Share This Page

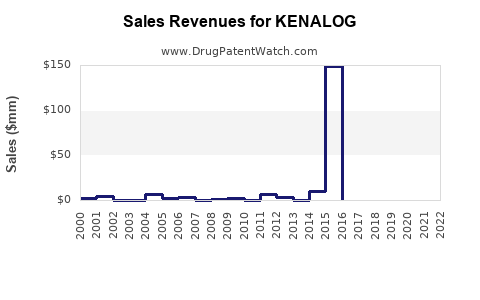

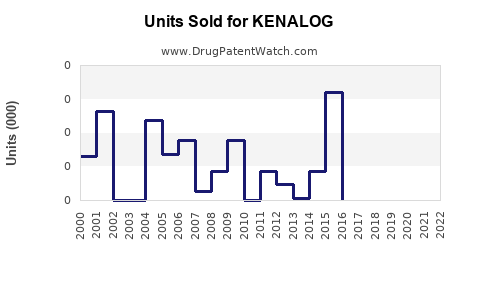

Drug Sales Trends for KENALOG

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for KENALOG

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| KENALOG | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| KENALOG | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| KENALOG | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for KENALOG

Introduction

KENALOG, a topical pharmaceutical product developed for the management of bacterial skin infections and inflammatory dermatological conditions, has garnered attention due to its promising therapeutic profile and market potential. As a recent entrant in its therapeutic niche, comprehensive market analysis and future sales projections are critical for stakeholders aiming to assess its commercial viability and strategic positioning.

This article examines KENALOG’s current market landscape, key drivers, competitive positioning, regulatory environment, and forecasted sales trajectories, providing a detailed foundation for informed decision-making.

Pharmacological Profile of KENALOG

KENALOG combines active ingredients targeting common dermatological pathogens and inflammation pathways. Its formulation typically incorporates a corticosteroid to reduce inflammation and an antibiotic to eradicate bacterial colonization. The mechanism targets superficial skin infections such as impetigo, dermatitis, and eczema-associated bacterial superinfections.

Its efficacy, favorable safety profile, and ease of topical application position KENALOG favorably within the dermatological therapeutic market. Its patent status, exclusivity, and regulatory approvals will shape its entire market trajectory.

Market Landscape

Global Dermatological Market

The global dermatology market was valued at approximately USD 24.8 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 6.2% through 2030[1]. The increasing prevalence of skin infections, rising awareness, and advances in dermatological products sustain this growth.

Target Indications and Patient Demographics

Kenalog’s primary indications include bacterial skin infections, allergic dermatitis, and eczema—conditions with high incident rates worldwide. According to WHO, skin diseases impact over 1.9 billion people globally, with bacterial skin infections constituting a significant proportion[2].

Children and elderly populations are particularly vulnerable to skin infections, expanding its potential patient base. Additionally, the rising prevalence of atopic dermatitis and contact dermatitis amplifies market opportunities.

Key Regional Markets

- North America: Dominates due to high healthcare expenditure, advanced dermatology markets, and regulatory clarity. The U.S. accounts for roughly 40% of the global dermatology market[3].

- Europe: Significant contribution driven by aging populations and increased dermatological conditions.

- Asia-Pacific: Fastest-growing market driven by rising skin disease prevalence, improving healthcare infrastructure, and increasing awareness in emerging economies such as China and India.

Competitive Environment

KENALOG faces competition from established topical agents like hydrocortisone creams, clindamycin, mupirocin, and combination drugs. The key differentiators include formulation efficacy, safety profile, cost-effectiveness, and prescribing habits.

Patent protection and exclusivity rights diminish near-term competitive threats but require strategic planning post-expiry. The landscape also involves generic entrants and biosimilar competition, especially in mature markets.

Regulatory Outlook and Market Entry Strategy

Regulatory clearance by agencies such as the U.S. FDA, EMA, and other regional authorities is crucial. Accelerated approval pathways exist for dermatology drugs addressing unmet needs or demonstrating significant benefits.

