Share This Page

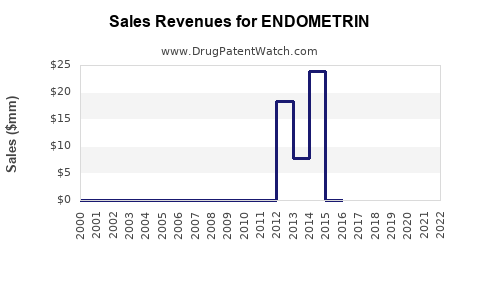

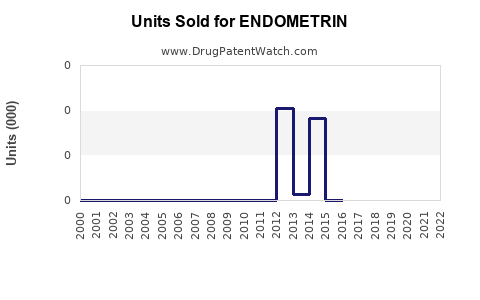

Drug Sales Trends for ENDOMETRIN

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for ENDOMETRIN

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ENDOMETRIN | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ENDOMETRIN | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ENDOMETRIN | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| ENDOMETRIN | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| ENDOMETRIN | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for ENDOMETRIN (Progesterone Vaginal Insert)

Introduction

ENDOMETRIN, a vaginal insert formulation of progesterone, is primarily employed to support pregnancy in women undergoing assisted reproductive technologies (ART), such as in-vitro fertilization (IVF). Its pharmacological class plays a pivotal role in luteal phase support, preventing early pregnancy loss and supporting embryo implantation. As an established product, understanding its market dynamics, competitive landscape, and future revenue potential is essential for stakeholders ranging from pharmaceutical companies to investors and healthcare policymakers.

Market Overview

Global Fertility Treatment Market Context

The global fertility market is expanding significantly due to increasing infertility prevalence, societal shifts towards delayed childbearing, and advancements in reproductive medicine. The fertility market was valued at approximately USD 18.4 billion in 2022 and is projected to grow at a CAGR of 10% through 2030 (Grand View Research). Within this broad landscape, hormone therapy products like ENDOMETRIN occupy an essential niche, primarily serving clinics performing IVF and related treatments.

Key Therapeutic Segment

ENDOMETRIN targets the luteal phase support segment within fertility treatment, where progesterone supplementation enhances implantation success rates. Its utilization spans multiple markets, including North America, Europe, Asia-Pacific, and emerging economies, driven by increasing ART cycles globally.

Market Penetration and Adoption

Current Market Position

ENDOMETRIN's market penetration remains robust in high-income countries. Established usage protocols, clinical validation, and physician familiarity have maintained its status as a preferred progesterone support product. However, competition from alternative formulations—such as intramuscular injections (e.g., progesterone aqueous solutions), other vaginal formulations (gel, suppositories), and compounded preparations—competes for market share.

Factors Influencing Adoption

- Clinical Efficacy & Safety: ENDOMETRIN's approval and consistent performance in clinical trials bolster its acceptance.

- Ease of Use: Vaginal inserts offer outpatient convenience and fewer injection-related concerns.

- Regulatory Approvals: Approval status across regions influences market entry and expansion.

- Pricing Strategies: Competitive pricing and reimbursement policies impact prescribing patterns.

Competitive Landscape

Major Competitors

- Crinone (progesterone gel): Market leader in the vaginal progesterone segment, recognized for ease of use.

- Vaginal suppositories: Various generic formulations.

- Injectable progesterone (e.g., IM depot): Used in specific cases, albeit less frequently preferred.

- Compounded bioidentical progesterone formulations: Popular in certain markets but less regulated.

Differentiators

ENDOMETRIN's strength lies in its established safety profile, targeted delivery system, and clinician familiarity. As new competitors emerge with innovative delivery systems or biosimilars, the market share dynamics may shift.

Regulatory and Reimbursement Landscape

Regional regulatory frameworks, including FDA approvals in the US, EMA approval in Europe, and national health authorities in Asia, influence market access. Reimbursement coverage directly impacts prescription volume; positive reimbursement policies boost sales, while reimbursement hurdles constrain growth.

Market Segmentation and Regional Outlook

| Region | Market Size (USD billion, 2022) | Growth Rate (CAGR 2022-2030) | Drivers of Growth |

|---|---|---|---|

| North America | 6.5 | 8% | Advanced fertility clinics, higher ART adoption |

| Europe | 4.8 | 9% | Aging population, ART prevalence |

| Asia-Pacific | 3.2 | 12% | Rising infertility rates, healthcare investments |

| Latin America & MEA | 1.9 | 10% | Growing fertility clinics, increasing awareness |

Sales Projections

Assumptions

- The number of ART cycles globally will grow at approximately 12% CAGR over the next decade (source: ASRM, ESHRE).

