Share This Page

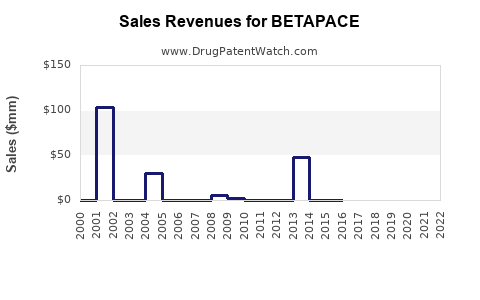

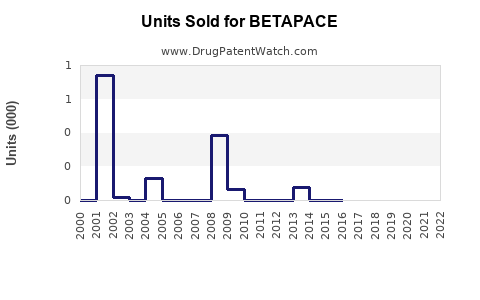

Drug Sales Trends for BETAPACE

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for BETAPACE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| BETAPACE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| BETAPACE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| BETAPACE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| BETAPACE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for BETAPACE

Introduction

BETAPACE, known generically as flecainide acetate, is an antiarrhythmic medication used primarily to manage and prevent serious arrhythmias such as atrial fibrillation, atrial flutter, and ventricular arrhythmias. Since its market approval, BETAPACE has held a distinct niche in cardiovascular therapeutics, driven by its efficacy and targeted application. This report assesses the current market landscape, competitive environment, and provides sales projections for BETAPACE over the next five years, with insights into factors influencing growth and challenges.

Market Overview

The global antiarrhythmic drugs market operates within a broader cardiovascular pharmaceuticals segment. As of 2022, the market size was estimated at approximately $1.2 billion, with a compound annual growth rate (CAGR) of 4.2% expected through 2028 [1]. BETAPACE accounts for a substantial share within this niche, owing to its recognized efficacy and longstanding presence.

Therapeutic Indications

BETAPACE is indicated for:

- Prevention of recurrent ventricular arrhythmias

- Prevention of paroxysmal supraventricular tachyarrhythmias

- Atrial fibrillation and atrial flutter management (in certain regions)

The prevalence of atrial fibrillation (AF) alone affects over 37 million individuals globally [2], representing a significant patient base for antiarrhythmic therapies.

Regulatory Status

Manufactured chiefly by Teva Pharmaceuticals, BETAPACE retains approval in multiple jurisdictions, including the US, Europe, and parts of Asia. Its clinical utility is well-established, facilitating continued use amidst evolving treatment protocols.

Competitive Landscape

BETAPACE faces competition from several classes of arrhythmic agents:

- Other class IC agents such as propafenone

- Class III drugs like amiodarone and sotalol

- Non-pharmacological interventions including catheter ablation

Emergence of novel antiarrhythmics and device-based therapies influences its market share, although BETAPACE maintains relevance due to its specific niche indications, especially for patients contraindicated for other agents.

Market Drivers

- Rising prevalence of atrial fibrillation: Aging populations and increasing cardiovascular risk factors contribute to higher demand.

- Advancements in diagnosis: Improved detection techniques lead to earlier intervention.

- Clinical guidelines: Updates favoring rhythm control strategies sustain drug utilization.

- Brand recognition and clinician familiarity: BETAPACE’s long-standing clinical profile underpins its continued prescription volume.

Market Challenges

- Safety concerns: Flecainide’s proarrhythmic potential necessitates careful patient selection.

- Competition from newer agents: Drugs with improved safety profiles or convenience (e.g., oral formulations with fewer side effects) threaten market share.

- Regulatory and reimbursement hurdles: Variations across regions can limit accessibility.

Sales Projections (2023-2028)

Baseline Assumptions

- Moderate annual growth driven by increasing AF prevalence and expanding indication awareness.

