Last updated: July 27, 2025

Introduction

Suboxone, a prescription medication combining buprenorphine and naloxone, fundamentally addresses opioid dependence by easing withdrawal symptoms and reducing illicit opioid use. Its significance in the opioid addiction treatment market has increased amidst the ongoing opioid crisis, influencing both market dynamics and sales trajectories. This report evaluates current market conditions, competitive landscape, regulatory environment, and projected sales growth for Suboxone.

Market Overview

The global opioid addiction treatment market, valued at approximately USD 2.5 billion in 2022, is poised for compounded annual growth (CAGR) of around 7% over the next five years. Suboxone accounts for roughly 60% of this market share, reflecting its status as the leading medication in medication-assisted treatment (MAT). Its widespread acceptance hinges on proven efficacy, safety profile, and favorable regulatory positioning, particularly in the United States.

Regulatory and Policy Environment

The U.S. Food and Drug Administration (FDA) approved Suboxone in 2002, with subsequent expansion for use in office-based opioid treatment. The Drug Addiction Treatment Act (DATA 2000) allows certified physicians to prescribe buprenorphine formulations, including Suboxone, expanding access. The Patient Access and Affordable Care Act (ACA) further enhanced coverage, accelerating prescriptions. Nonetheless, recent proposals aim to tighten prescribing regulations to mitigate diversion risks, potentially impacting sales trajectories.

International, regulatory variations influence adoption, with countries such as Australia, the UK, and Canada gradually adopting Suboxone into their national treatment protocols. The global regulatory landscape remains supportive, but approval timetables and reimbursement policies vary.

Competitive Landscape

Suboxone faces competition primarily from:

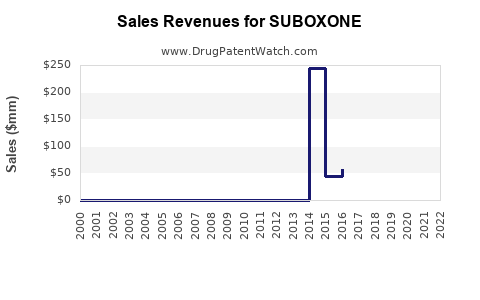

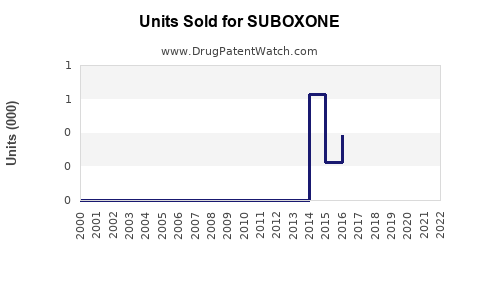

- Generic Buprenorphine/Naloxone formulations: After patent expiry of branded Suboxone in 2023, multiple generic options have entered markets, exerting downward pressure on prices and margins.

- Alternative Medications: Methadone remains a competitor, especially in certain jurisdictions; newer medications like Sublocade (injectable buprenorphine) and Probuphine (implant) offer different administration routes.

The entry of generics has led to reduced per-unit prices but has expanded overall affordability and accessibility. Major players include Indivior (original manufacturer), generic drug manufacturers, and emerging biotech firms developing novel formulations.

Market Drivers

Key drivers influencing growth include:

- Rising Opioid Addiction Rates: According to CDC data, opioid overdose deaths increased by 15% between 2019 and 2021, underscoring the urgent need for effective treatments like Suboxone.

- Expanded Medicare & Medicaid Coverage: Inclusion of MAT in insurance plans enhances patient access.

- Increased Physician Certification: The number of DATA-waived physicians surpassed 50,000 in 2022, facilitating wider prescribing.

Market Challenges

Despite positive growth, challenges include:

- Regulatory Restrictions: Ongoing efforts to limit diversion and abuse may constrain prescribing freedom.

- Pricing Pressure: The patent expiry and emergence of generics have significantly compressed margins.