- ENDOMETRIN's market share within progesterone products remains stable at around 25% in developed markets.

- Price points are maintained with minor inflation adjustments.

Forecasted Revenue

| Year | Estimated Global Sales (USD billion) | Comments |

|---|---|---|

| 2023 | 0.27 | Current market valuation based on existing prescriptions |

| 2025 | 0.40 | Market expansion, increased ART cycles, regional growth |

| 2027 | 0.55 | Greater adoption in emerging markets, competitive stabilization |

| 2030 | 0.80 | Maturity of markets, potential biosimilars entering the scene |

Growth Drivers and Challenges

Drivers

- Increasing Infertility Rates: Factors such as delayed childbearing, environmental influences, and lifestyle choices elevate ART demand.

- Advancements in ART Techniques: Improved success rates encourage more treatments, increasing progesterone supplement utilization.

- Patient Preference for Outpatient Treatment: Vaginal inserts enhance patient convenience, driving adherence and repeat usage.

- Regulatory Approvals and Expanded Indications: Broader indications and newer formulations can catalyze sales.

Challenges

- Competitive Innovations: Emergence of novel delivery systems or biosimilars could erode market share.

- Pricing Pressures: Price sensitivity, especially in emerging markets, may limit revenue growth.

- Reimbursement Barriers: Variability and restrictions may hamper access and adoption.

- Patient Preferences and Compliance: Some patients may prefer injections or alternative uterine support methods.

Strategic Outlook

To sustain and amplify growth, manufacturers should focus on per-region strategic initiatives:

- Expand Geographical Reach: Enhance market access in Asia-Pacific, Latin America, and Africa.

- Invest in Clinical Evidence: Support head-to-head trials comparing ENDOMETRIN with competitors to demonstrate superior efficacy or safety.

- Develop Novel Formulations: Innovate with sustained-release inserts to improve patient compliance.

- Strengthen Reimbursement Strategies: Engage with payers early to secure favorable coverage policies.

- Leverage Digital Marketing: Educate clinicians and patients about benefits, especially in emerging markets with increasing healthcare infrastructure.

Conclusion

ENDOMETRIN’s position in the progesterone support market remains stable, underpinned by clinical reliability and clinician familiarity. The expanding ART landscape, driven by demographic trends and technological advances, promises a positive trajectory for sales. However, competitive pressures, regulatory flux, and market access challenges necessitate strategic agility to maximize growth potential.

Key Takeaways

- The global market for progesterone support via vaginal inserts like ENDOMETRIN is poised for robust growth, driven primarily by the expanding ART industry.

- Regional variations favor North America and Europe currently, but emerging markets are experiencing rapid growth.

- Competitive innovations and biosimilars pose significant threats; ongoing R&D and clinical validation are essential.

- Market access and reimbursement policies significantly influence sales; strategic engagement with payers can unlock revenue.

- To capitalize on market opportunities, manufacturers should focus on regional expansion, formulation innovation, and strengthening clinical evidence.

FAQs

1. How does ENDOMETRIN compare to other progesterone formulations in the market?

ENDOMETRIN is recognized for its proven safety profile, targeted delivery, and clinician familiarity. While competitors like Crinone offer similar benefits, differences in formulation, ease of use, and pricing influence physician choice. Ongoing head-to-head trials and real-world data will further delineate its comparative advantages.

2. What are the main factors driving demand for progesterone vaginal inserts globally?

Demand is primarily driven by the increasing number of ART procedures worldwide, demographic shifts towards older maternal age, and patient preference for non-invasive, outpatient-supported therapies that improve compliance.

3. Which regions have the greatest growth potential for ENDOMETRIN sales?

Emerging markets in Asia-Pacific, Latin America, and the Middle East present substantial upside due to rising infertility rates, expanding healthcare infrastructure, and increasing ART adoption.

4. Are biosimilars a threat to ENDOMETRIN's market share?

Potentially, yes. As patents expire and biosimilar products enter the market, pricing competition could intensify. Differentiation through clinical data, branding, and formulation innovation will be crucial for maintaining market share.

5. What strategies can manufacturers deploy to maximize sales of ENDOMETRIN?

Strategies include expanding regional market access, investing in clinical trials, developing patient-friendly formulations, engaging payers for reimbursement, and leveraging digital marketing platforms to increase awareness and education.

References

[1] Grand View Research, "Fertility Services Market Size & Trends."

[2] European Society of Human Reproduction and Embryology (ESHRE), "Annual Report 2022."

[3] American Society for Reproductive Medicine (ASRM), "Reproductive Medicine Reports."

More… ↓