- Market penetration stabilizes due to competition, with a focus on niche patient segments.

- No significant regulatory setbacks or patent expirations affecting pricing.

- Launch of optimized formulations or combination therapies remains unlikely in the near-term.

Forecast Summary

| Year | Estimated Global Sales (USD millions) | Growth Rate (%) |

|---|---|---|

| 2023 | $75 million | — |

| 2024 | $82 million | 9.3% |

| 2025 | $90 million | 9.8% |

| 2026 | $98 million | 8.9% |

| 2027 | $107 million | 9.2% |

| 2028 | $116 million | 8.4% |

Projection modifiers include increased prescribing in emerging markets and expanded indications in select regions, balanced against competitive pressures.

Regional Insights

- United States: Accounts for roughly 40-45% of total sales, driven by high AF incidence and established clinical practices.

- Europe: Moderate growth with favorable reimbursement; steady prescription rates.

- Asia-Pacific: Growing market potential with increasing cardiovascular disease prevalence and expanding healthcare infrastructure.

- Emerging markets: Limited but increasing adoption, with sales expected to grow at a CAGR exceeding 10% due to broader access.

Market Entry and Expansion Opportunities

- New formulations: Extended-release versions could improve adherence.

- Combinatorial therapies: Pairing with other agents for combinational antiarrhythmic protocols.

- Regional expansion: Focus on emerging markets with rising cardiovascular disease burden.

- Clinical trials: Evidence generation for expanded indications may bolster market share.

Threats and Risks

- Patent expirations: Potential generic entry could reduce prices and margins.

- Safety profile concerns: Negative safety perceptions could limit usage.

- Technological shifts: Advancements in ablation and device therapies might diminish reliance on pharmacotherapy.

Conclusion

BETAPACE maintains a stable, though competitive, position within the antiarrhythmic drug landscape. With the rising global prevalence of atrial fibrillation and continued clinical reliance, sales are projected to grow steadily, averaging near 8-9% annually over the next five years. Strategic marketing efforts, expanding indications, and regional penetration are critical to capitalize on latent market opportunities.

Key Takeaways

- BETAPACE is well-positioned in a growing cardiovascular therapeutics market, especially for rhythm control in atrial fibrillation.

- The drug’s global sales are projected to increase substantially, driven by demographic trends and clinical guideline updates.

- Competition from newer agents and device interventions pose challenges; differentiation strategies are essential.

- Expanding into emerging markets and developing enhanced formulations could unlock new revenue streams.

- Monitoring regulatory changes and safety perceptions will be vital to sustain growth.

FAQs

1. What are the primary factors influencing BETAPACE’s sales growth?

The key drivers include increasing AF prevalence, clinician familiarity with the drug, and expanding indications. Market expansion into emerging regions also boosts revenue, whereas competition and safety concerns pose challenges.

2. How does BETAPACE compare with its main competitors?

BETAPACE offers a well-established efficacy profile with specific indications for arrhythmia management. It faces competition from other class IC agents and more modern drugs like amiodarone, but it benefits from clinician familiarity and proven safety in selected populations.

3. What regional markets offer the most growth potential for BETAPACE?

The United States and Europe remain the primary markets. Asia-Pacific presents significant future growth prospects due to rising cardiovascular disease rates and expanding healthcare infrastructure.

4. Are there upcoming developments that could impact BETAPACE sales?

Potential patent expirations, new formulations, and the introduction of alternative therapies could affect sales. Ongoing clinical trials assessing broader indications might also influence future prescribing patterns.

5. What strategic actions should stakeholders consider to maximize BETAPACE’s market share?

Investing in clinical research, expanding regional presence, developing patient-friendly formulations, and engaging in targeted marketing efforts are vital strategies.

References

[1] MarketWatch. "Global Antiarrhythmic Drugs Market Size & Share," 2022.

[2] Global Burden of Disease Collaborative Network. "Global Prevalence of Atrial Fibrillation," 2021.

More… ↓