Last updated: July 29, 2025

Introduction

Levocetirizine, a third-generation antihistamine, is primarily used to treat allergic rhinitis and chronic idiopathic urticaria. Market dynamics for levocetirizine are driven by increasing prevalence of allergic conditions, expanding therapeutic use, and broadening geographical accessibility. This report provides a comprehensive market analysis and sales forecast for levocetirizine, emphasizing key factors influencing growth, competitive landscape, and projected revenue across regions for the next five years.

Market Landscape

Global Demand and Epidemiological Trends

The rising global prevalence of allergic rhinitis affects approximately 10-30% of the population worldwide, with a significant burden in Asia-Pacific and North America [1]. The World Health Organization (WHO) highlights environmental factors, urbanization, and air pollution as exacerbating allergy rates. The chronic nature of allergic rhinitis and urticaria necessitates long-term pharmacotherapy, supporting steady demand for non-sedating antihistamines like levocetirizine.

Product Profile and Therapeutic Positioning

Levocetirizine, marketed under brands such as Xyzal, enjoys a favorable profile owing to its high efficacy, minimal sedative effects, and suitability for both adult and pediatric populations. The increasing preference for second-generation antihistamines over sedating counterparts enhances levocetirizine's market penetration.

Regulatory and Manufacturing Landscape

Major pharmaceutical players possess generic and branded formulations of levocetirizine, supported by global regulatory approvals. Stringent patent expirations in key markets have led to a proliferation of generics, intensifying competition but also expanding access.

Market Drivers

- Rising Allergic Disease Incidence: Urbanization and pollution accelerate allergic conditions, fueling demand.

- Expanding Age Demographics: Use in pediatric and elderly populations broadens market scope.

- Brand and Generic Competition: Availability of multiple formulations reduces prices and increases adoption.

- Healthcare Infrastructure Improvement: Enhanced healthcare access in emerging markets enables greater prescription rates.

- Product Innovation: Development of combination therapies incorporating levocetirizine enhances therapeutic options.

Market Challenges

- Generic Competition Pressure: Price erosion due to multiple generic entries.

- Regulatory Variations: Differing approval statuses and patent protections across regions.

- Pricing and Reimbursement Policies: Cost containment measures may limit market growth.

- Local Preference and Prescription Habits: Variability hampers uniform adoption.

Regional Market Overview

North America

The North American market exhibits high penetration owing to established healthcare infrastructure and widespread awareness. The U.S. accounts for approximately 70% of North American sales, driven by patent expirations and robust OTC availability.

Europe

Europe demonstrates considerable market maturity, with significant adoption in Germany, France, and the UK. Regulatory frameworks favor generic proliferation, supporting price competition.

Asia-Pacific

This region represents the fastest-growing segment, propelled by rising allergy prevalence, expanding pharmaceutical manufacturing, and increasing healthcare access. Countries like India, China, and Japan are key contributors.

Latin America and Middle East & Africa

Emerging markets exhibit promising growth, although smaller in size. Cost sensitivities and regulatory challenges temper the pace.

Competitive Landscape

Major pharmaceutical firms such as Sanofi (Xyzal), Sandoz, Teva, and Mylan dominate the market through generics and branded formulations. The entry of biosimilars and new antihistamine agents may pose future competition.

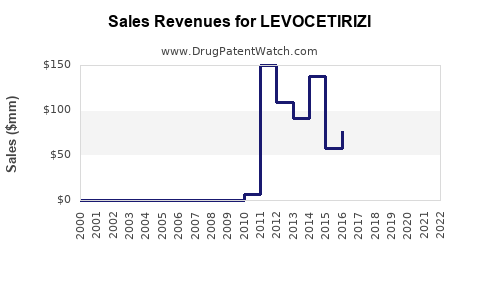

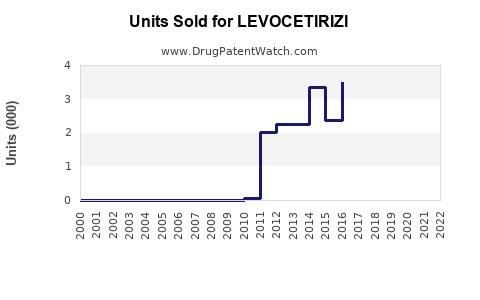

Sales Projections (2023-2028)

Methodology

Forecasts are derived from compound annual growth rate (CAGR) models, considering epidemiological data, market penetration rates, pricing trends, and regulatory developments, informed by industry reports and filings.

