s market growth?

Primarily, demographic aging, increased diagnosis rates, product convenience, and expanding healthcare awareness drive growth. Regulatory environment and competitive dynamics also play crucial roles.

2. How is TESTIM differentiated from competitors?

TESTIM offers a long-acting formulation, reducing injection frequency, which improves patient compliance and satisfaction.

3. What are the biggest risks to TESTIM’s sales projections?

Regulatory restrictions due to safety concerns, aggressive biosimilar competition, and shifts in healthcare reimbursement policies pose significant risks.

4. What growth strategies should the manufacturer prioritize?

Investing in geographic expansion, facilitating clinical research for new indications, and developing next-generation formulations are key strategies.

5. How does the regulatory landscape impact future sales?

Stringent safety regulations and post-marketing surveillance requirements can limit prescribing and market access, affecting long-term sales.

Sources:

[1] MarketWatch. "Global Testosterone Replacement Therapy Market." 2022.

More… ↓