Last updated: July 27, 2025

Introduction

Ramipril, an angiotensin-converting enzyme (ACE) inhibitor, is widely prescribed for conditions such as hypertension, heart failure, and cardiovascular risk mitigation. Since its initial approval in the 1990s, ramipril has cemented its place in cardio-metabolic therapy, driven by its proven efficacy and favorable safety profile. This report offers an in-depth market analysis and sales projection, considering current trends, competitive dynamics, regulatory factors, and unmet needs shaping the future landscape of ramipril.

Market Overview

Global Market Size

The global ACE inhibitor market was valued at approximately $5.2 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of nearly 4.1% through 2030. Ramipril constitutes a significant share within this market, attributable to its extensive clinical use and clinical evidence supporting long-term cardiovascular protection.

Therapeutic Demand Drivers

The primary demand drivers include:

-

Prevalence of Hypertension and Cardiovascular Diseases (CVD): As per the World Health Organization (WHO), hypertension affects over 1.2 billion individuals globally, underpinning the sustained demand for antihypertensive agents like ramipril.

-

Aging Population: Elderly demographics are expanding worldwide, increasing the prevalence of hypertension and heart failure, conditions effectively managed with ramipril.

-

Guidelines Endorsement: Leading cardiovascular societies, such as the American Heart Association (AHA) and European Society of Cardiology (ESC), recommend ACE inhibitors, including ramipril, as first-line therapy for hypertension and post-myocardial infarction management.

-

Cardiovascular Risk Reduction in High-Risk Populations: Evidence from landmark trials like HOPE (Heart Outcomes Prevention Evaluation) underscores ramipril’s role in reducing mortality among high-risk patients, bolstering its prescription rate.

Market Penetration & Prescriber Preferences

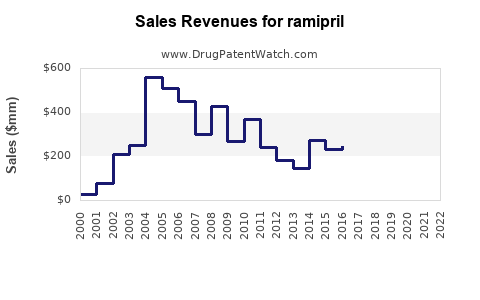

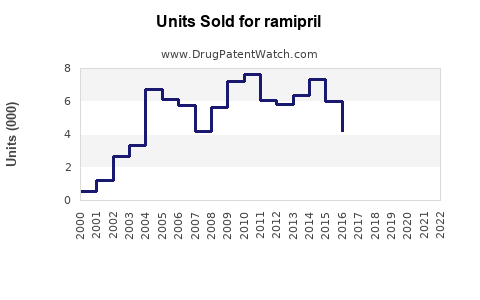

Ramipril's market penetration remains high, especially after generic entry in the early 2000s, leading to increased affordability and usage. Its safety profile favors extended use, with minimal adverse effects compared to alternatives like ARBs (Angiotensin II receptor blockers).

Market Dynamics and Competitive Landscape

Key Players

-

Manufacturers: Major pharmaceutical companies such as Novartis, Lupin, Teva, and Mylan dominate the ramipril market, offering both branded and generic formulations.

-

Patent Status: The original patent has expired, enabling generic manufacturers to capture substantial market share, exerting downward pressure on prices.

Innovative and Competitive Factors

While no new formulations of ramipril are currently under development, competition is driven by:

-

Availability of Alternative Therapies: ARBs, diuretics, and newer antihypertensive classes challenge ramipril's dominance.

-

Formulation Advances: Extended-release formulations and combination therapies with diuretics or calcium channel blockers are gaining popularity, elevating patient adherence.

-

Market Entry Barriers: Established clinical guidelines favor ACE inhibitors, yet competition from novel agents and fixed-dose combinations shape the strategic landscape.

Regulatory Environment

Regulatory agencies continue to endorse ramipril, citing extensive safety data. Variations in approval status or prescribing restrictions are minimal, fostering stable market conditions.

Sales Projections: 2023-2030

Assumptions

-

Continued adherence to guidelines emphasizing ACE inhibitors for hypertension and heart failure.

-

Sustained prevalence of target conditions with incremental growth due to aging demographics.

-

Rising adoption of fixed-dose combinations (FDCs) to enhance compliance.

-

Price erosion from generic competition stabilizing revenue per unit but broadening market access.