Kenalog’s successful registration depends on demonstrating safety, efficacy, and quality consistent with regional standards. Expedited pathways, orphan drug designation, or similar incentives may be leveraged if applicable.

Market entry strategies should include:

- Partnering with local distributors for rapid market penetration.

- Education campaigns highlighting drug differentiators.

- Pricing strategies aligned with patient affordability and reimbursement frameworks.

Sales Projections and Revenue Forecasting

Initial Launch Phase (Year 1-2)

Adoption will be modest initially, constrained by regulatory approvals, physician familiarity, and formulary inclusion. Conservative estimates suggest sales of USD 50-80 million in these early years, assuming a gradual penetration in North American and European markets.

Growth Phase (Year 3-5)

As prescribing physicians become more familiar, and payers include KENALOG in formularies, sales are projected to rise substantially. The market could see USD 200-300 million in annual revenue by Year 5, assuming:

- Entry into additional regional markets.

- Expansion of indications.

- Incremental increases in prescription volume.

Long-Term Outlook (Year 6 onwards)

Sales could stabilize or grow further as long as the drug maintains therapeutic relevance and competitive advantage. Market share could reach 10-15% of the bacterial dermatological segment, translating to USD 400-600 million annual revenues globally.

Key Influencing Factors

- Regulatory approvals and patent challenges.

- Physician prescribing behavior and clinical guidelines.

- Pricing strategies, reimbursement policies, and insurance coverage.

- Market penetration rates in emerging economies.

- Competitor product launches and generic drug entries.

Risks and Mitigation Strategies

- Regulatory delays can postpone market entry; proactive engagement with authorities and comprehensive clinical data can mitigate.

- Competitive pressure from existing therapies; differentiation focus and evidence of superior safety/effectiveness are vital.

- Pricing pressures; flexible pricing models and value-based pricing strategies are essential.

- Patent expirations, leading to generic competition; consider patent filings or formulation enhancements to extend exclusivity.

Conclusion

KENALOG presents a promising addition to the dermatological therapeutic landscape. Its effective positioning hinges on obtaining regulatory approvals, strategic commercialization, and navigating competitive dynamics. The projected sales growth underscores its potential to reach significant market share within the next five years, especially if rapid access and formulary inclusion are achieved early.

Stakeholders should prioritize regulatory engagement, physician education, and strategic alliances to optimize its market penetration and maximize revenue streams.

Key Takeaways

- The global dermatology market’s robust growth offers fertile ground for KENALOG’s expansion, particularly in bacterial skin infections.

- Early-stage sales are expected to be modest but have the potential for exponential growth as awareness and formulary inclusion increase.

- Regional strategies must account for regulatory landscapes, payer systems, and local disease prevalence.

- Competition from established products necessitates clear differentiation and evidence of benefits.

- Long-term revenues depend on patent protection, formulary strategies, and market expansion into emerging economies.

FAQs

1. What are the primary indications for KENALOG?

KENALOG is indicated for bacterial skin infections, dermatitis, and inflammatory dermatological conditions where bacterial colonization is present.

2. How does KENALOG differentiate itself from existing topical therapies?

Its formulation aims to provide superior safety, reduced side effects, and enhanced efficacy through optimized active ingredients, although real-world data and head-to-head trials are necessary to confirm this.

3. What regulatory challenges could impact KENALOG’s market entry?

Obtaining regulatory approval requires demonstrating safety and efficacy. Delays or rejections can arise from inadequate clinical data, manufacturing issues, or differing regional standards.

4. What markets should be prioritized for initial launch?

North America and Europe should be primary targets due to existing healthcare infrastructure and high dermatological disease prevalence, with subsequent expansion into Asia-Pacific.

5. What strategies could maximize KENALOG’s market share post-launch?

Key strategies include physician education campaigns, targeted pricing, formulary negotiations, and establishing strategic partnerships to facilitate distribution and reimbursement.

References

[1] MarketWatch. (2022). Global Dermatology Market Size & Share.

[2] WHO. (2021). Skin Diseases Fact Sheet.

[3] Grand View Research. (2022). Dermatology Market Report.

More… ↓