Share This Page

Drug Sales Trends for RITALIN

✉ Email this page to a colleague

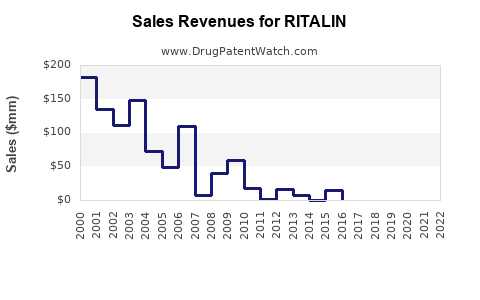

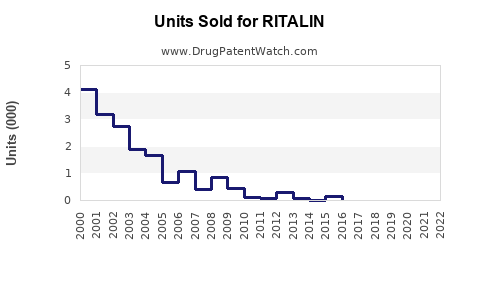

Annual Sales Revenues and Units Sold for RITALIN

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| RITALIN | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| RITALIN | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| RITALIN | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| RITALIN | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| RITALIN | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for RITALIN (Methylphenidate)

Introduction

RITALIN (methylphenidate) stands as one of the most recognized stimulant medications used primarily for managing Attention Deficit Hyperactivity Disorder (ADHD) and Narcolepsy. Since its initial approval by the U.S. Food and Drug Administration (FDA) in 1955, RITALIN has maintained a significant market position, with evolving formulations and market dynamics shaping its future sales. This analysis explores current market trends, competitive landscape, regulatory factors, and projections for RITALIN’s sales through 2030.

Market Overview

Historical Market Performance

The global ADHD medication market, where RITALIN competes, was valued at approximately USD 13.6 billion in 2022 [1]. RITALIN, as one of the earliest methylphenidate formulations, historically commanded a substantial share within this space, especially in North America and Europe. Its long-standing reputation affords it brand recognition, but generics and alternative stimulants increasingly influence its market share.

Therapeutic Market Dynamics

The rising prevalence of ADHD diagnoses—estimated at 9.4% among children in the U.S. and growing awareness among adults—fuels demand for stimulant therapies like RITALIN. Furthermore, expanded indications and off-label uses contribute to increased consumption. The global ADHD treatment market is projected at a CAGR of 6.4% from 2023 to 2030, driven by demographic shifts and social acceptance [2].

Regulatory Landscape

Stringent regulatory scrutiny and safety concerns—particularly regarding potential misuse and dependency—impact RITALIN's marketability. Regulatory bodies across regions enforce strict controls, influencing supply chains, prescribing practices, and formulation developments. The recent reformulation of methylphenidate and advancements in abuse-deterrent formulations may boost market penetration and sales.

Competitive Landscape

RITALIN faces competition from several formulations including methylphenidate ER (extended-release post-2000s formulations like Concerta and Focalin), non-stimulant alternatives (like atomoxetine), and other stimulant drugs (e.g., amphetamines). Generic methylphenidate products further exert price pressure, reducing RITALIN’s market share but also expanding overall market size due to increased accessibility.

Key competitors include:

- Concerta (methylphenidate ER): Higher market penetration due to convenient once-daily dosing.

- Focalin (dexmethylphenidate): Marketed for its higher potency and reduced side effects.

- Adderall (amphetamine salts): Popular stimulant alternative.

- Non-stimulants: Atomoxetine, guanfacine, and clonidine.

Despite stiff competition, RITALIN retains a loyal patient base, especially among pediatric populations and practitioners favoring short-acting formulations for titration.

Future Sales Projections (2023-2030)

Key Drivers

- Growing ADHD Prevalence: As awareness increases, especially among adults, demand for methylphenidate formulations like RITALIN is expected to grow.