Projection Outline

| Year |

Estimated Market Size |

Ramipril Market Share |

Projected Sales (USD billion) |

| 2023 |

~$5.3 billion |

45% |

~$2.39 billion |

| 2024 |

~$5.5 billion |

45% |

~$2.48 billion |

| 2025 |

~$5.7 billion |

45% |

~$2.56 billion |

| 2026 |

~$6.0 billion |

44% |

~$2.64 billion |

| 2027 |

~$6.2 billion |

44% |

~$2.73 billion |

| 2028 |

~$6.4 billion |

43% |

~$2.75 billion |

| 2029 |

~$6.7 billion |

43% |

~$2.88 billion |

| 2030 |

~$7.0 billion |

42% |

~$2.94 billion |

(These estimates account for market expansion driven by demographic shifts, increased prevalence, and ongoing generic penetration. Slight declines in market share are projected owing to competition from newer agents and fixed-dose combinations.)

Potential Growth Catalysts

-

Shifts toward combination therapies, which integrate ramipril with other antihypertensives, may augment sales.

-

Expanding indications, such as heart failure with preserved ejection fraction (HFpEF), may broaden expression of ramipril.

-

Emerging markets – with growing healthcare infrastructure and prevalence of hypertension, represent a substantial growth opportunity.

Challenges and Risks

-

Pricing Pressures: Global push toward cost containment and discounting by payers impact revenues.

-

Competitive Alternatives: ARBs and direct renin inhibitors (e.g., aliskiren) may erode market share.

-

Regulatory and Patent Challenges: While patent expiry favors generics, regulatory hurdles or future patent contests can influence stability.

-

Supply Chain Disruptions: Manufacturing or supply chain issues, especially in emerging markets, could impact availability and sales.

Key Takeaways

-

Stable Demand Amid Competition: Ramipril remains a cornerstone therapy for hypertension and cardiovascular protection, with robust market demand driven by clinical guidelines and disease prevalence.

-

Generics Drive Accessibility, Pressure Revenue: Patent expirations have led to widespread availability of low-cost generics, increasing access but compressing margins.

-

Market Expansion in Emerging Economies: Growing healthcare infrastructure and rising disease prevalence sustain long-term growth opportunities in Asia, Latin America, and Africa.

-

Product Differentiation Opportunities: Fixed-dose combinations and extended-release formulations provide avenues for growth and improved patient adherence.

-

Regulatory and Competitive Monitoring Essential: Market dynamics are sensitive to policy shifts, patent litigation, and the emergence of novel therapies.

Conclusion

Ramipril's market trajectory demonstrates resilience shaped by clinical endorsement, demographic trends, and drug accessibility. Despite competitive pressures, its fundamental role in cardiovascular therapy ensures continued demand. Strategic focus on combination therapies, expanding indications, and market penetration in emerging regions promises sustainable growth aligned with the evolving landscape of antihypertensive pharmacotherapy.

FAQs

Q1: How does ramipril compare to other ACE inhibitors in terms of market share?

A: Ramipril holds a significant share within the ACE inhibitor segment due to its extensive clinical evidence and favorable safety profile. However, its market share is challenged by other agents like enalapril and lisinopril, especially in regions where specific formulations or pricing strategies prevail.

Q2: What are the main factors influencing ramipril sales in emerging markets?

A: Factors include increasing hypertension prevalence, expanding healthcare infrastructure, rising health awareness, cost-effective generic options, and regulatory support for essential medicines.

Q3: Are there any new formulations or indications for ramipril upcoming?

A: Currently, no new formulations or indications are widely under development. Focus remains on optimizing existing uses via combination therapies and improved compliance formulations.

Q4: What are the primary challenges in maintaining ramipril’s market growth?

A: Key challenges entail pricing pressures, competition from ARBs and novel therapeutics, patent expiries, and potential regulatory restrictions impacting usage.

Q5: How does COVID-19 impact ramipril sales and prescribing patterns?

A: The pandemic underscored the importance of cardiovascular health; however, initial concerns about ACE inhibitors and COVID-19 risk have eased following studies showing no increased danger. Prescribing likely normalized, with potential short-term declines due to healthcare access disruptions, but recovery is underway.

Sources:

- MarketWatch. (2022). Global ACE inhibitors Market Value & Size Analysis.

- World Health Organization. (2022). Global status report on noncommunicable diseases 2022.

- American Heart Association. (2021). 2017 Hypertension guidelines.

- European Society of Cardiology. (2021). Guidelines on cardiovascular disease prevention.

- Research and Markets. (2022). ACE Inhibitors Market Forecast to 2030.