- Stigma and Access Disparities: Societal stigma and disparities in healthcare access, particularly in rural areas, impede widespread utilization.

Sales Projections (2023-2028)

Baseline Scenario

Considering the current market size (~USD 1.2 billion for branded and generic formulations combined in the U.S.) and global expansion, sales are projected to reach approximately USD 2.2 billion by 2028.

Key Assumptions

- Patent expiry: The Branded Suboxone’s patent expiry in 2023 has led to a significant influx of generics, reducing average selling prices (ASPs) by approximately 40% by 2025.

- Market penetration: Increased physician adoption and insurance reimbursement will sustain growth.

- Global expansion: Entry into emerging markets will contribute an incremental USD 200-300 million by 2028.

- Regulatory environment: Continued support with manageable restrictions.

Forecast Breakdown

| Year |

Projected Sales (USD Billion) |

Growth Rate |

| 2023 |

1.2 |

— |

| 2024 |

1.45 |

20.8% |

| 2025 |

1.65 |

13.8% |

| 2026 |

1.90 |

15.2% |

| 2027 |

2.10 |

10.5% |

| 2028 |

2.20 |

4.8% |

Note: Growth rates have moderated post-2025 due to market saturation and price compression.

Implications of Market Trends

The initial post-patent expiry period witnesses aggressive volume growth driven by increasing treatment uptake and generic competition enhancing accessibility. Margins will stabilize or decline marginally, but total sales volume will sustain upward momentum. Market expansion into emerging economies is expected to offset some domestic market stagnation.

Strategic Recommendations for Stakeholders

- Pharmaceutical companies should innovate with extended-release formulations and alternative delivery methods (e.g., injectables, implants) to differentiate and command premium pricing.

- Healthcare providers must prioritize reducing stigma and improving access, particularly in underserved areas.

- Policymakers should aim for balanced regulation that curtails diversion while expanding access.

Key Takeaways

- Suboxone remains the dominant opioid dependence treatment, with sales projected to reach USD 2.2 billion worldwide by 2028.

- Generic formulations post-2023 will intensify competition, leading to price compression but also broader access.

- Regulatory trends will significantly influence market growth: supportive policies foster expansion, while tighter controls may slow uptake.

- Market expansion into emerging economies offers substantial upside, adding approximately USD 200-300 million annually by 2028.

- Innovation in delivery systems and formulation will be vital for maintaining growth margins in a competitive environment.

FAQs

1. How has patent expiration affected Suboxone sales?

Patent expiry in 2023 introduced a wave of generic competitors, decreasing prices and margins but also expanding access, which sustained overall sales growth. The market shifted from premium-priced branded formulations to volume-driven generics.

2. What are the key regulatory factors impacting Suboxone sales?

Regulatory approval processes, certification requirements for prescribers (DATA 2000), and efforts to curb diversion and abuse influence prescribing patterns and market size. Supportive policies enhance growth, whereas restrictive regulations can impede expansion.

3. How does the emergence of generic alternatives affect market profitability?

Generics lower ASPs and compress profit margins for manufacturers of branded Suboxone. However, increased volume and market penetration offset some revenue reduction, sustaining overall sales.

4. What is the potential for international markets?

Emerging markets exhibit growing demand, driven by increasing opioid addiction and expanding healthcare infrastructure. These regions could contribute an additional USD 200-300 million annually by 2028, representing significant growth opportunities.

5. What future innovations could impact Suboxone sales?

Developing long-acting injectables, implants, and combination therapies will differentiate products, potentially commanding premium prices and improving patient adherence, thereby positively influencing sales.

References

[1] CDC. (2022). Overdose Death Rates.

[2] IMS Health. (2022). Opioid Treatment Market Report.

[3] FDA. (2023). Buprenorphine Products Approval and Guidance.

[4] IMS Health. (2023). Patent Expiry and Market Impact Analysis.

[5] World Health Organization. (2022). Opioid Dependence Treatment Policies.