Assumptions

- CAGR of 4.5% globally, driven predominantly by Asia-Pacific expansion.

- US market growth at a modest 2.5%, maintaining saturation.

- Europe and North America experiencing slow growth (~2%), stabilizing due to market maturity.

- Generics capturing over 65% of sales by 2025, exerting downward price pressure.

Projected Revenue

| Year |

Global Market Size (USD Billion) |

Estimated Sales of Levocetirizine (USD Billion) |

| 2023 |

2.8 |

1.4 |

| 2024 |

3.0 |

1.55 |

| 2025 |

3.2 |

1.65 |

| 2026 |

3.4 |

1.75 |

| 2027 |

3.7 |

1.87 |

| 2028 |

4.0 |

2.0 |

Note: These figures represent estimated OTC and prescription-based sales, incorporating generic and branded formulations.

Key observation: The ongoing patent expirations and increasing use in emerging markets likely provide a steady sales trajectory, with Asia-Pacific leading growth.

Strategic Recommendations

- Product Differentiation: Focus on formulations with improved bioavailability and combination therapies.

- Market Expansion: Tailored strategies for emerging markets with growing allergy burdens.

- Pricing Optimization: Balance between competitive pricing and maintaining margins amid generic proliferation.

- Regulatory Engagement: Fast-tracking approvals and conducting local clinical studies could expedite market access.

- Partnerships: Collaborations with local manufacturers and distributors enhance market reach.

Conclusion

Levocetirizine maintains a strong position within the antihistamine market, buoyed by escalating allergy prevalence and expanding therapeutic use. While challenges from generics and pricing pressures exist, strategic focus on emerging markets and innovation can sustain growth. The forecast indicates a healthy CAGR, positioning levocetirizine as a valuable agent in allergy management over the next five years.

Key Takeaways

- The global levocetirizine market is projected to grow at approximately 4.5% CAGR through 2028.

- Asia-Pacific is the primary driver, with rising allergy prevalence and expanding healthcare infrastructure.

- Patent expirations and increased generic availability pressure US and European markets but also widen access.

- Innovation in formulations and strategic regional expansion will optimize sales potential.

- Market players should monitor regulatory trends and pricing environments to adapt strategies accordingly.

FAQs

Q1: What factors are driving the increased adoption of levocetirizine globally?

A1: The rising global prevalence of allergic rhinitis and urticaria, coupled with levocetirizine’s favorable safety profile, minimal sedation, and OTC availability in many regions, are primary drivers.

Q2: How do patent expirations impact levocetirizine sales?

A2: Patent expirations lead to an influx of generics, increasing market competition, reducing prices, and expanding access, which can initially reduce branded sales but also enlarge overall market volume.

Q3: Which regions present the most growth opportunities for levocetirizine?

A3: The Asia-Pacific region offers the most substantial growth prospects due to increasing allergy prevalence and improving healthcare infrastructure.

Q4: What challenges could impede the growth of levocetirizine markets?

A4: Challenges include intense generic competition, price pressure, regulatory variations, and changes in healthcare reimbursement policies.

Q5: Will new antihistamines threaten levocetirizine's market share?

A5: Potentially, as new agents with enhanced efficacy or convenience could capture segments; however, levocetirizine's established efficacy and safety support its continued prominence.

References

[1] World Health Organization. (2022). World Allergy Organization Epidemiology Reports.