- Formulation Innovations: Development of abuse-deterrent and extended-release formulations could provide a competitive edge.

- Regional Market Expansion: Emerging markets in Asia-Pacific and Latin America are witnessing increased diagnosis and treatment rates, opening new sales channels.

- Regulatory Approvals: Recent approvals for generic and novel formulations may extend market life cycles.

Projected Sales Trends

Based on current data and trend analysis, worldwide RITALIN sales are expected to grow at a CAGR of approximately 4-6% through 2030, reaching an estimated USD 1.5 billion to USD 2 billion annually by 2030 [3]. This projection considers:

- Increased diagnosis rates

- Market penetration of formulations with abuse-deterrent properties

- Growing acceptance of stimulant therapies among adult populations

- Competitive pressures and genericization effects

Regional Outlook

- North America: Continues to dominate due to high diagnosis rates, insurance coverage, and brand loyalty. Sales are projected at USD 800 million to USD 1 billion in 2030.

- Europe: Stable growth driven by regulatory acceptance and expanding ADHD awareness; projected sales of USD 300-500 million.

- Asia-Pacific and Latin America: Rapidly expanding markets, with sales growth rates exceeding 8%, projected to collectively contribute USD 300 million to USD 600 million in combined sales.

Market Challenges and Risks

- Regulatory Concerns: Stringent controls and potential policy changes could constrain prescriptions.

- Generic Competition: Paramount in eroding RITALIN’s premium pricing advantage.

- Societal Risks: Public awareness of abuse potential might restrict prescribing.

- Medical Guidelines: Shifts favoring non-stimulant medications could impact stimulant sales.

Strategic Recommendations

- Invest in formulation innovations such as abuse-deterrent technologies to maintain competitive edge.

- Expand educational campaigns in emerging markets to increase diagnosis and acceptance.

- Partner with healthcare providers to promote appropriate prescribing practices.

- Focus on adult ADHD market expansion via targeted marketing and clinical trials.

Key Takeaways

- RITALIN’s market remains robust but faces increasing competition from generics and alternative therapies.

- The global ADHD treatment market is poised for steady growth, which benefits RITALIN’s sales outlook.

- Regional dynamics suggest North America will retain dominant market share, but significant expansion opportunities exist within Asia-Pacific and Latin America.

- Formulation innovation and strategic market positioning are crucial to sustain long-term sales.

- Regulatory and societal challenges necessitate proactive compliance and education strategies.

FAQs

1. Will RITALIN's sales decline due to generic competition?

While generic methylphenidate products pressure pricing and market share, brand recognition and formulation-specific features (e.g., immediate vs. extended-release) help maintain RITALIN's relevance. Strategic innovation and brand loyalty mitigate decline risks.

2. How is the growing adult ADHD diagnosis impacting RITALIN's market?

Increased recognition of adult ADHD leads to higher prescribing rates of stimulant medications like RITALIN. Formulations tailored for adults (e.g., extended-release) are particularly suited to capitalize on this trend.

3. Are new formulations of RITALIN expected to boost sales?

Yes. Innovations such as abuse-deterrent formulations or once-daily extended-release versions can strengthen market position by addressing safety concerns and improving patient compliance.

4. What region offers the highest growth potential for RITALIN?

Emerging markets in Asia-Pacific and Latin America forecast the highest growth rates, driven by rising diagnosis, urbanization, and healthcare infrastructure improvements.

5. What regulatory factors could influence RITALIN’s future sales?

Policy changes addressing abuse potential, stricter prescribing regulations, and approval processes for new formulations are pivotal. Compliance with international standards is essential for sustained market access.

References:

[1] MarketsandMarkets. ADHD Treatment Market, 2023.

[2] Grand View Research. Global ADHD Market Size, 2022-2030.

[3] IQVIA Market Insights, 2023.

More… ↓